Source: dailyhodl.com

Commodity strategists from Bloomberg say that two altcoins are outshining Ethereum (ETH) when looking at one particular metric.

In the latest Bloomberg Intelligence: Crypto Outlook report, analysts Mike McGlone and Jamie Douglas Coutts say that in terms of its fee structure and issuance system, Ethereum enjoys a strong dominance over much of the market.

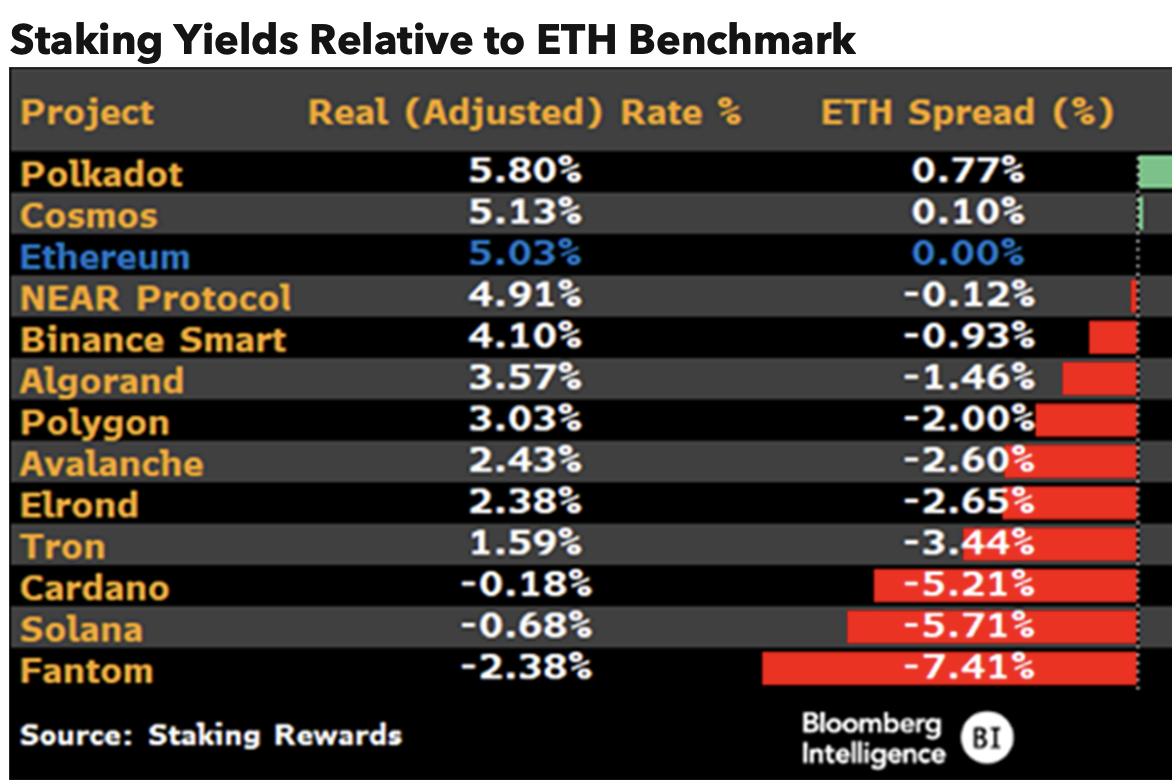

However, the analysts say there are two blockchains that outperform Ethereum as far as staking yield. These altcoins include interoperable blockchain Polkadot (DOT) and Cosmos (ATOM), an ecosystem of blockchains designed to scale and communicate with each other.

“As a result of Ethereum’s dominant market share in fee income and sound monetary (issuance) policy, capital deployment in the crypto economy is likely to start pricing risk relative to Ethereum’s real/adjusted rate (yield). On Bloomberg’s list of layer-1 crypto assets, only two networks have real yields that trade with a positive spread to Ethereum’s benchmark rate of 5.03%. Polkadot trades at a 0.77% premium while Cosmos is at a 0.10% premium. The assets which trade at negative spreads may be victims of mispricing. Inflation/issuance for these assets may need to undergo a radical reduction, similar to Ethereum, in order to attract more capital.”

The Bloomberg analysts say that staking has brought a new dimension to investing in crypto, and they compare it to investing in corporate bonds.

“The emergence of crypto as an asset class in conjunction with a yield component presents a new set of considerations for investors when assessing the risk/reward opportunities in this space. Given the volatility and newness of the demand for smart contract use, staking assets could be considered as equivalent to junk bonds. Yields for proof-of-stake are similar to corporate bonds in that they’re tied to the fees/cash flows

of the network/company.”

According to the analysts, a rise in staking yields is to be expected potentially as early as the first half of 2023, when they speculate that central bank liquidity could improve.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong/Natalia Siiatovskaia

Read More at dailyhodl.com