Source: dailyhodl.com

Fidelity Investments’ global macro director Jurrien Timmer is updating his outlook on Bitcoin (BTC) following the latest price surge.

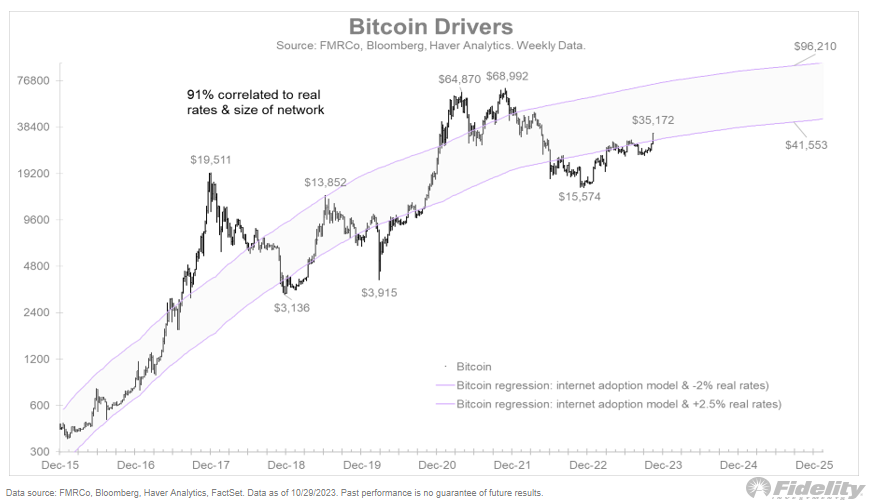

Timmer tells his 173,000 followers on the social media platform X that Bitcoin could soar beyond $96,210 by 2025 due to two main factors.

He lays out a scenario for Bitcoin’s price performance in the coming years based on real interest rates, which is the interest rate minus inflation, and BTC’s adoption rate, which is based on historical internet adoption.

Says Timmer,

“With Bitcoin moving up once again, will its adoption curve accelerate as it did a few years ago? And how does the macro trend on rates affect it? Here’s some data to consider:

[Below], I show a fair value band based on both the slope of the internet adoption curve and the path for real rates. The bottom boundary assumes a TIPS (Treasury Inflation-Protected Securities) real rate of +2.5% (where we are at currently) and the upper boundary assumes -2% (where we were in 2021).

The macro can speed up or slow down the adoption curve, which we have seen play out recently.”

Looking at his chart, the analyst predicts Bitcoin’s price would hit the lower bound of $41,553 in 2025 if the TIPS real rate remains as high as the current rate. However, if real rates decline to what it was in 2021, he predicts BTC would soar in 2025 to $96,210, a 175% increase from its current value.

Bitcoin is trading for $34,991 at time of writing.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Krit Suppaudom

Read More at dailyhodl.com