Source: dailyhodl.com

A trader who nailed the end of Bitcoin’s (BTC) 2021 bull market is outlining when the crypto king could witness a big burst to the upside.

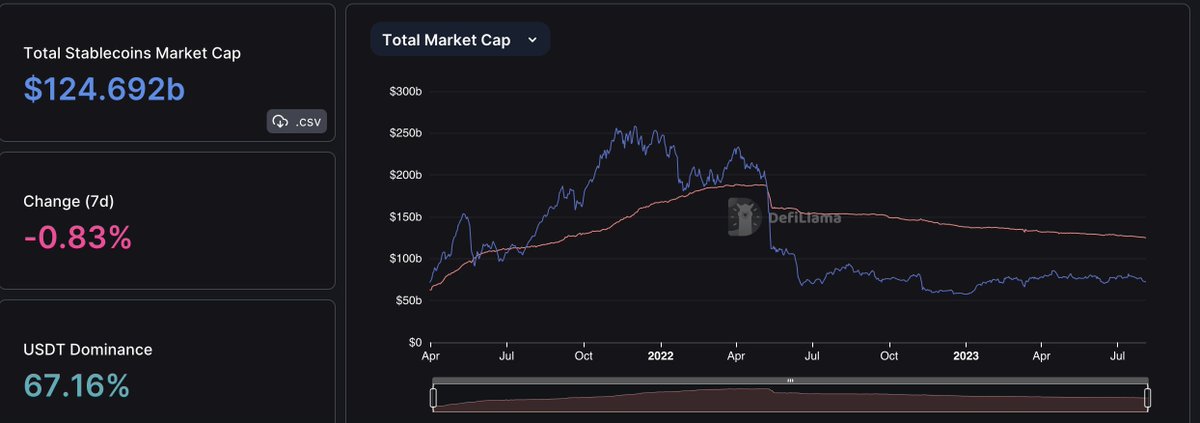

Pseudonymous analyst Pentoshi tells his 699,400 Twitter followers that capital appears to be leaving the crypto markets.

However, the trader says that market conditions will likely change in the coming months just before Bitcoin witnesses its next halving event.

“Every day checking stablecoin (market cap) and total value locked (TVL).

Every day, stablecoin (market cap) goes down, TVL goes down, *MOST* altcoins TREND down.

When new money? SOON! Think by or around Q1 2024 BTC is screaming up…

Hate to think where we’d be if it wasn’t for Saylor, Tether + ETF (exchange-traded fund). Maybe sub $20,000.”

The next Bitcoin halving is slated for April 2024.

In the meantime, the trader holds a bearish outlook on BTC due to two macro headwinds.

Pentoshi says that the recent rally in the oil markets suggests that inflation will once again rear its ugly head. He also expects regulators to hold off on approving a spot-based Bitcoin exchange-traded fund (ETF).

According to Pentoshi, the ensuing correction from these two factors could set up BTC for a huge rally once regulators green light a Bitcoin ETF.

“Maybe after ETF Delay + Hot CPI (consumer price index) print. Fake dump into pump seems likely for later ETF spot approval…

Has nothing to do with hope. Everything to do with paying attention (my job).

Have you looked at energy in the last six weeks? Oil is up 24%, which leads to everything going up. Will either see it this (CPI) print or next. Fed is now showing a hot print as well.”

At time of writing, BTC is worth $29,098.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Antonov Serg/Nikelser Kate

Read More at dailyhodl.com