Source: news.google.com

The need for greater transparency and compliance with established rules will be critical in 2023.

In a recent keynote, Leo Zhao, a venture partner at M-Ventures, which is MEXC, a global cryptocurrency exchange, spoke about the various opportunities and prospects that the cryptocurrency market could bring to institutions in 2023.

Leo explored the following central points:

- How layer 2 blockchain solutions and Zero Knowledge Proofs technology are maturing.

- The State of Crypto Mainstream Adoption

- Transparency and regulatory compliance

Current Market Review

- LUNA and FTX

- The Significant Drop in Crypto Market Capitalization and Defi TVL

- The decline in activities of cryptocurrency developers

- Venture capitalists continue to invest in the industry

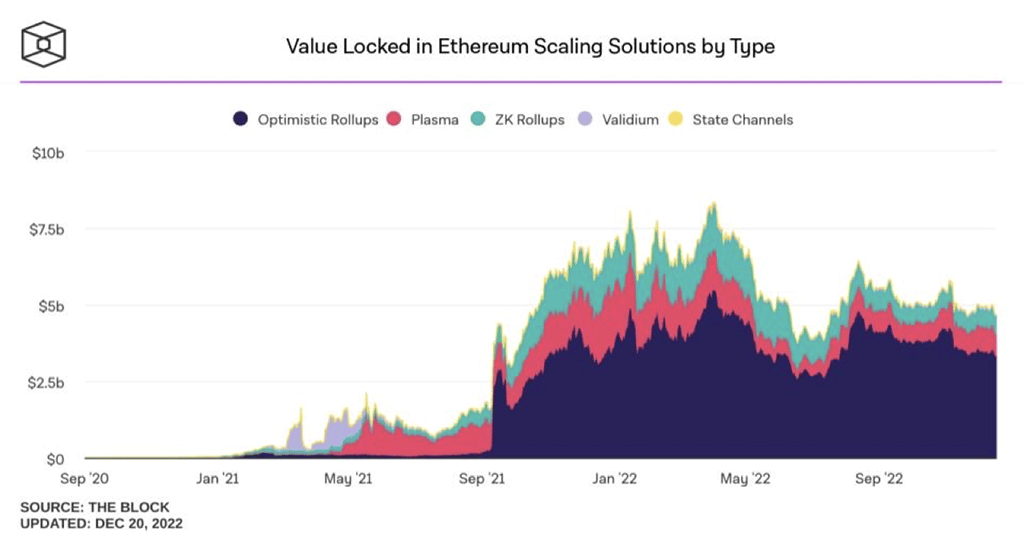

- The Ethereum Merge, the rise of L2 TVL, accumulation of value

- NFT gets the main spotlight

To sum up the current state of the crypto market in 2022, he compared the events of the past year to the blockbuster movie, The Good, the Bad and the Ugly. In his assessment, the film best summed up everything that happened in the past year. Since record inflation, the Fed’s continued interest rate hikes, and the effect of rising funds rates on the capital market, eventually precipitating last year’s severe decline.

Typically, he noted, when the regulatory “tide” recedes, financial markets tend to deleverage rather quickly, and it was evident last year. As the cracks began to widen, most companies found themselves swimming naked. In the case of Terra and LUNA, it was more severe. At the peaks, they were valued at $40 billion and $20 billion, respectively. They crashed and people, including exposed institutions, lost money. In the case of FTX, they raised $2 billion, only to get $8 billion of much-needed liquidity out of the open crypto market. These swift and damaging aftermath have broken investor confidence in the industry. Trust can only be restored through strong and genuine actions.

