Source: dailyhodl.com

Blockchain analytics platform Santiment is predicting that crypto markets could climb even higher after Bitcoin (BTC) reached a 24-hour high of $30,442.

According to a new Santiment blog post, the king crypto’s latest rally this week was ignited by the news of BlackRock filing for a spot trading Bitcoin spot ETF as well as other institutions wading into the crypto space.

The sudden rally came after the digital asset markets had collapsed the prior week in the aftermath of the U.S. Securities and Exchange Commission (SEC) suing major exchanges Binance and Coinbase.

Santiment says that digital assets may continue to rise due to institutional interest in the form of exchange-traded funds (ETFs) and other flashing bullish signals.

“But why exactly are ETFs such a bullish, welcome sign for crypto? Two words: institutional investors. With the emergence of (theoretically) more secure and simple ways for large capital investors to have exposure to crypto without actually having to own any, this has allowed more capital to enter the markets that have been starving for more entrants.”

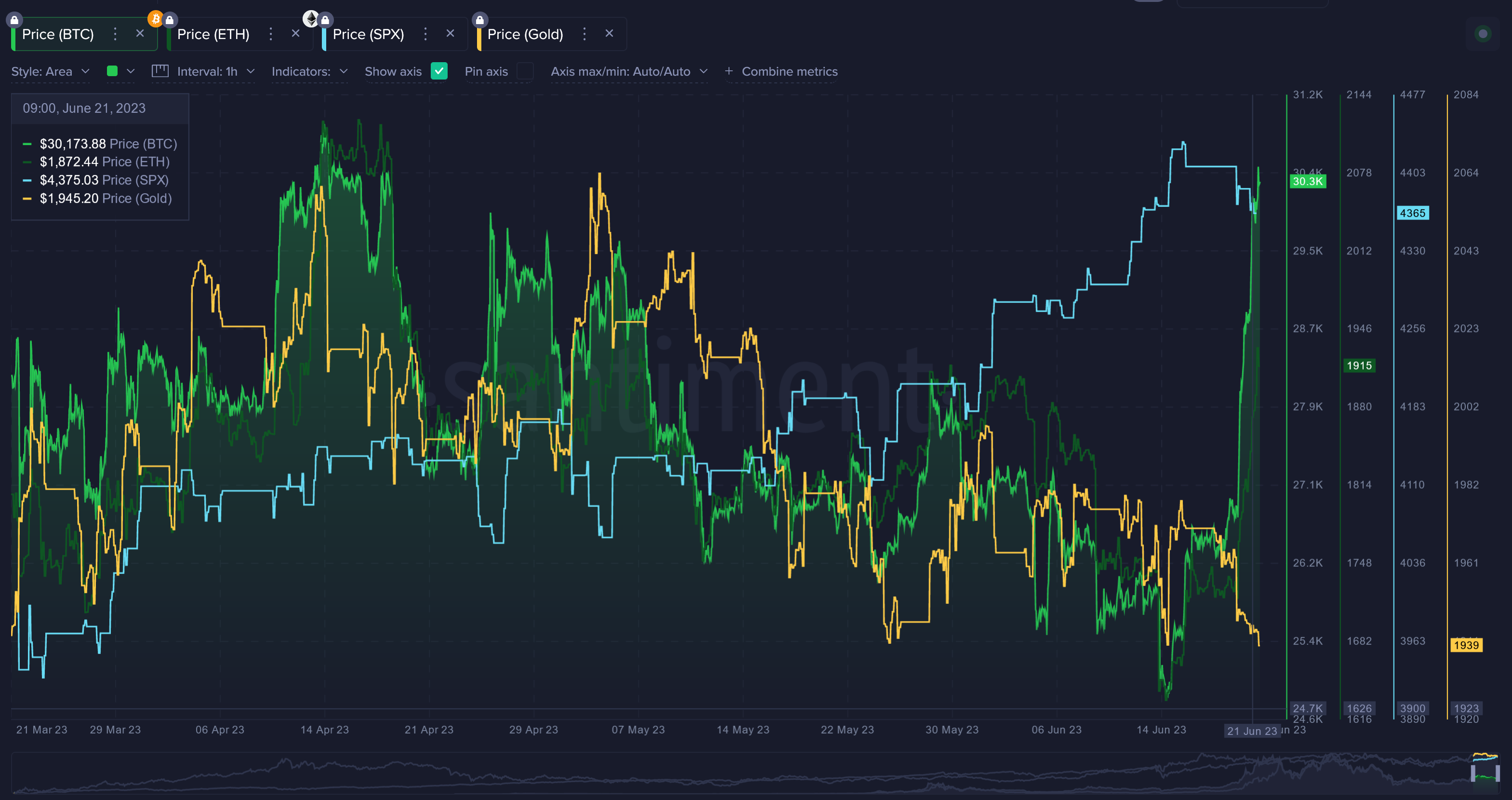

According to Santiment, digital assets like Bitcoin and Ethereum (ETH) may also continue moving to the upside to catch up with stocks, which have been outperforming the crypto markets.

“For one, equities had been veering far and away ahead of crypto markets. And considering how closely tied these two sectors have been to one another, there likely would have been a bit of catch-up time even without all of this added exposure for investors.”

Santiment also says that since many traders are underwater on their crypto holdings there is a greater likelihood of more buying, not selling, and that would lift digital assets up.

“And we can also see that the average trading returns for mid-term traders are still much closer to opportunity zones than they are to danger zones. Traders are still well under water for most assets, and this surge has caught many off guard as they were taking profit. So even now, there could still be more ‘meat on the bone’.”

However, Santiment warns that the SEC lawsuits still have the potential to create strong headwinds for digital assets.

“Regardless of all of this, we still should keep a close eye on the Binance and Coinbase lawsuits. Those certainly haven’t disappeared just because of all of this ETF craze. Watch for the crowd getting too euphoric as a sign we may have topped for the time being as well.”

Bitcoin is trading for $30,114 at time of writing, down 1.5% during the last 24 hours.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Marina Korniienko/Krasovski Dmitri

Read More at dailyhodl.com