Source: dailyhodl.com

Quantitative analytics company CryptoQuant says that Ethereum (ETH) is potentially on the edge of another large sell-off event due to a number of on-chain factors.

The firm says that the Shanghai Hard Fork, which is slated for March of next year and will result in the unlocking of at least 15.3 million ETH, may have implications on the leading smart contract platform’s price.

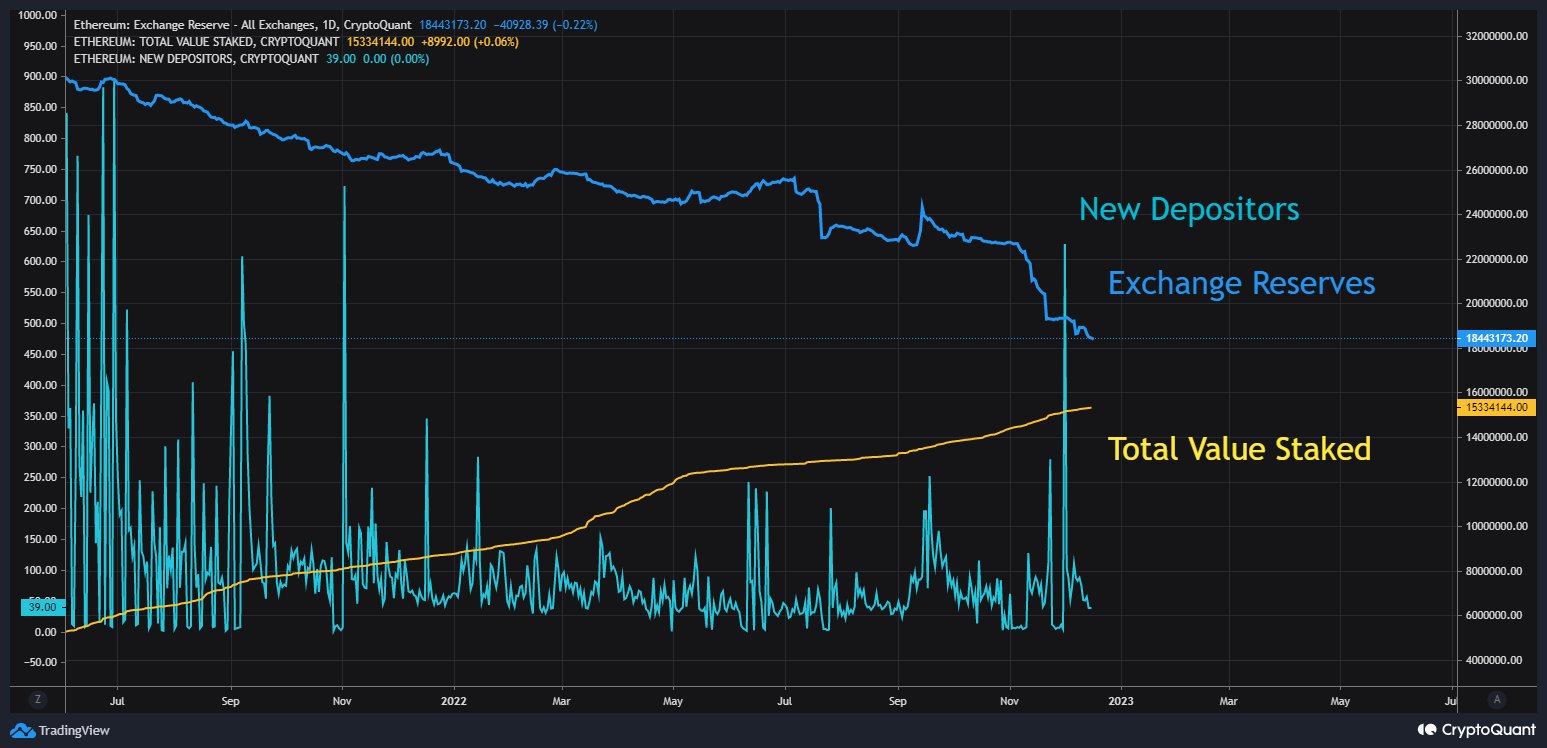

CryptoQuant also says that as staked ETH amasses, Ethereum reserves on crypto exchanges trends down.

“ETH mass-selling event is coming? The ETH2 Deposit [smart contract] has amassed, holding 12% of the total supply. As the ETH exchange reserve drops down to 15% of the total supply and continues to decrease, what will happen on ETH after the Shanghai Hard Fork?”

