Source: dailyhodl.com

On-chain analyst Willy Woo says Bitcoin could hit the $125,000 mark at a “minimum” this year if financial giants BlackRock and Fidelity allocate relatively conservative amounts of capital.

Woo tells his 1 million followers on the social media platform X that if clients of the two firms decide to rotate 3% of assets to Bitcoin, BTC can easily hit the $2.5 trillion market cap level.

“BTC price will go past $125k minimum before the end of 2025 just from Blackrock and Fidelity clients if they rotate 3% exposure to #Bitcoin.

These are their most optimistic portfolio allocation recommendations:

Blackrock ($9.1T): 84.9%

Fidelity ($4.2T): 3%”

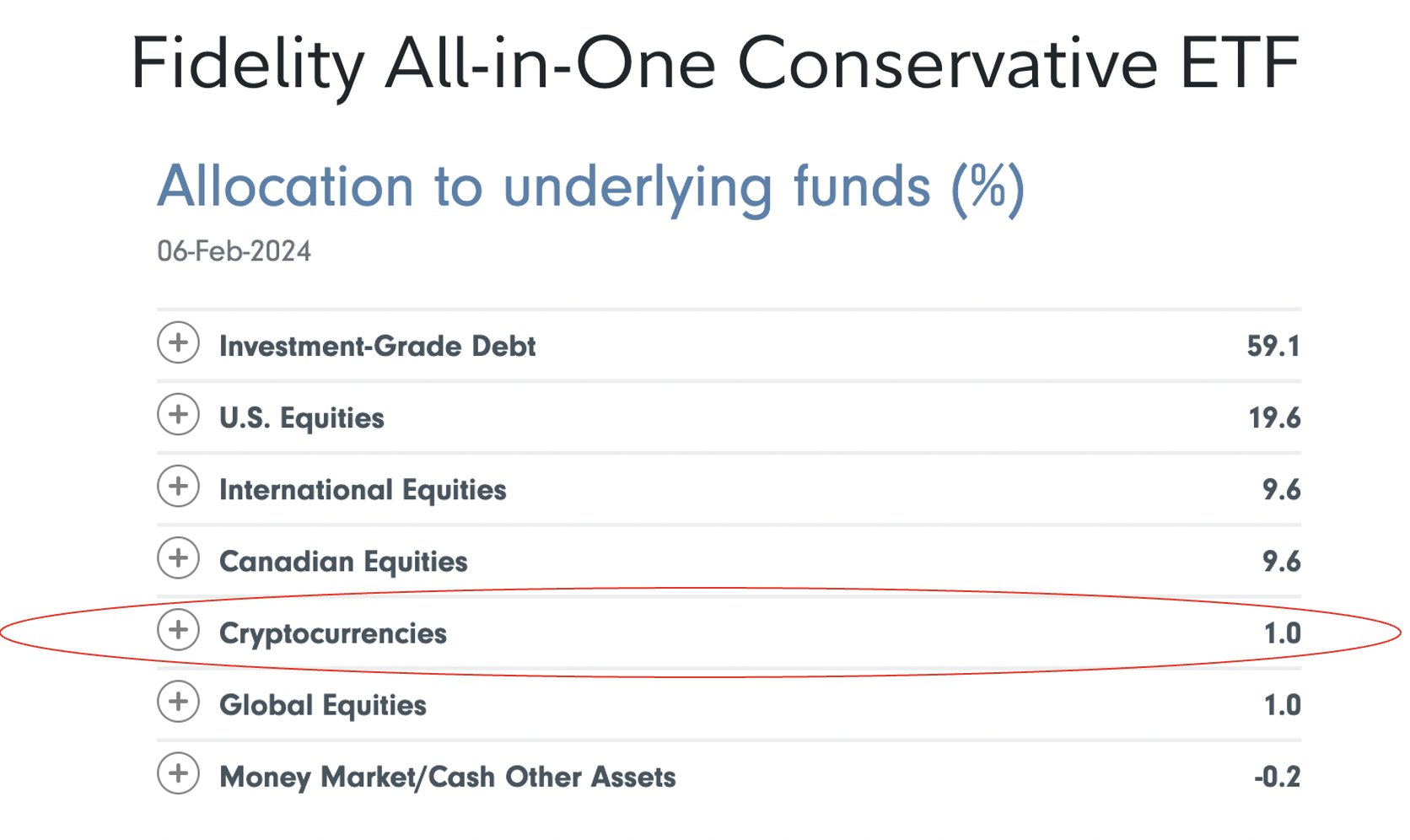

Recently, Fidelity’s Canadian subsidiary revealed a 1-3% allocation to crypto assets in its “Fidelity All-in-One Conservative ETF” which currently has just under $200 million in net assets under management.

Bitwise CIO Matt Hougan commented on the ETF, saying,

“Fidelity has a 1-3% bitcoin allocation in their ‘All-in-One’ asset allocation funds in Canada, using spot bitcoin ETFs. The “Conservative” version is posted below.

When and if this becomes the norm for portfolios in the US, wow…”

According to Woo, the $125,000 price target is still conservative given that Fidelity and Blackrock’s assets are still only a small portion of the available global wealth.

“Very conservative as it’s only $13.3T of global wealth accounted for. There’s $500T out there, presumably quite a bit of this comes on because of this validation from the largest asset managers.”

At time of writing, Bitcoin is trading at $66,504, up $67,222.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Fortis Design/maksum iliasin

Read More at dailyhodl.com