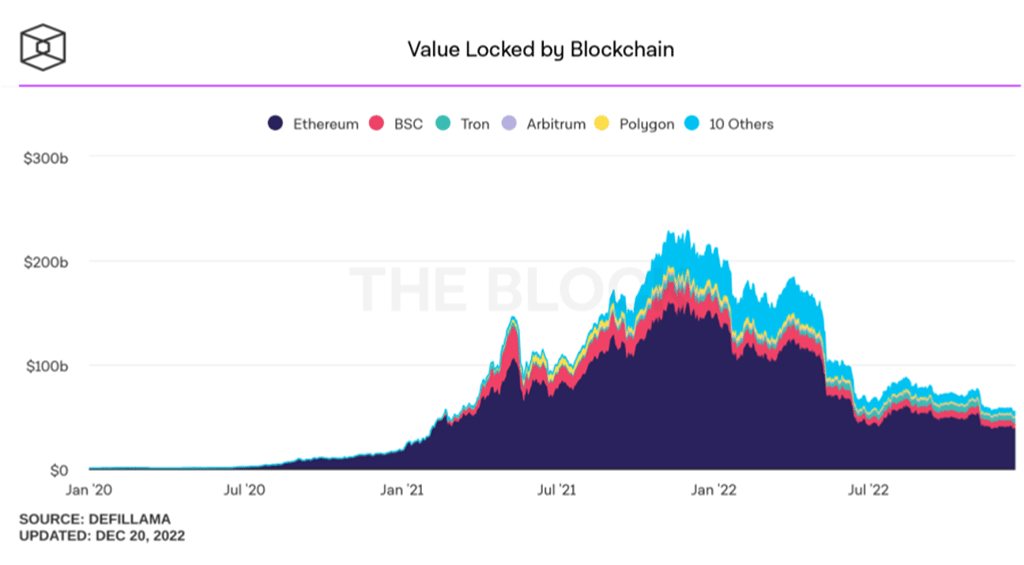

Liquidity is currently low and investors are playing it safe. Looking at crypto charts, total market capitalization dropped from $3 trillion at 2021 peaks to around $800 billion, losing 73 percent. On the other hand, the total value locked (TVL) in DeFi protocols across all blockchains dropped from $218 billion to $54 billion, representing a 75 percent decrease.

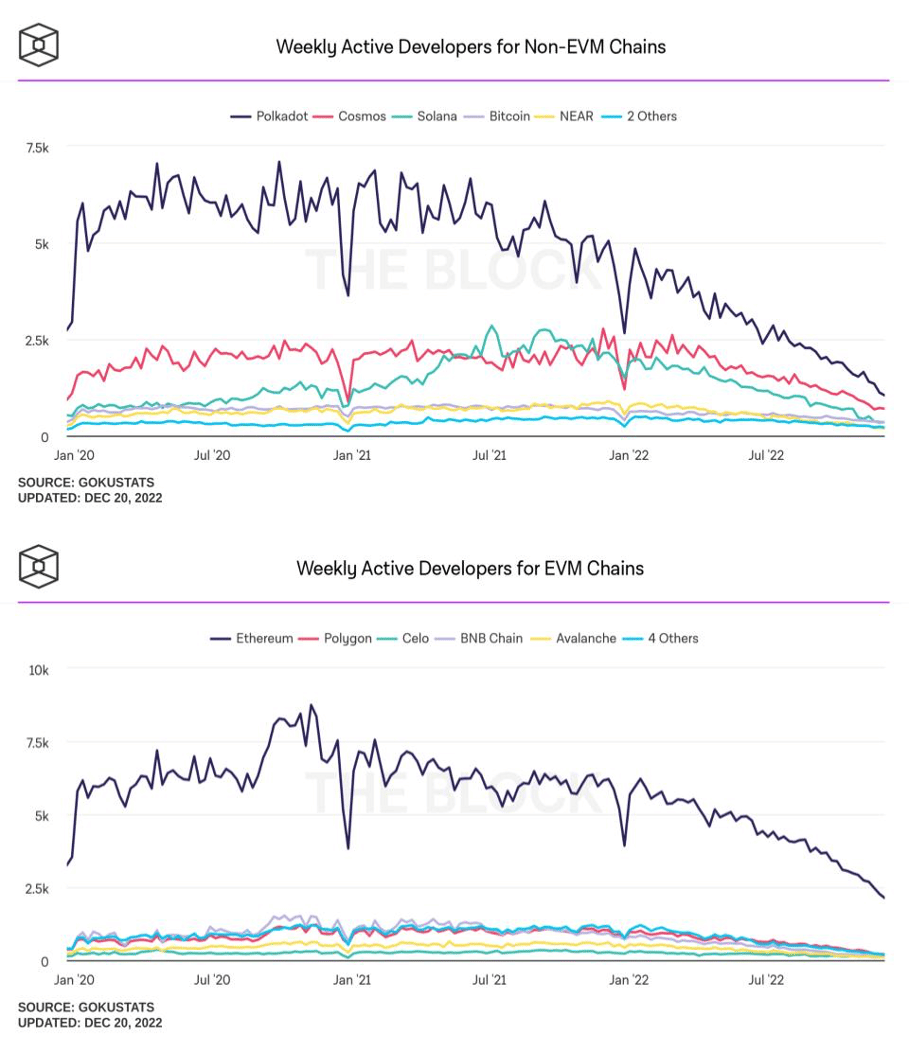

Reflecting general apprehensions across the board, the activities of Ethereum Virtual Machine (EVM) and non-EVM blockchain developers have also dropped significantly.

