Source: dailyhodl.com

Digital assets manager CoinShares says Bitcoin (BTC), Ethereum (ETH), Solana (SOL) saw heavy inflows from institutional investors last week.

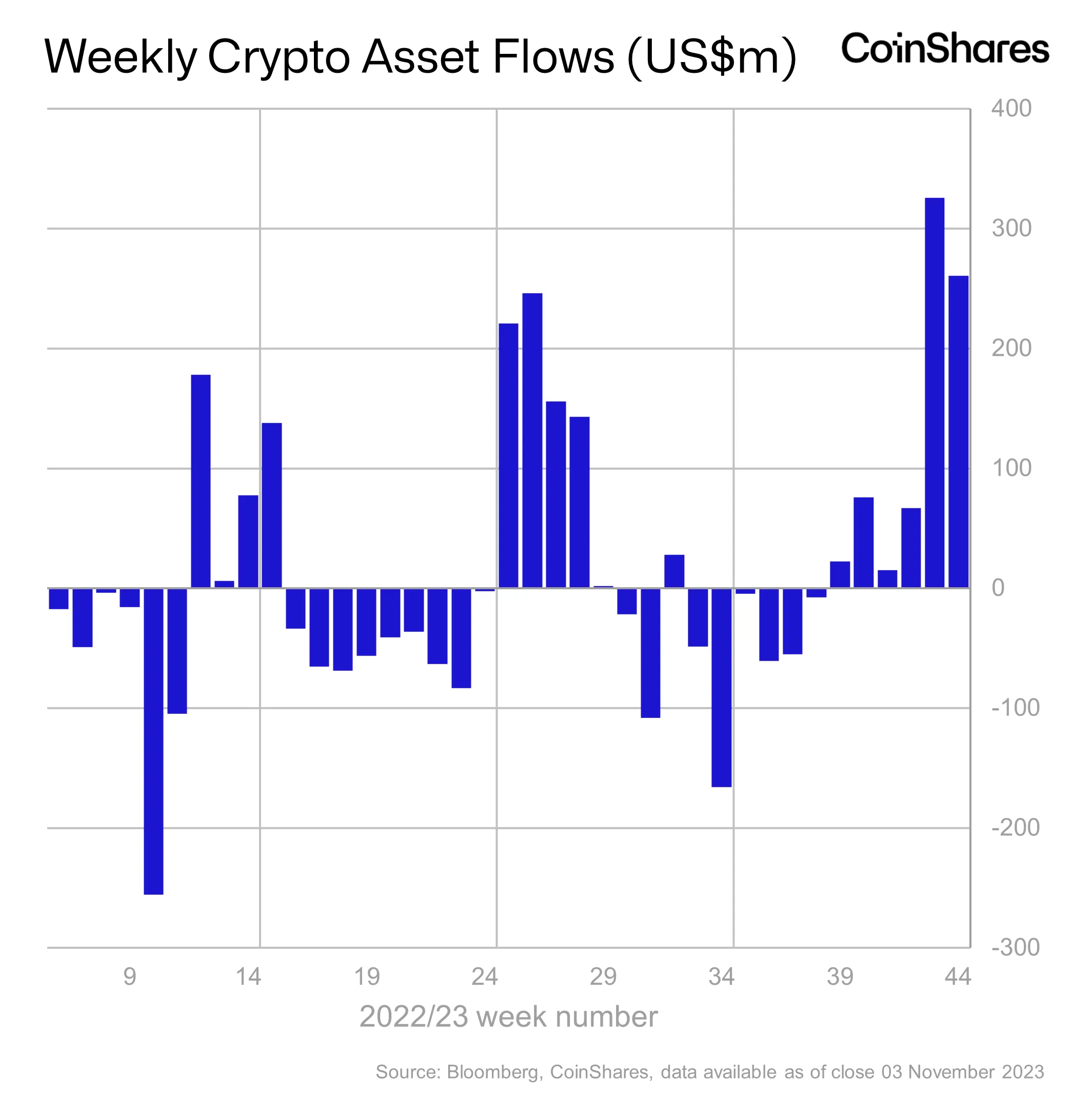

In its latest Digital Asset Fund Flows report, CoinShares finds that institutional investors are continuing to allocate to crypto as the asset class enjoys its sixth consecutive week of institutional inflows.

“Digital asset investment products saw inflows totaling US $261 million, representing the 6th week of consecutive inflows that now totals US $767 million, surpassing the total inflows of US $736 million seen in 2022. This run of inflows now matches the July 2023 run of inflows and is the largest since the end of the bull market in December 2021.”

Per usual, king crypto BTC took the lion’s share of inflows at $229 million, likely spurred by the belief that a spot BTC exchange-traded fund (ETF) is likely on the way, according to the firm.

“Bitcoin saw the lion’s share of inflows, totaling US $229 million, bringing year-to-date inflows to US $842 million, likely buoyed by the increasing likeliness of a spot-based ETF in the US and weaker than expected macro data, bringing into question the efficacy of US monetary policy.”

ETH products saw $17.5 million in inflows last week, breaking a trend that has put ETH flows in the negative by $107 million this year. Solana continued to be an investor darling, raking in $10.8 million last week.

Ethereum-based blockchain oracle Chainlink (LINK) appreciated inflows of $2 million while Polygon (MATIC) and Cardano (ADA) saw inflows of less than a million apiece.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Scrudje/DDevecee

Read More at dailyhodl.com