Source: dailyhodl.com

Closely followed quant analyst PlanB says that Bitcoin (BTC) is now on its way to expanding by trillions of dollars to compete with some of the biggest asset classes.

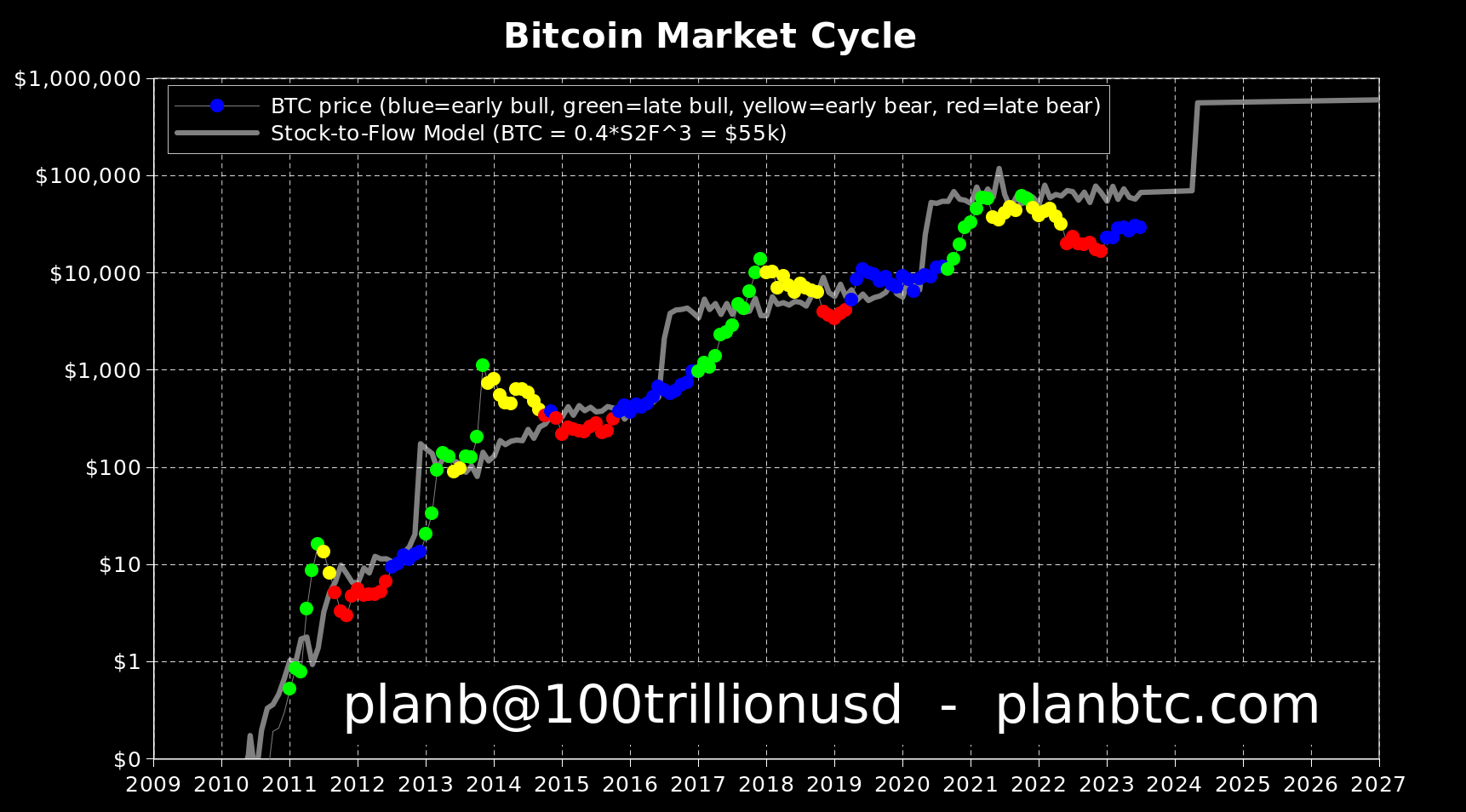

The pseudonymous analyst tells his 1.8 million Twitter followers that Bitcoin is now in the early stages of a bull market that may allow large players like BlackRock to accumulate BTC while it’s low.

“Is in stage-1 early bull market (blue). Of course BlackRock wants to buy cheap, just before ETF approval, and just before stage-2 full blown bull market.”

