Source: www.ledgerinsights.com

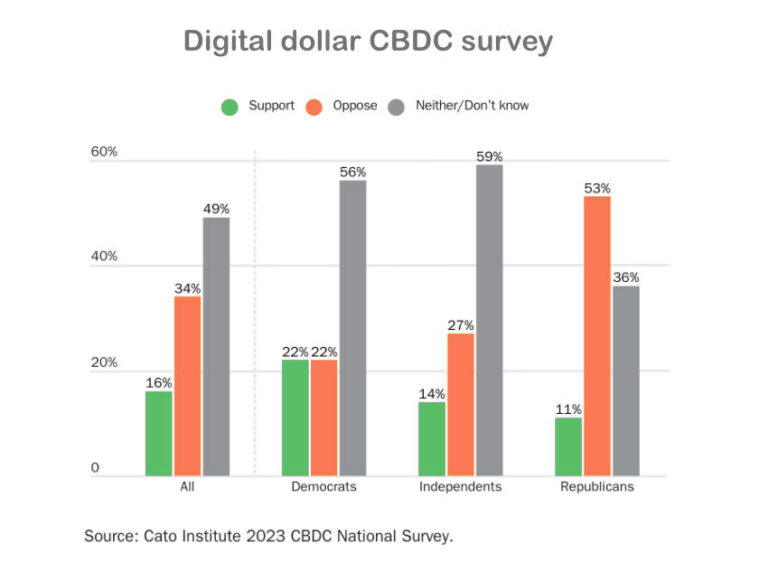

A recent survey by YouGov and the Cato Institute found that 34% of Americans oppose issuing a central bank digital currency (CBDC), compared to 16% in favor. Fears of government control, cash removal, and cyberattacks continue to affect people’s views of a digital dollar, especially among US Republicans. Confidence in the Federal Reserve (Fed) and familiarity with the CBDC were the most correlated with support.

Skepticism about the digital dollar

The poll found that twice as many Americans oppose the idea of a federally controlled digital dollar than those who support it. However, the majority of people (49%) have not yet formed an opinion, probably due to the general lack of awareness of CBDCs by the population.

Among those who opposed a digital dollar, the most compelling reasons were associated with familiar concerns about government monitoring and control, as well as fears about the future of cash and the risks of attracting potential cyberattacks. For example, 68% of Americans would oppose a CBDC if it meant the government could see where they spend their money, as would 68% if it led to the abolition of cash.

On the other hand, some people expressed support for a CBDC if it helped combat financial crime (42%), ensure that welfare payments are spent for their intended purpose (40%), and fight economic downturns (32%). ).

Still, the survey showed that, for most Americans, the potential risks of CBDCs outweigh the benefits. Three-quarters say privacy concerns outweigh the potential benefits of financial inclusion and reduced financial crime.

Determinants of CBDC Attitudes

There were the expected differences across party lines. Republicans generally oppose a digital dollar, while most Democrats either have no opinion or are less resistant.

The survey revealed interesting information about demographics. For example, men (22%), black Americans (32%), and youth (32%) tend to be more supportive of CBDCs, while women (11%), white Americans (13%) and older people (3%) are much less likely to have a positive opinion. Income levels did not have a substantial effect, with 19% of people making less than $20,000 a year expressing support, compared to 21% of those making more than $100,000.

However, the strongest predictors were confidence in the Federal Reserve and familiarity with CBDCs. 52% of those who had a “very favorable” opinion of the central bank expressed their support for the digital dollar, compared to 4% of those who had an “unfavorable” opinion. Similarly, 58% of those who were very or extremely familiar with the CBDC concept supported the idea, compared to 10% of those who were “not very familiar”.

Read More at www.ledgerinsights.com