Source: www.ledgerinsights.com

Today, the central banks of Israel, Norway and Sweden and the BIS Innovation Hub shared the results of Project Icebreaker, a cross-border central bank digital currency (CDBC) research project.

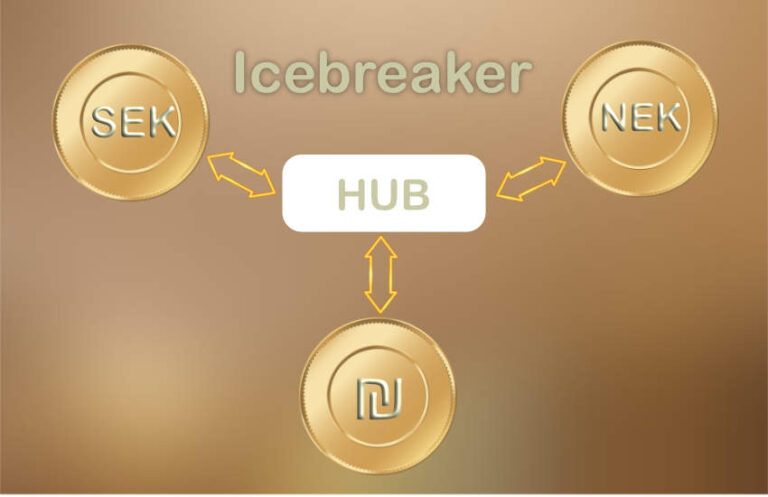

There have been several cross-border CBDC initiatives, but to date, all have focused on the use of interbank or wholesale CBDCs. Project Icebreaker is the first to explore connecting retail CBDCs in a hub and spoke model as a cross-border CBDC application.

Domestic CBDC does not travel across borders. Instead, the payment goes to a foreign exchange (FX) provider who exchanges the domestic CBDC for a foreign CBDC. Unlike today’s payment systems, where the payment provider is often also the FX provider, at Icebreaker there is price competition between FX providers which addresses one of the biggest cost issues with cross-border payments.

For FX, an intermediate currency may be used if there is not enough competition for a particular FX pair.

Icebreaker’s platform is designed as a hub and spokes model, with the central hub operating solely as a message exchange, similar to SWIFT.

All three CBDCs used distributed ledger technology (DLT), Israel and Norway used Ethereum-based private ledgers (Quorum and Besu) and Sweden used the Corda enterprise blockchain.

“When exploring CBDCs, it is important to include cross-currency opportunities early on,” said Aino Bunge, deputy governor at Sveriges Riksbank. “Project Icebreaker is an interesting project that shows how different CBDC solutions in different countries could enable instant cross-currency transactions in a way that would greatly benefit end users.”

Despite the need to consider cross-border issues at the outset, the project found that CBDCs could be very different, with minimal similarities. This includes conditional Hash Time Locked Contracts (HTLC) for interoperability and instant settlement and a CBDC that operates 24/7/365. Also, there must be several FX providers.

“If Israel is going to issue a digital shekel, it would be very important that we do so in accordance with evolving global standards, so that Israelis can also use it for efficient and accessible cross-border payments,” said Andrew Abir, deputy governor of the Bank. from Israel “While there is still a lot of work ahead for the Icebreaker model to become a global standard, the learnings from this successful project have been very important to us and the central banking community.”

The project assumed that wallet providers would deal with anti-money laundering (AML) processes. AML is one of the biggest frictions in cross-border payments. “A wallet provider in one country may not know the origin of funds sent by the payer in another country in a cross-border payment chain,” the document says. It suggests that the center owner might want to explore new technologies to address friction.

Meanwhile, in Asia, the MBridge project, a wholesale cross-border CBDC, is moving towards production as a joint initiative between the BIS and the central banks of China, Hong Kong, Thailand and the United Arab Emirates.

Read More at www.ledgerinsights.com