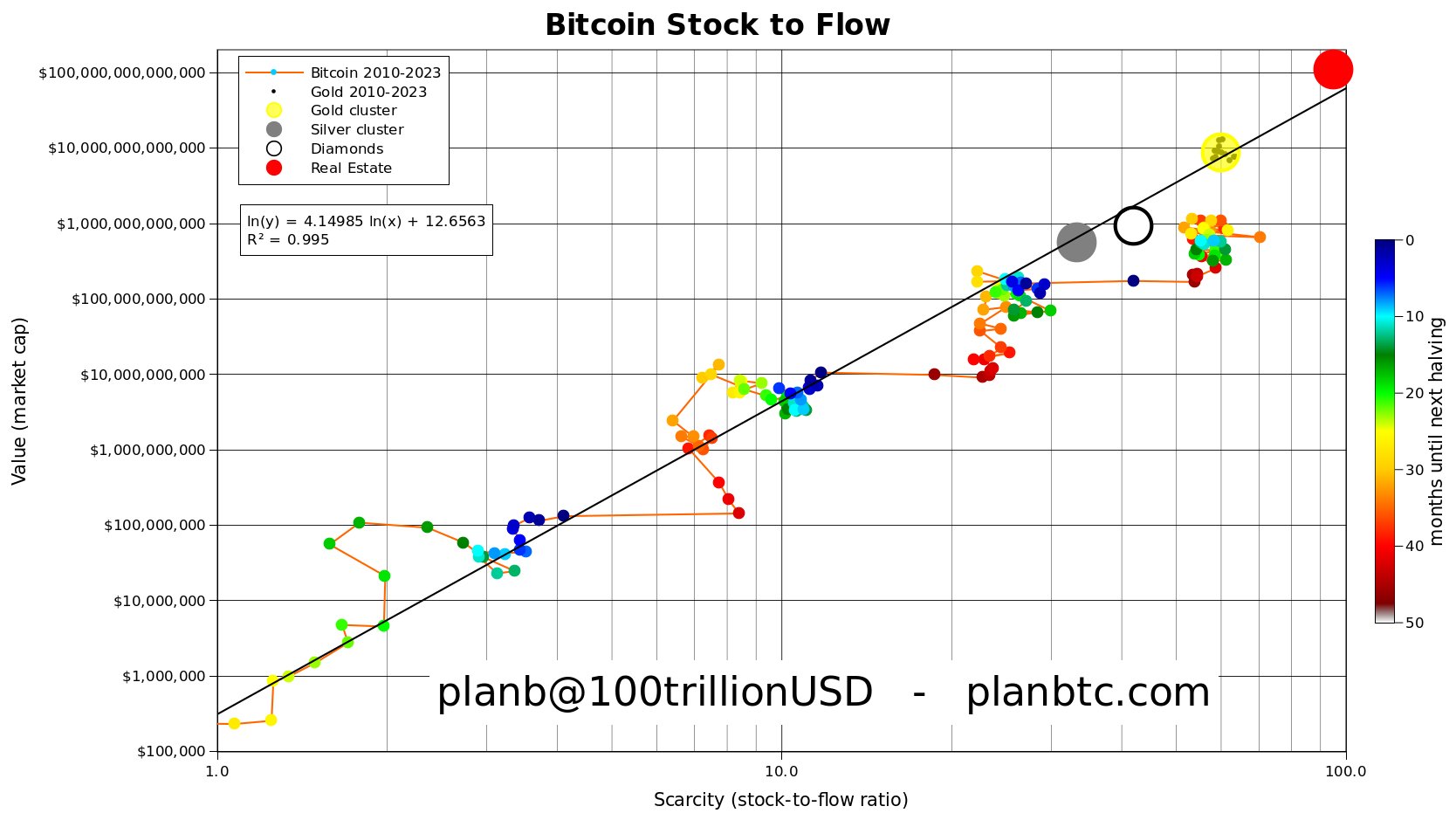

PlanB popularized the use of the stock-to-flow (S2F), which aims to measure the newly created supply of an asset that is being created over time, relative to the existing supply. After Bitcoin’s next halving, which cuts the newly created BTC issued to miners in half, PlanB says the S2F will suggest that the king crypto will ultimately become more scarce than real estate, and extremely undervalued compared to other commodities like gold, silver and diamonds.

“Bitcoin (S2F 58, market value $400B) is extremely undervalued compared to:

– gold (S2F ~60, market value ~$10T)

– diamonds (S2F ~40, market value ~$1T)

– silver (S2F ~30, market value ~$500B)

How will markets react after 2024 halving, when BTC S2F goes to ~110 (>real estate)?”

In a new strategy session, PlanB says he envisions the crypto king surging in price to about the $50,000 mark as Bitcoin approaches its next halving event.

Says the analyst,

“The big question is [what] will the price of Bitcoin be at the 2024 April halving? We can try and estimate that from only this 200-week moving average…

The 200-week moving average increases currently at about $500 a [month], so nine times $500 will be $4,500, and Bitcoin’s 200-week moving average right now is a little under $28,000, so $28,000 plus $4,000 is well [a] $32,000 dollars (200-week) moving average at the halving approximately.

And Bitcoin would be above that right, and usually it would be like 50% above that, which would indicate a range of Bitcoin at the halving between $40,000 and $50,000.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Shutterstock/Chuenmanuse

Read More at dailyhodl.com