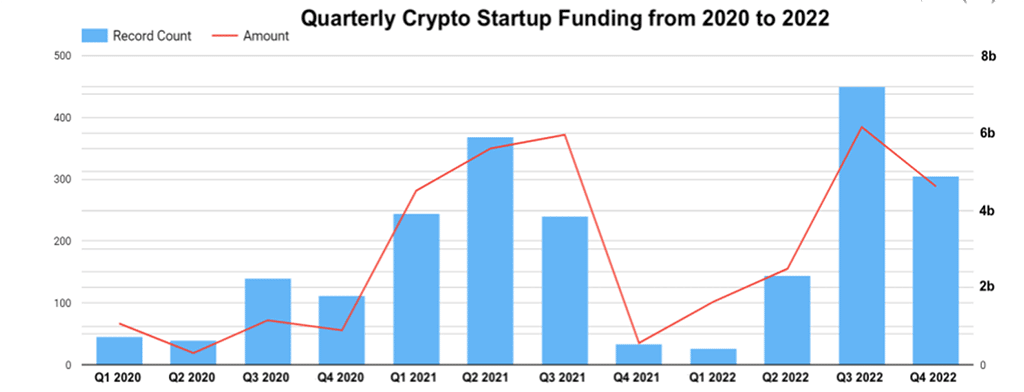

However, this is a big exception. Despite free-falling markets, deep-pocketed crypto venture capitalists are doubling down. They seem to be picking up worthy projects. As the charts reveal, bear markets are historically the best time to invest.

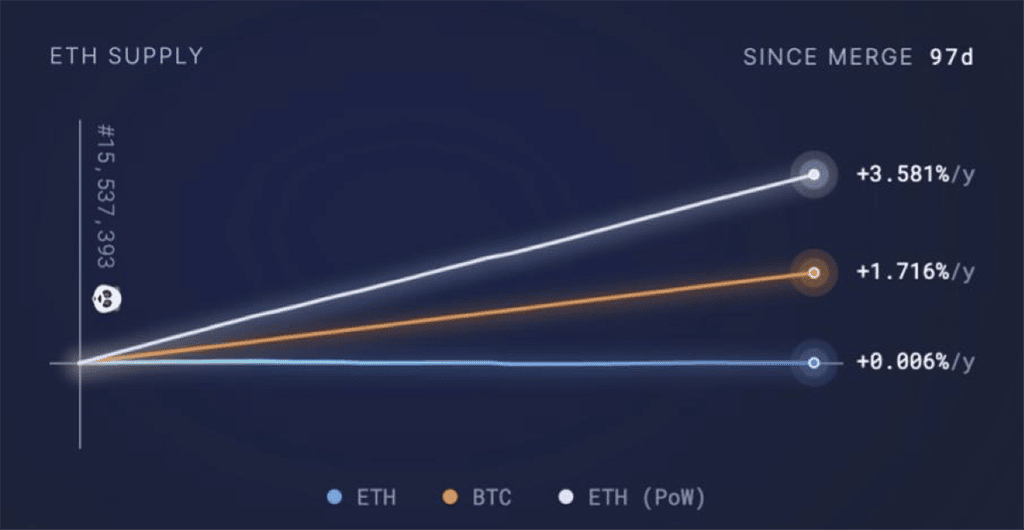

The impact of the Ethereum Merge is also clear. The merger was historic for Ethereum and its effects are being felt today. ETH is gradually turning into ultrasound money. In 97 days after the update, only 2000 ETH was added to circulation instead of the 1.1 million worth of $1.2 billion that could have been added and possibly sold by miners.

