Source: news.google.com

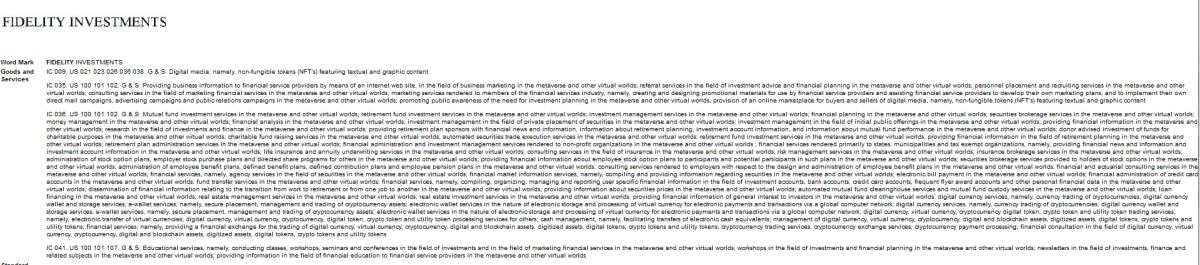

Investment giant Fidelity Investments recently filed three trademark applications with the United States Patent and Trademark Office (USPTO) for a wide range of Web3 products and services. These include an NFT marketplace, financial investment options, and metaverse cryptocurrency trading, all introduced on December 21, as noted by trademark attorney Mike Kondoudis via his December 27 tweet.

Fidelity Investments plans to provide new services

Fidelity Investments puts the metaverse first, offering investment services within simulated environments such as mutual funds, retirement accounts, asset management, and financial planning. Also, it seems that metaverse-based payment services could be updated soon. These would include electronic bill payments, funds transfers, and the ability to manage credit card accounts within virtual worlds and the metaverse itself.

However, it is evident from the documents that this company could probably provide virtual currency wallet services and offer business and management solutions in cyberspace. With these upcoming developments, the crypto space may be on its way to a whole new level.

“Electronic wallet services such as electronic storage and processing of virtual currency for electronic payments and transactions over a global computer network; digital currency, virtual currency, cryptocurrency digital token,” the filing reads.

As described by Fidelity, they could provide educational services in the metaverse, such as classes, workshops, seminars, and conferences related to investing and financial services marketing.

Fidelity is actively considering launching an online marketplace for NFTs, however details about this effort are still largely unknown. Additionally, this initiative would allow buyers and sellers to participate in digital media transactions involving non-fungible tokens.

Fidelity’s bold expansion into the crypto space

Fidelity stands out among other major financial services companies for its rapid adoption of digital assets. In October, it declared that it would add an additional 100 crypto experts to its digital asset team, a move that would bring the total size of the team to 500.

In April, the firm announced its intentions to add Bitcoin as an investment option for 401(K) plans. Unfortunately, not everyone was happy with this decision, and three United States Senators called for it to be reversed due to the highly uncertain nature of cryptocurrencies. The senators pointed to the “volatile, tumultuous and chaotic” state of the industry, which could jeopardize retirement savings if allowed in 401(K) plans without proper risk management considerations.

Last October, Fidelity Digital Assets announced that it enabled Ethereum (ETH) trading for its institutional clients. This news is incredibly compelling because Fidelity has assets with an estimated value of $2.7 trillion. With this new disclosure, Fidelity has become a major player in starting a wave of widespread adoption and use within the metaverse space.

Despite the bear market, Fidelity is undaunted in its investment expansion into the crypto space. Last November, it introduced Fidelity Crypto to specifically cater to retail investors, and it has already amassed a long waiting list of eager clients.

Read More at news.google.com