Source: www.ledgerinsights.com

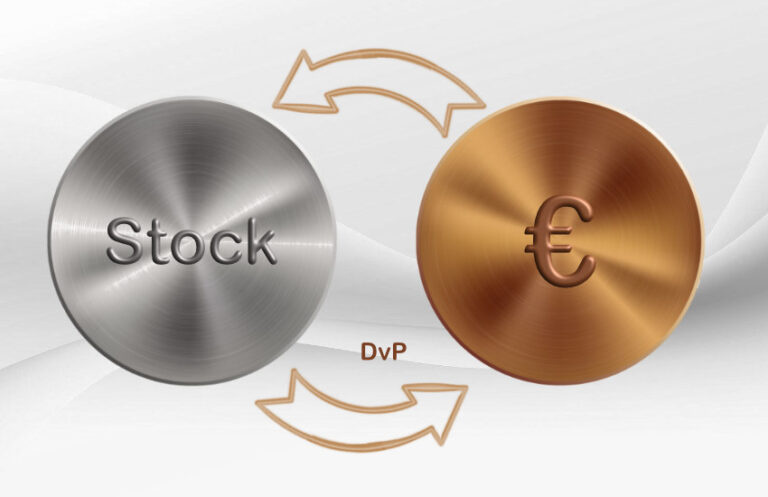

Germany’s SWIAT, the DLT tokenization network founded by DekaBank, proposes a trigger payment solution, Cycros, to use central bank money to settle digital asset transactions. One of the benefits of distributed ledger technology (DLT) is the reduction of risk by allowing the simultaneous transfer of money and tokenized securities in delivery versus payment (DvP) transactions. Ideally, this would be done with central bank digital currency (CBDC).

However, a CBDC digital euro is not likely to be online anytime soon, so a trigger payment solution offers an alternative in the meantime. In particular, as March 2023 sees the launch of the Eurozone DLT Pilot Scheme, which supports blockchain-based securities settlement and trading infrastructures.

The Banque de France has already shown its willingness to get involved in projects using its pilot wholesale CBDC. However, it remains to be seen at what scale it will be available, as the pilot regime should be in the many tens of billions or even hundreds of billions in volume.

Regarding trigger payments, the Deutsche Bundesbank tried a similar solution with the Deutsche Börse last year. Now SWIAT is planning a proof of concept for Cycros with a prototype targeting securities purchase and sale transactions, as well as repurchase agreements.

“The most exciting, innovative and effective aspect of this proposal is leveraging the existing cash infrastructure to rapidly bring delivery vs. payment with central bank money to the DLT,” said Dr. Timo Reinschmidt, European head of banks and houses bag. , Standard chartered. “Intraday risks are mitigated by the simultaneous delivery of digital securities against the central bank money exchange.”

However, when we spoke to DZ Bank’s Holger Meffert a few months ago, he saw a trigger solution as a short-term option. “This would be a solution that would be temporary. Because to really do it the right way would need to have a currency on the ledger that can settle on the ledger,” Moffert said.

How the trigger payment works

Under the Cycros solution, the trigger initiates a payment of central bank money on the next Target2 RTGS (real-time gross settlement) update using ISO 20022 messages and SWIFT public key infrastructure.

This is behavior similar to escrow. Once a security transaction is agreed, the smart contract associated with the digital security token will lock the security until the payment is made. The digital security is transferred to the buyer when the payment is final and is communicated to the smart contract.

Meanwhile, DekaBank launched the SWIAT network in 2021. It uses an enterprise version of the Ethereum blockchain. To date, it has implemented securities lending, German-compliant bearer bonds, and tokenization of existing traditional assets.

Read More at www.ledgerinsights.com