Source: www.ledgerinsights.com

The largest bank in Japan, MUFG, has been working for years to develop a security token platform, Progmat. It recently expanded its digital asset solution beyond securities to support utility tokens, stablecoins, and a wallet infrastructure. The bank concluded that rather than developing the solution itself, it should be co-created by industry and hosted by a neutral company.

Therefore, a joint venture with SMBC, Mizuho, Sumitomo Mitsui Trust, SBI PTS (owner of Osaka Digital Exchange ODX), JPX (owner of Tokyo Stock Exchange) and NTT Data are being discussed.

In 2019, MUFG created the Security Token Research Consortium, which was renamed the Digital Asset Co-creation Consortium (DCC) earlier this year. In a sign of the growing interest in digital securities in Japan, the DCC has grown from 80 members in February to 163 companies today. The work of the Consortium focuses on the use of Progmat.

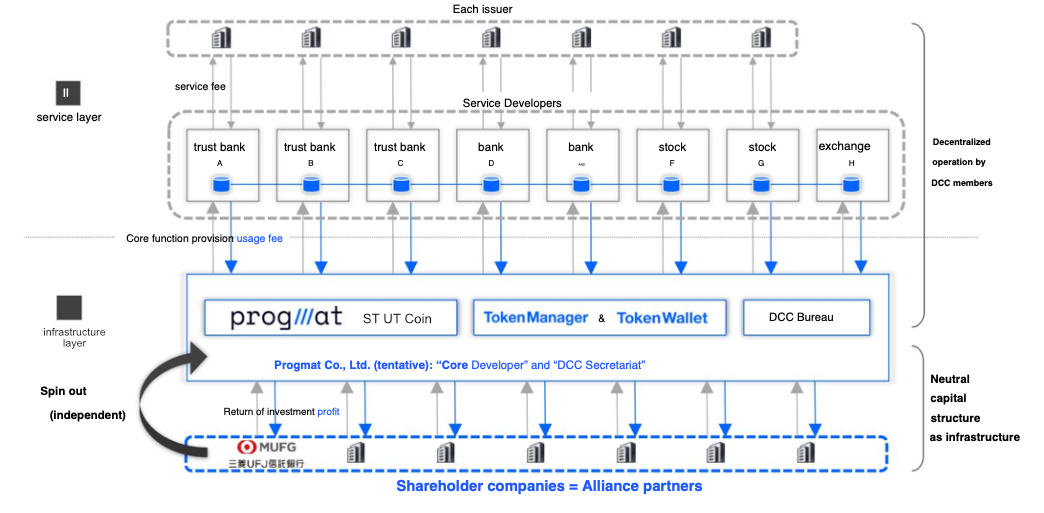

Until now, MUFG owned the intellectual property of the Progmat software and managed the governance of the DCC consortium. With this new national digital asset infrastructure, the technology will be transferred to a new joint venture, Progmat Co (tentative), and the DCC secretariat will be responsible for governance.

While the security token platform was initially considered the primary application, the Progmat Coin solution is now considered critical and is intended to be used for securities settlement, whether on Progmat, other digital securities platforms, and beyond.

The Progmat coin is different from the conventional stablecoin concept. First, there will be multiple currencies, each backed by a pool of money protected by a trust. Using the Progmat Coin infrastructure, coin transfer means payments do not touch the banking system, similar to public blockchain payments.

Another key difference is that the current focus is on a wholesale stablecoin, primarily for institutional use. It is called LBTR (Real Time Gross Settlement) in Progmat. The Progmat Coin is intended to be used for settlement on multiple token infrastructures. Therefore, some recent work has focused on cross-chain ‘RTGS’ payments where the blockchains use a different technology. Progmat uses the R3 Corda enterprise blockchain.

Read More at www.ledgerinsights.com