Source: www.ledgerinsights.com

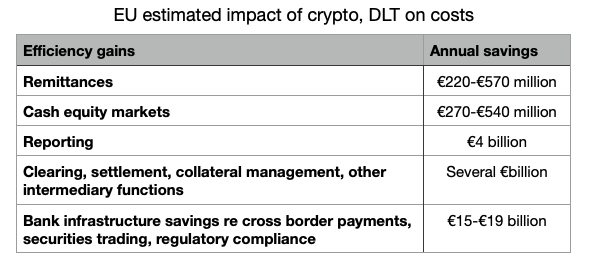

Earlier this month, the European Parliament Research Service published a paper estimating the combined benefit of EU DLT and crypto regulations at €33 billion annually. The legislation includes MiCA for crypto assets and the DLT Pilot Regime for capital markets. That figure counts efficiency savings, but not potential gains from innovation.

However, beyond the impact of blockchain legislation, the number also includes the benefits of cyber resilience and the use of data in the financial sector. But the breakdown of the numbers below is mainly the impact of blockchain.

Previous EU research estimated the benefits of cryptocurrencies and DLT between €27 and €55 billion, including the impact of innovation.

One or two of the figures may be a bit out of date. For example, the banking infrastructure savings are based on a 2015 Oliver Wyman & Santander report that predicted that the level of benefit would be evident by 2022. In 2016, SWIFT estimated that the impact on administrative and management costs could be of $50 billion. To be fair, most innovations take longer than expected to materialize. And when they do, the impact is often greater than anticipated.

However, the most recent estimates of the impact of innovation are likely to be higher. For example, BGC estimated that asset tokenization will reach $16 trillion by 2030. If that generates profits of half of one percent, that equates to $80 billion.

The EU investigation does not paint a bright picture of the crypto-asset and DLT sectors. A significant part of the text describes a wide range of risks.

Read More at www.ledgerinsights.com