Ethereum’s merge to a proof-of-stake consensus mechanism provided the ability for investors to earn yield in the form of ETH via staking. With a mass unlock coming early next year to the tune of about 15 million ETH worth over $17.7 billion at time of writing, CryptoQuant says that investors may sell off their Ethereum in search of higher-yielding opportunities.

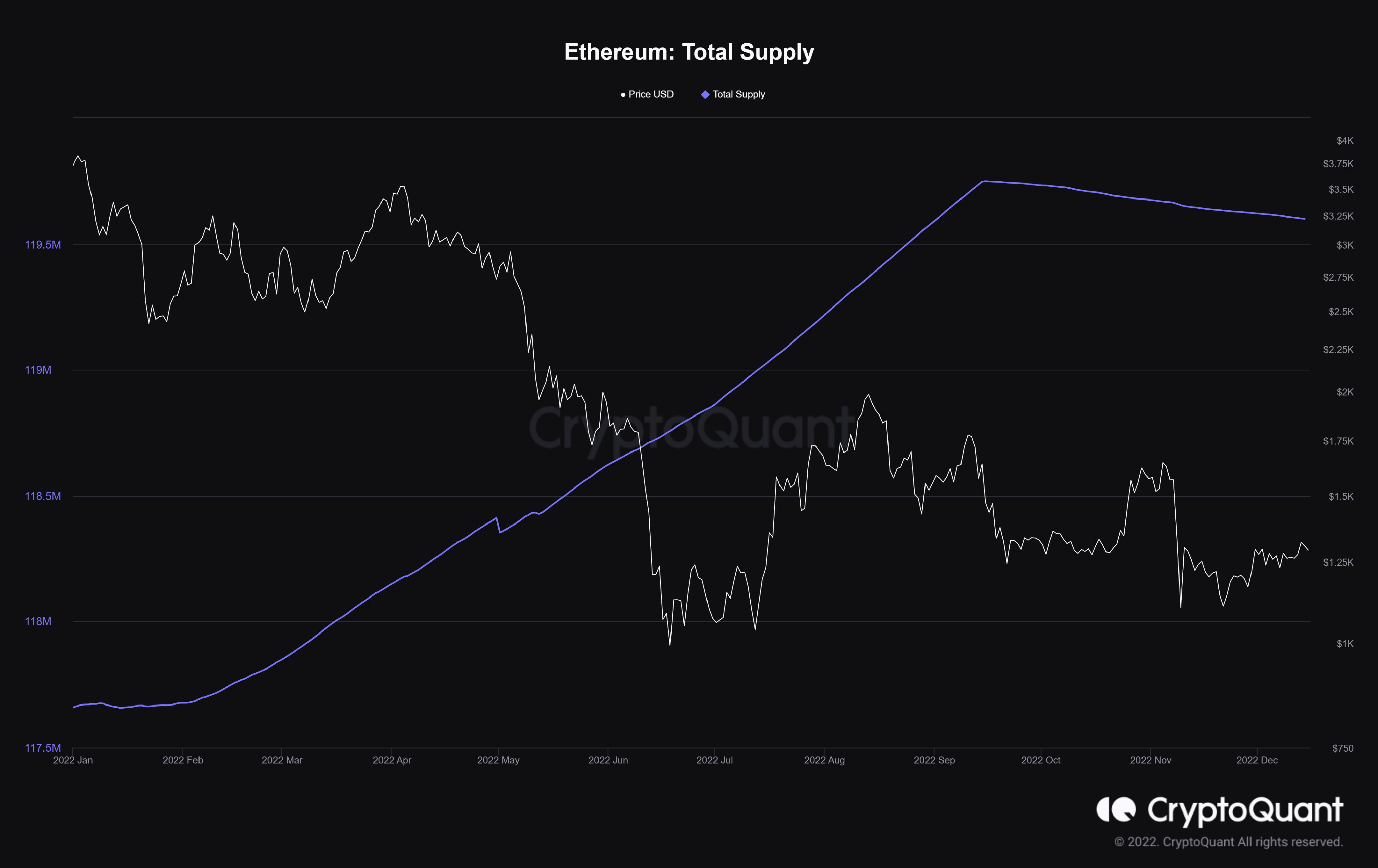

“After the Merge, the supply began to decline; 0.1M. The supply and demand dynamics will shift after the fork. ETH price volatility is imminent. Will Shanghai trigger mass-selling? Or is it an opportunity that provides more liquidity to buy more ETH?”

Ethereum is currently trading at $1,182, down over 75% from its all-time high.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/YanaBu/VECTORY_NT

Read More at dailyhodl.com