Source: www.ledgerinsights.com

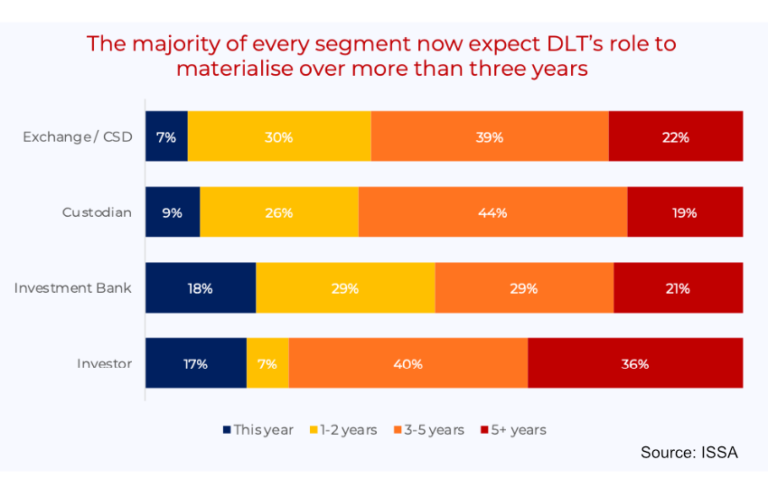

A survey conducted on behalf of the International Security Services Association (ISSA) found that 39% of respondents have DLT implementations that are now in production, up from 32% last year. Despite this, the expected timeframe for the benefits to materialize has become longer. There is a significant reduction in those predicting results this year with 61% anticipating full benefits achieved in three years or more.

Seventy percent of the 359 participants were custodian banks, investment banks, exchanges, or CSDs, and on average these groups viewed DLT as 10% more important than last year. At Ledger Insights, we have seen a significant increase in interest in DLT from asset managers, which was reflected in the survey with an increase of 45% for them and 40% for wealth managers. By contrast, the importance of DLT for insurance companies and pension funds has dropped significantly by 50% or more. However, the small number of survey participants from all groups with high percentage changes means that one should not read too much into this.

Last year there was a 60:40 split in public and private blockchain implementations. The share of public blockchain usage continued to grow, reaching 44%. However, the vast majority have app permissions.

DLT, liquidity and other key drivers

One topic that received significant attention in the report was liquidity as a motivator. Investment banks were the most bullish, with 13% focused on liquidity, 9% on custodians and 6% on CSDs. One of the problems with DLT is that liquidity benefits can only be realized over the longer term. To achieve greater liquidity, there must be a significant ecosystem and integrations with other platforms and legacy systems.

For example, if you look at bond issuance, many issuance platforms are standalone with limited integration. That means that the digital bond is less liquid. In contrast, UBS issued a digital native bond in SDX that was pegged to the conventional SIX central securities depository (CSD), allowing investors to purchase the bond without requiring its custodian to integrate with the blockchain. Therefore, this integration significantly impacted the liquidity of the bond.

The largest expected liquidity benefits from DLT are for cash and collateral. And it comes as no surprise that tokenized settlement platform Fnality was a sponsor of the report.

General liquidity and increased mobility were a driver for only 9% of projects. Cost savings is the primary motivation behind 28% of projects, with learning and new revenue each scoring 23%.

For the reasons already mentioned, liquidity also ranked as the number three challenge in DLT projects. The biggest challenge is the lack of ROI, cited by 21% of respondents, followed by competition from other non-DLT projects for internal resources.

Read More at www.ledgerinsights.com