Source: blockchain.news

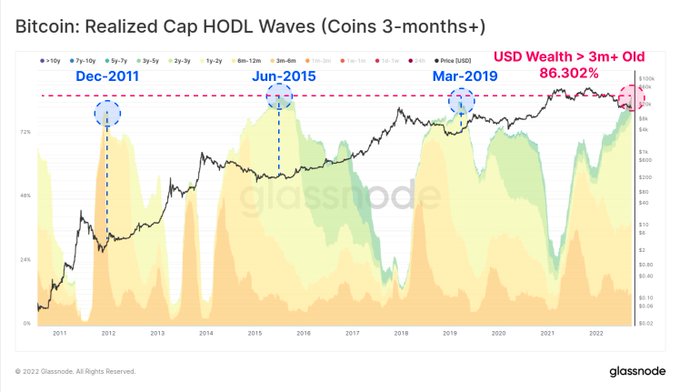

Bitcoin lacked significant upside momentum, but this hasn’t dampened hodlers’ spirits as coins aged at least 3 months hit an ATH of 86.3%, according to Glassnode.

Based on BTC Realized Cap HODL Wave, the market insight provider he pointed:

“3M+ coins now represent an ATH of 86.3% of all dollar wealth held by the BTC supply. Bitcoin hodlers appear to be firm and unwavering in their conviction.”

Source: Glassnode

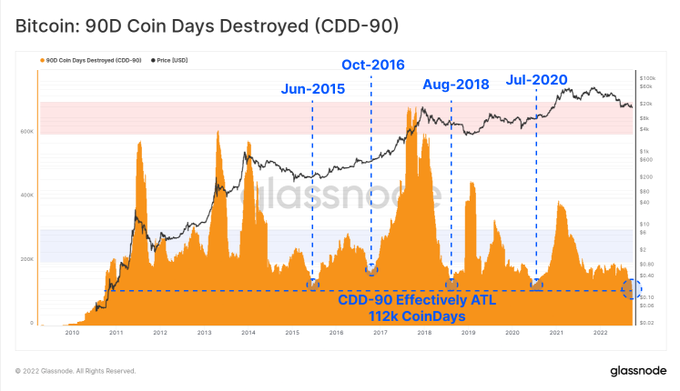

glass node additional:

“The total volume of days worth of Bitcoin coins destroyed in the last 90 days has effectively reached an all-time low. This indicates that coins that have been stored for several months or years are more dormant than ever.”

Source: Glassnode

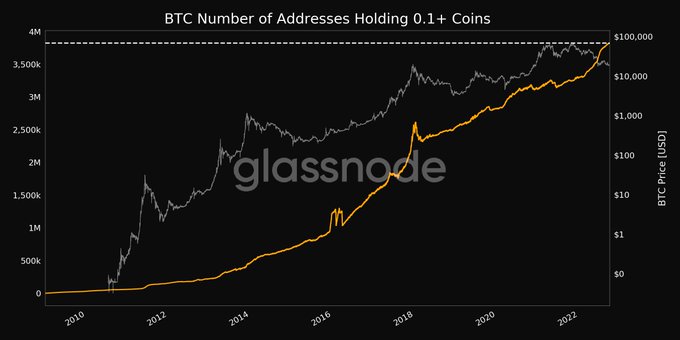

Hodling is one of the favorite strategies in the crypto scene because the coins are held for future purposes other than speculation. glass node fixed:

“The number of BTC addresses containing more than 0.1 coins has just reached an ATH of 3,824,449. The previous ATH of 3,824,379 was observed on September 25, 2022.”

Source: Glassnode

Therefore, BTC hodlers remain undeterred despite major cryptocurrencies trading on shaky ground due to factors such as tighter macroeconomic conditions.

Bitcoin hovered around $18,895 during intraday trading, according to CoinMarketCap.

Meanwhile, Michael Saylor, co-founder of MicroStrategy, recently opined that Bitcoin was 100 times better than gold despite the market crash. Therefore, he expected BTC to emerge as the next great store of value.

“I think the next logical step for Bitcoin is to replace gold as a non-sovereign store of value asset, and gold is a $10 trillion asset right now. Bitcoin is digital gold; it’s 100 times better than gold,” Saylor said.

Image Source: Shutterstock

Read More at blockchain.news