Source: blockchain.news

The crypto market has not yet been able to find its footing due to stringent macroeconomic factors and Russia’s invasion of Ukraine.

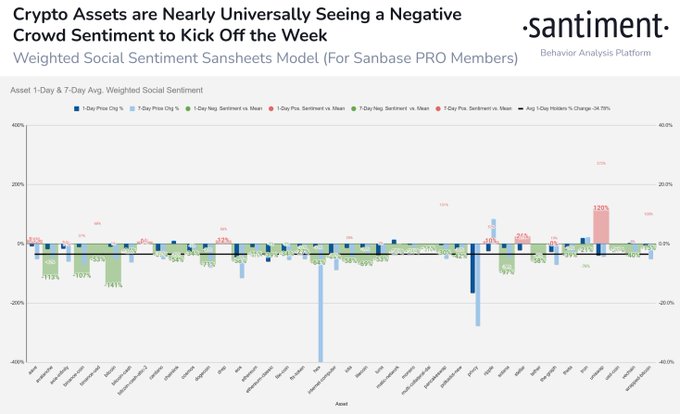

As a result, the crowd’s sentiment towards CRYPTOCURRENCIES has turned negative. Santiment Market Knowledge Provider explained:

“With BitcoinWith Ethereum and most altcoins down slightly on Monday, the bearish outlook of the crowd is still evident. Green bars indicate more FUD than usual towards an asset, and red bars indicate more FOMO.”

Source: Santiment

According to data from Santiment, fear, uncertainty, and doubt (FUD) continue to rock the crypto market, leading to a bearish outlook. Bitcoin (BTC) and Ethereum fell 1.89% and 2.95% to hit $19,067 and $1,278, respectively, during intraday trading, according to CoinMarketCap.

This trend is being witnessed ahead of the release of US inflation data scheduled for October 13.

Riyad Carey, a research analyst at Kaiko, noted:

“There seems to be some nervousness and risk-taking in all markets as we get closer to Thursday’s CPI release.”

Carey added:

“Bitcoin is moving closely with stocks and I expect that to continue as there haven’t been many crypto-specific catalysts in recent weeks. I also expect significant volatility on Thursday, with a move up or down depending on the inflation figure.”

The Bureau of Labor Statistics is set to release the consumer price index (CPI) for September, with some economists expecting a 0.3% monthly increase and an 8.1% annual gain.

the federal Reserve (Fed) has been on a rollercoaster ride of raising interest rates to control runaway inflation, but this has been detrimental to the crypto market.

This trend has raised the concern of several players. For example, James Butterfill, head of research at CoinShares, stated:

“We think there is a growing narrative that central banks are starting to make policy mistakes. Several of our clients have signaled that they don’t want to buy Bitcoin at the moment, but as soon as the Fed changes they will add positions.”

UNCTAD recently noted that the Fed should ease interest rate hikes because this could trigger a global recession, Blockchain.News reported.

Image source: Shutterstock

Read More at blockchain.news