Photo: Ultrasound.Money

What Crypto Must Overcome

- infrastructure limits

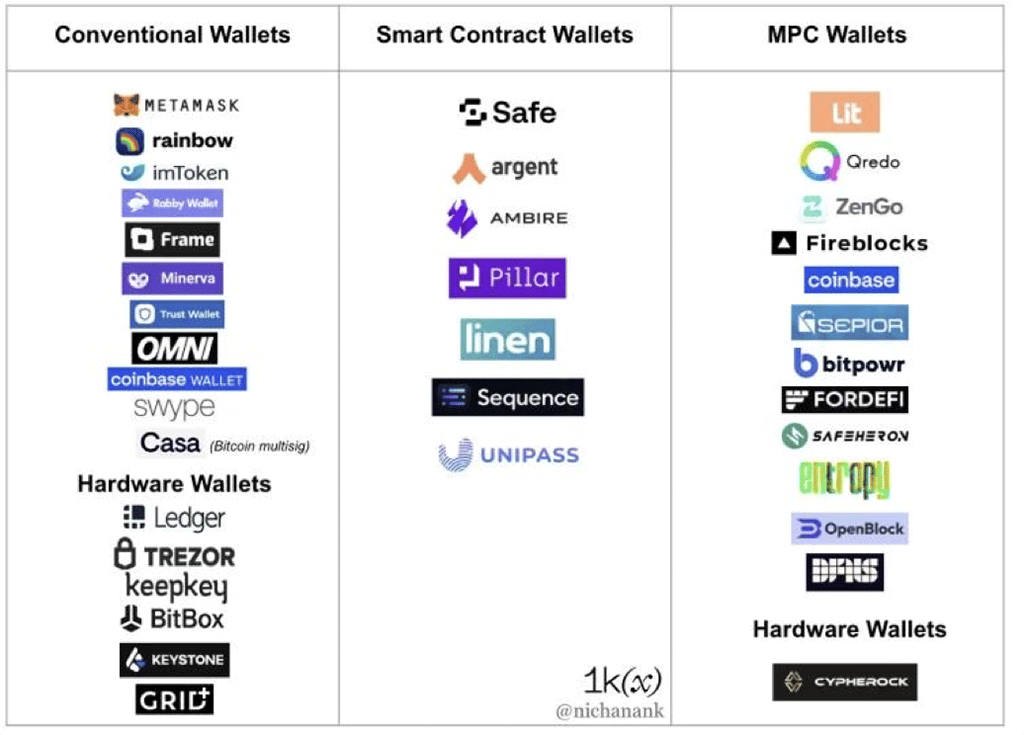

- Bad user interface and experience

- Opacity and compliance

To solve these challenges and create opportunities, the problems must first be detailed. Leo Zhao anticipated that the three main problems mentioned above should be satisfactorily resolved.

The current misconception in the crypto and blockchain scenes, he said, was the assumption that the infrastructure only encapsulated layer 1 and layer 2 platforms. In his opinion, there are centralized elements of blockchain that need to be addressed first. He cites GitHub, a repository that can easily censor Tornado Cash code. Additionally, there are cross-chain bridges that are continually being attacked, costing protocols millions of dollars.

Unlike web2, where browsing and interactions are smooth, ordinary people who are not tech-savvy are afraid to use blockchain-based solutions. On average, even storing seed phrases can be scary for the average user.

Zhao also took issue with centralized institutions, saying there should be more transparency and a clearer regulatory framework to drive adoption.

Trends and opportunities in 2023

- L2 and ZK technologies for scaling blockchains are maturing:

