Source: www.ledgerinsights.com

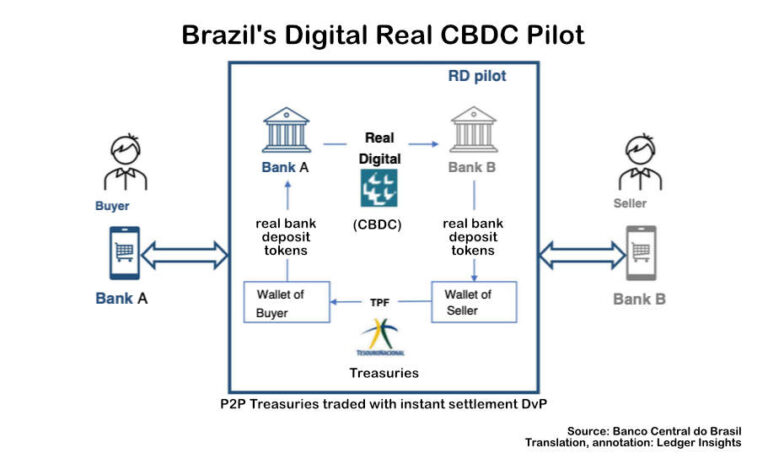

Yesterday afternoon, the Banco Central do Brasil announced the formal start of its central bank digital currency (CBDC) real digital pilot program, with the final launch expected by the end of 2024. The CBDC is based on a distributed ledger technology (DLT) designed to settle wholesale interbank transactions. However, retail access will be enabled through tokenized bank deposits. The central bank also said that the Treasury is contemplating issuing tokenized government bonds.

The pilot transactions will target instant settlements to ensure delivery versus payment (DvP) of financial assets with some programmability. Crucially, this will enable transactions between banks using CBDCs, with instant settlement at the end-customer level using deposit tokens. The central bank also wants to test the privacy of these transactions. Instead of actual transactions, the pilot will initially include simulations.

One of the main reasons the CBDC will not focus on conventional retail payments is the success of Brazil’s “Pix”, an instant payment method that allows individuals and organizations to transfer and receive money, make purchases and pay bills. .

The development and testing phase will run until February 2024, after which the evaluation stage will begin. During the pilot phase, participation will be restricted to a limited number of entities and restricted opening hours. A consultation forum will explore policy issues. Other organizations involved are the National Treasury Secretariat (STN) for potential government bond tokens and the Securities and Exchange Commission (CVM) to provide information for future phases, which will involve CVM-regulated securities.

The platform chosen for the pilot is a licensed version of the Hyperledger Besu blockchain client due to its compatibility with an Ethereum Virtual Machine (EVM).

More to follow.

Read More at www.ledgerinsights.com