Source: www.ledgerinsights.com

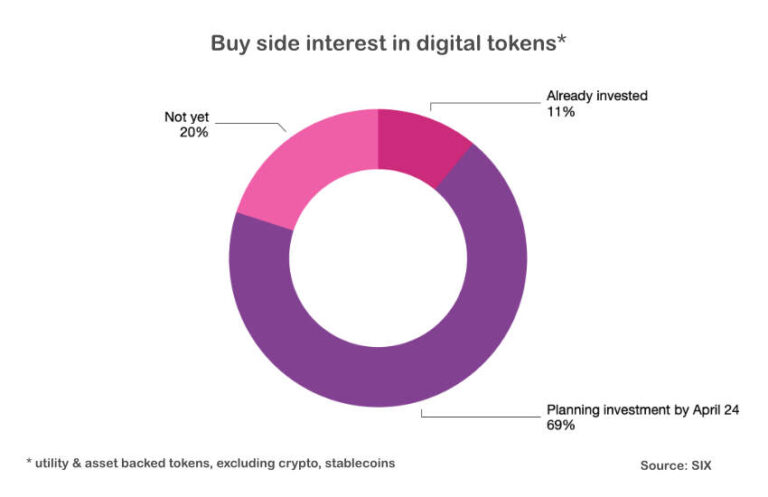

Last week, SIX released the results of an April survey of buy-side firms that cover digital assets and other topics like ESG. It found that only 11% of respondents currently held ‘digital tokens’, but another 69% plan to invest within the year. Digital tokens were defined as asset-backed tokens or utility tokens, but excluded cryptocurrencies, stablecoins, or CBDCs. The survey covered 300 asset managers, wealth managers and hedge funds from around the world.

The biggest driver of adoption was seen as technological advances, but SIX ranked several other motivations such as increased trust. These include reduced counterparty risk, more exchange-traded products, and more regulated trading venues.

Of those who already trade digital tokens, only 54% currently trade on regulated markets.

Lack of conventional custodians is a blocker

The European Investment Bank (EIB) has issued four blockchain bonds. Unrelated to the survey, he sees the need for more traditional custodians as the number one factor currently holding back digital asset adoption. This is because investors prefer to deal with their current custody providers.

Likewise, the SIX survey found that 55% of respondents said they would be more willing to participate if the assets were held by a conventional custodian.

SIX has its SIX Digital Exchange (SDX) for digital assets. Therefore, it is not surprising that you have asked about the importance of a regulated exchange in the entire digital asset sector, including cryptocurrencies. The key roles were seen as increased transparency (42%), followed by increased growth potential (32%) and counterparty risk mitigation (21%).

Meanwhile, SDX is participating in central bank digital currency (CBDC) trials for the Swiss franc. The Swiss National Bank is issuing a real wholesale CBDC on the SDX exchange for a limited period of time.

Read More at www.ledgerinsights.com