Source: blockchain.news

A tight macroeconomic environment has been the biggest obstacle to Bitcoin’s bullish momentum as the leading cryptocurrency continues to hover between the $18K and $22K zone.

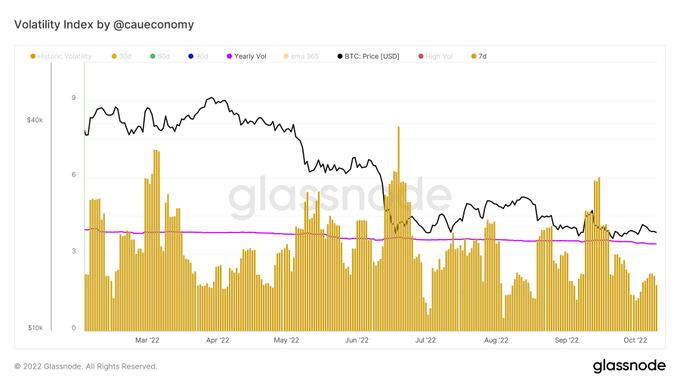

However, all may not be lost because the leading cryptocurrency could be heading for a significant move, according to Caue Oliveira. The Leading Chain Analyst on BlockTrends explained:

“Bitcoin could be close to a strong move. Decreasing historical volatility (7d) may signal the approach of a new “leg” as current price ranges provide low interest, traders are eager for some change.”

Source: Glassnode

Oliveira believes that the decline in interest and volatility in the BTC market could prompt some traders to instigate a strong move so that the status quo can be changed.

Bitcoin fell to lows of $18,300 on Oct. 13 as US inflation data continued to flood the market. However, the top cryptocurrency has picked up momentum to hit $19,588 during intraday trading, according to CoinMarketCap.

The hodling culture continues to mark

Despite the bearish market conditions, Bitcoin hodlers are not giving up their quest for more coins. Market Insight Provider Glassnode fixed:

“The amount of coins HODLed or lost just hit a 5-year high of 7,546,093,884 BTC. The previous 5-year high of 7,545,994.018 BTC was observed on October 13, 2022.”

Source: Glassnode

On the other hand, the balance of Bitcoin on exchanges has also decreased after hitting a minimum of 4 years.

Coins leaving crypto exchanges signify a hodling culture because they are transferred to cold storage or digital wallets for future purposes other than speculation.

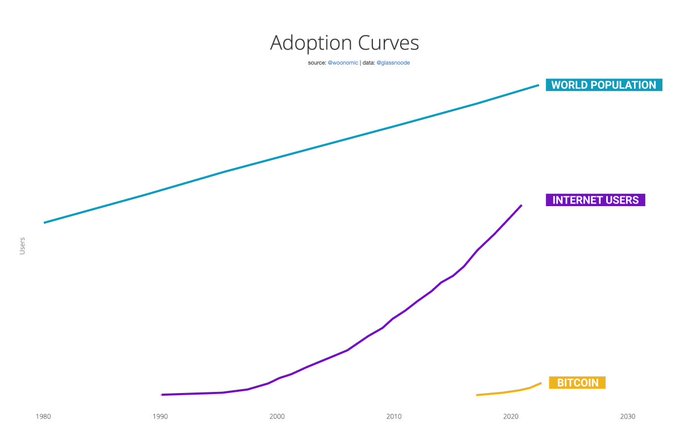

Meanwhile, the number of Bitcoin users continues to grow, with their number speculated to reach 1 billion by 2025. Bitcoin Analyst Willy Woo indicated:

“Bitcoin took 6 months to get 1000 users; 5 years to find 1 million users. Today, 13.8 years after its creation, it has more than 300 million users, 4% of the world. At current growth rates, 1 billion users will be affected in the next 3 years. That’s 12% of the world.”

Source: WillyWoo

Data analytics firm IntoTheBlock recently revealed that over 42 million addresses held BTC despite the bear market, which was 4.5 million more than in 2021.

Image Source: Shutterstock

Read More at blockchain.news