Source: www.ledgerinsights.com

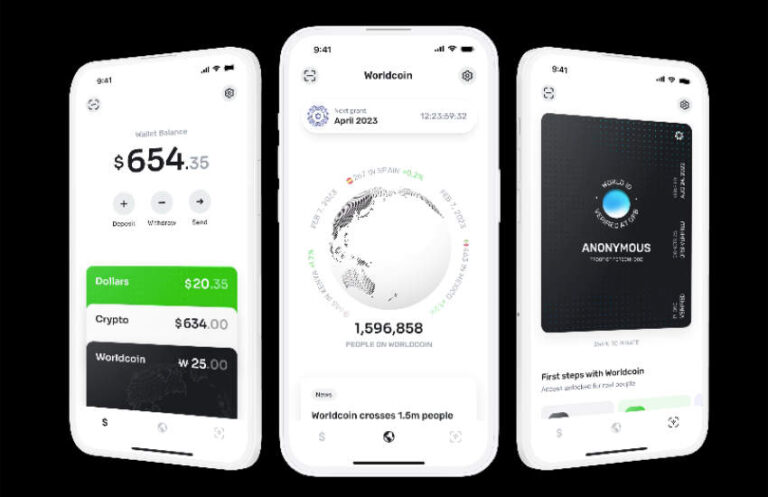

Yesterday, the Worldcoin network officially went live with the grand goal of providing a biometric digital identity to the world, fueled by cryptography. At first glance, the idea seems scarier than it is. Digging deeper, a lot of thought has gone into thorny privacy issues and the business model.

However, two realities are inescapable. First, it is almost impossible to design a digital identity solution that is completely secure and resistant to fraud. And despite its goal to decentralize, blockchain has a habit of doing the opposite, and no one more so than Worldcoin.

The focus here is on business knowledge, but first let’s clarify what Worldcoin is and isn’t.

What is a global ID?

The project aims to create a unique digital identity, a global ID, for everyone on the planet by taking a high-resolution scan of the iris using Worldcoin-designed equipment, the Orb. Much of the motivation relates to Sam Altman’s other big business, AI. If AI displaces human jobs, there may need to be a universal basic income (UBI) which will likely require a biometric identity. Plus, AI makes spoofing easier every day. Thus, India’s Aadhaar identity system uses biometric data to prevent fraud, but unlike Worldcoin, the Indian system stores the actual iris and fingerprint data.

Worldcoin repeatedly says that it does not keep iris scans unless it chooses to share them. Instead, it maintains a hash of the data similar to a fingerprint and stores it in a private centralized database instead of a blockchain. There is a singular purpose in retaining the data: to confirm that the iris has not been previously scanned to ensure its uniqueness.

At first this seems creepy, but given the design of the system, the encrypted data may not be that useful. Today, people leak large amounts of data using blockchain wallets. If someone buys an NFT, she can often browse all of the crypto transactions that person has ever made. And linking that wallet to a real identity isn’t that hard.

On the contrary, we believe that there is no direct public link between the iris hash and everything you do. Using Zero Knowledge Proofs (ZKP), Worldcoin helps obfuscate the connections between your activities. Ethereum’s Vitalk Buterin did a great analysis of the biometric aspect of Worldcoin and concluded that “these iris hashes leak only a small amount of data.” If a hacker were to break into the database, they would somehow have to get another iris scan of you, and that would just reveal whether or not you’re in the database.

The challenges of security and centralization

Worldcoin’s white paper argues in favor of biometrics and its custom Orb iris-scanning hardware for security purposes. By contrast, mobile phone face scans are not especially secure. Know-your-customer (KYC) verification is usually based on passports and identity documents that not everyone possesses. And KYC can be faked with a bribe. Buterin points out, however, that an easy way to spoof World ID is to pay someone to link your iris to the briber’s device and public key.

There’s also the issue of custom hardware. Anyone who has their eyes scanned takes someone’s word that the data is not retained and transmitted somewhere. The manufacturer could insert something dubious. If Worldcoin eventually decentralizes the manufacturing process, that increases the risk.