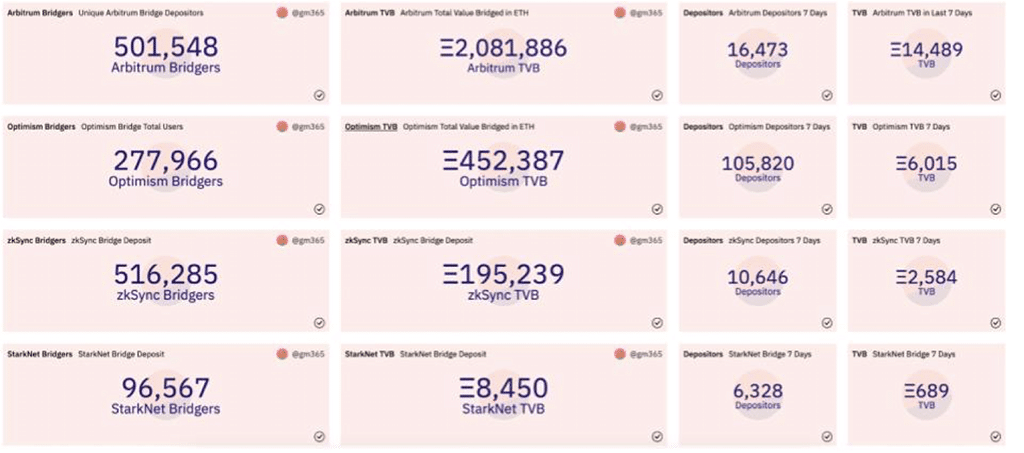

- Popular Ethereum L2 TVLs like Arbitrum and Optimism are rising

- ZK

- Other modular blockchain solutions

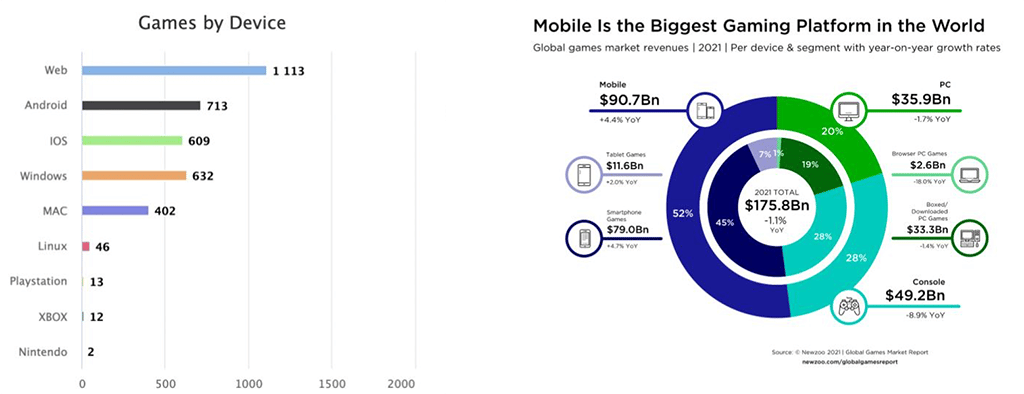

- NFT all. People no longer need to ask “what is NFT?”, but “what NFT should I imitate?” Games, Social and Music

- MPC wallet and smart contract wallet

- Migration of Web2 users

- Transparency and Compliance

- CEX now have to be more transparent or be displaced by DeFi

- There is more clarity on crypto asset regulations

- Hong Kong

To streamline processes, Zhao said the following trends and opportunities could emerge in 2023 and beyond:

First, it signals that scaling solutions are maturing and being adopted. Although TVL fell in USD terms, it seems more people are locking up their assets in DeFi protocols as the number increased from 250k to almost 4 million ETH. At this rate, he predicts more activities will migrate from the mainnet to Layer 2 as more exciting opportunities emerge, ranging from Layer 2 as a service to specific applications. Zhao also said that developers will also look to launch more reliable bridges and aggregators.

Besides L2, ZK Rollup solutions are catching up, especially with zkSync and StarkWare deployment solutions. As the sector grows, Zhao sees opportunities in ZKP Hardware, the personal data market, and cross-chain bridges powered by ZK.

Photo: Dune Analytics

The use of NFTs might have declined by 2022, but Zhao believes the sub-sector could flourish in 2023. As the data shows, the number of Lens Profile users is increasing. The Lens Protocol is a permissionless, composable, and decentralized social graph. All these social graphs are NFT, which means that developers can integrate all your social activities. The way Lens Protocol is designed, this technology could revolutionize the way social apps are built, while also heavily influencing music and gaming.

Photo: Dune Analytics

Web3 dApps, especially wallets, are likely to have better designs in 2023. Just as there are social recovery, logins, and semi-escrowdship controls on platforms like Google and Facebook, it will be possible for web3 users to invite users to co-manage accounts via email and other means.

Photo: 1kx

There will also be a paradigm shift in gaming. While traditional desktop and mobile games have an annual revenue of $90 billion, Play-to-Earn (P2E) blockchain games are still in development and are in the era of “web page” games. “. P2E and blockchain games are starting as their infrastructure develops, including those with better distribution, trading and engines.

Finally, the need for greater transparency and compliance with established rules will be paramount in 2023. If centralized institutions do not comply, their market share could be eroded by innovative DeFi protocols, launched on the blockchain, that offer higher levels of transparency. As this takes shape, more governments will be required to provide more clarity on the regulatory framework for crypto and blockchain that the next billion users will adopt.

Conclution

As he concluded, Zhao advised developers to pick these opportunities and take advantage of them. He urged crypto venture capitalists to keep investing in the sound ideas above as they will ultimately brighten the future and bring a better financial world.

About M-Ventures

M-Ventures is a crypto fund under MEXC Global, with $100m+ AUM and 300+ portfolio investments. We constantly study the market and the different sectors of the crypto industry to look for the next billion-dollar ideas. It is a pleasure to take this opportunity to share with you some of our observations.

About MEXC

MEXC is the world’s leading cryptocurrency trading platform, providing comprehensive cryptocurrency trading services for Spot, ETF, Futures, Stake, NFT Index and more. MEXC currently serves more than 10 million users worldwide and embraces the philosophy of “Users First, MEXC Changes for You”.

next

Check out the latest news, expert commentary, and industry insights from Coinspeaker contributors.

Read More at news.google.com