Source: news.google.com

(Bloomberg Opinion) — Animoca Brands Corp. is looking to raise about $1 billion this quarter for its new Web3 and metaverse investment fund, slashing its ambitions during the current collapse of the cryptocurrency industry.

Bloomberg’s Most Read

Animoca Capital is in talks with potential investors and would use the money to support blockchain and metaverse startups, co-founder Yat Siu, who is also chairman of Animoca Brands, said in a Twitter Spaces chat with Bloomberg in Hong Kong on Thursday.

https://t.co/CrFCO1j8iv

— Vlad Savov (@vladsavov) January 5, 2023

The collapse of the FTX exchange in early November turned the cryptocurrency world upside down, leading to bankruptcies and closures among various players in the industry. About a dozen Animoca portfolio companies were badly affected by the event, beyond the broader market downturn, Siu said. Among them was spaceship seller NFT Star Atlas, which had much of its treasury in the now-defunct trading platform of Sam Bankman-Fried.

For Animoca Capital, “the first quarter is the target and then we’ll see what happens,” Siu said. “It is fair to say that it is a challenging market. But we are quite interested.” He added that a shaky market could eventually mean rising slightly below the target amount.

In November, the Animoca boss said in an interview with Nikkei that the company plans to raise up to $2 billion for the new fund, which will be set up together with former Morgan Stanley executive Homer Sun.

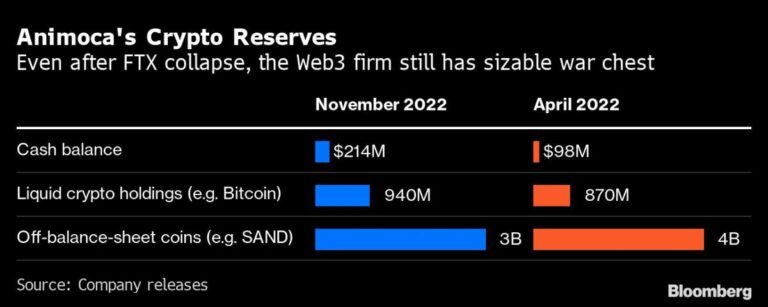

The effects of that FTX chill and the global economic slowdown have made fundraising more difficult, but Siu remains optimistic that capital and interest in cryptocurrencies remains. Several subsidiaries of Sequoia-backed Animoca have raised money even through the FTX cycle, Siu said, without disclosing names or valuations.

Animoca Brands, which has stakes in more than 380 companies, does not plan to raise more funds after accepting Temasek’s investment in September, Siu said. His approach is to develop an ecosystem of complementary crypto companies building the so-called Web3, a loosely defined next iteration of the web with fewer intermediaries and more direct interaction between users and service and content providers.

Market turbulence has affected Animoca’s revenue due to falling prices of digital assets, Siu said. “Because our revenue is token-based, overall revenue on fiat terms will also be affected.”

Online markets for digital tokens crashed in 2022, led by the global liquidity tightening, the collapse of the Terra ecosystem and, most recently, the failure of FTX and Bankman-Fried’s Alameda Research. The largest cryptocurrency, Bitcoin, has plunged more than 61% over the past year, while Ether, which ranks second, has fallen almost 65%.

–With the help of Sarah Zheng.

Bloomberg Businessweek Most Read

©2023 Bloomberg L.P.

Read More at news.google.com