Then there is the aspect of centralization. While there are many valid complaints about KYC, particularly the data retention issue, it’s actually a relatively decentralized process. Especially in comparison to Worldcoin, which wants to operate the identity system of the whole world.

The startup Tools for Humanity, co-founded by Altman, is helping launch Worldcoin and initially stores all iris hashes and performs uniqueness verification.

The Business Knowledge Behind Worldcoin

For all its cutting-edge technology, Worldcoin is based on classic business thinking. Identity can provide a gateway to wallets, which in turn provides a portal to our finances and payments. That makes identity a great app. The same is true for cross-border payments, particularly remittances that rely heavily on identification for anti-money laundering purposes. Worldcoin has remittance users sign up with cash and gifts of WLD tokens. Bring up the idea of a token potentially linked to a possible future universal basic income financed through AI. And create a pit with custom hardware for iris scans.

As an aside, the world app/wallet is operated by Tools for Humanity, not the Worldcoin Foundation.

If you’re using the wallet for identity and finance, why not use it for payments as well?

Ambitions bigger than Meta/Diem?

Here is an excerpt about the Worldcoin WLD token in the whitepaper:

“The user community will determine the utility of the token, but some other use cases besides governance could emerge. For example, users may choose to use the WLD token to pay for certain actions in World App or another wallet application, to make other payments (e.g. remittances, tipping artists, buying and selling goods and services), or to signal their approval or support of other causes or initiatives. In the long term, the WLD token can also be treated as a global store of value.”

If Worldcoin takes off as planned, they may regret not keeping quiet on the last sentence because the central banks did a good job winding down Meta-founded Diem.

The point of remittances is interesting, because a sizeable proportion of the two million initial users of the platform are from emerging economies. Worldcoin has been criticized for exploiting people by encouraging them to have their eyes scanned in exchange for small amounts of cash and WLD tokens. It is more worrisome if that is children instead of adults.

These early adopters in emerging economies serve a triple purpose. They help the startup refine the hardware, software, and process. They increase the number of users to two million for launch to help pump the token. And maybe, once there’s enough traction, they’ll use the wallet for remittances, probably with some added crypto incentives.

The Orb is the moat

The cryptocurrency sector is highly competitive. For example, the Uniswap decentralized exchange was quickly copied by SushiSwap, which remains a serious competitor.

The team behind Worldcoin is candid that they are very much a for-profit team. Regardless of the talk of decentralization, for most companies the goal is to be a monopoly in their niche. That implies a kind of moat. Net effects work like a moat, but it can take time to build a flyer. Meanwhile, having a custom hardware unit like Orb for iris scans acts as a moat.

While much of Orb’s design code is publicly available, the license means that people can’t use it before (approximately) February 2027.

Do you really need custom hardware? Arguably, it could have used existing high-resolution iris scanner equipment. However, the real issue is hardware security and ensuring that iris scans are not retained. That’s a sufficient argument that the Orb is a necessity and simply creates a four-year trading moat.

The WLD tab

Last but not least is the WLD token. It’s not just a token that could power the world’s identity and is backed by OpenAi founder Sam Altman. No. “It may eventually support a path to AI-financed UBI (universal basic income).” That one is probably more aimed at the cryptocurrency crowd used to tokens unlocking future benefits.

The supply at launch was 143 million tokens, of which 100 million were ‘loaned’ to market makers for three months.

Internals retain a quarter of the tokens, with 9.8% going to the early development team. The 25% stake was expanded from 20% two years ago.

The other three quarters go to the community, including up to 15% for network and ecosystem operations.

The WLD token price has already seen a big drop, doubling from an opening of $1.66 to as high as $3.30, but it fell back to $2.12 in a single day. Currently the market capitalization is $228 million.

A fly in the ointment was the timing of the recent crypto crackdown in the United States. That means you can get your eyes scanned in the US for a World ID, but you can’t receive a Worldcoin token. So for now, it’s the world minus the US.

Read More at www.ledgerinsights.com