Source: dailyhodl.com

Blockchain analyst Jamie Coutts says that a certain on-chain indicator strongly suggests that Bitcoin should reach a minimum price target of $100,000 by next year.

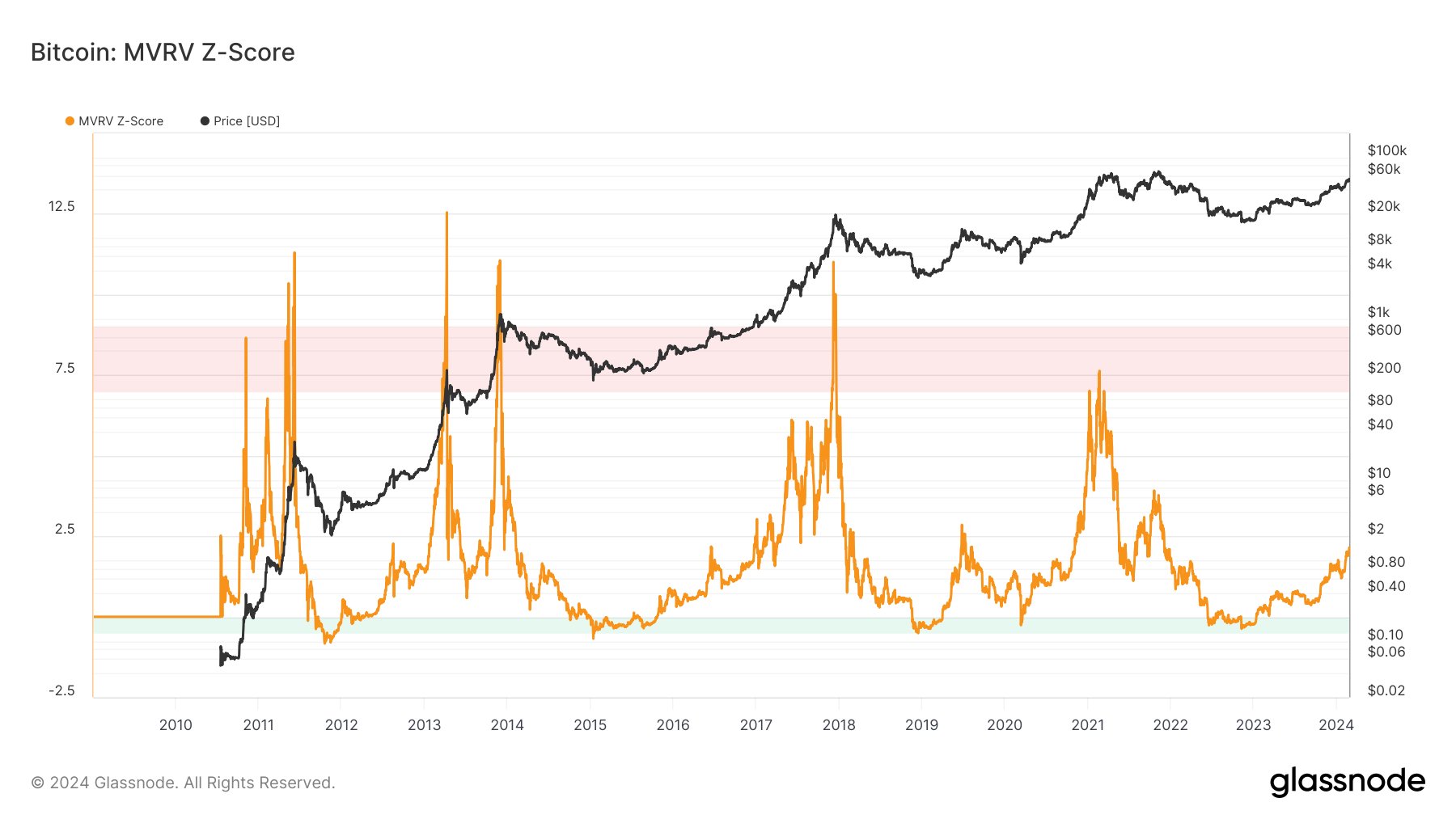

Coutts tells his followers on the social media platform X that he’s watching Bitcoin’s MVRV Z-score, which aims to measure whether BTC is “undervalued” or “overvalued” by comparing its market value to its realized value.

According to Coutts, based on the metric’s historical cycles and the current Bitcoin price, the MVRV Z-score should top out four standard deviations above fair value, implying a minimum of $100,000 per BTC by 2025.

“Last time MVRV Z-score was rising >2 standard deviations in a new cycle was November 2020, 6 months after the Halving. Bitcoin is now ahead of previous 2 cycles on price performance. MVRV Z-score topped above 6 last cycle. If cycle moderation continues, then 4-5 standard deviations seems fair this cycle, implying a BTC price of $100k min by 2025.”

Coutts, a former Bloomberg analyst, also shares an Ethereum versus Bitcoin (ETH/BTC) chart that he says acts as a signal for the different phases of crypto bull markets.

According to the analyst, ETH/BTC’s 50-week simple moving average (SMA) moving above its 200-week SMA has – though the sample size is low – historically signaled the beginning of a new bull market chapter where capital rotates from Bitcoin into altcoins.

“My market regime [for] Ethereum vs. Bitcoin signal will likely trigger in the coming days, marking the next phase in the crypto bull market.

The signal and rationale are simple;

In the first phase of the bull market, BTC outperforms and the tombstone engravers come for ETH pushing the ratio to -3 standard deviation below the 200 SMA – see blue chart (2019, 2022, and 2023).

What follows is a clawback that goes relatively unnoticed and then accelerates as the profit takers move in pre-halving, rotating profits into alts. This conservative strategy waits for the 50/200 SMA cross before it confirms.

Statistically significant? No. Only a handful of instances, but that’s all we have to work with in crypto. Intuitively, it makes sense, mapping degen psychology. And it has guardrails so that if it doesn’t work, the 50/200 SMA will signal by crossing in the opposite direction, as it did in 2022, for usually a small loss.”

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Read More at dailyhodl.com