Source: dailyhodl.com

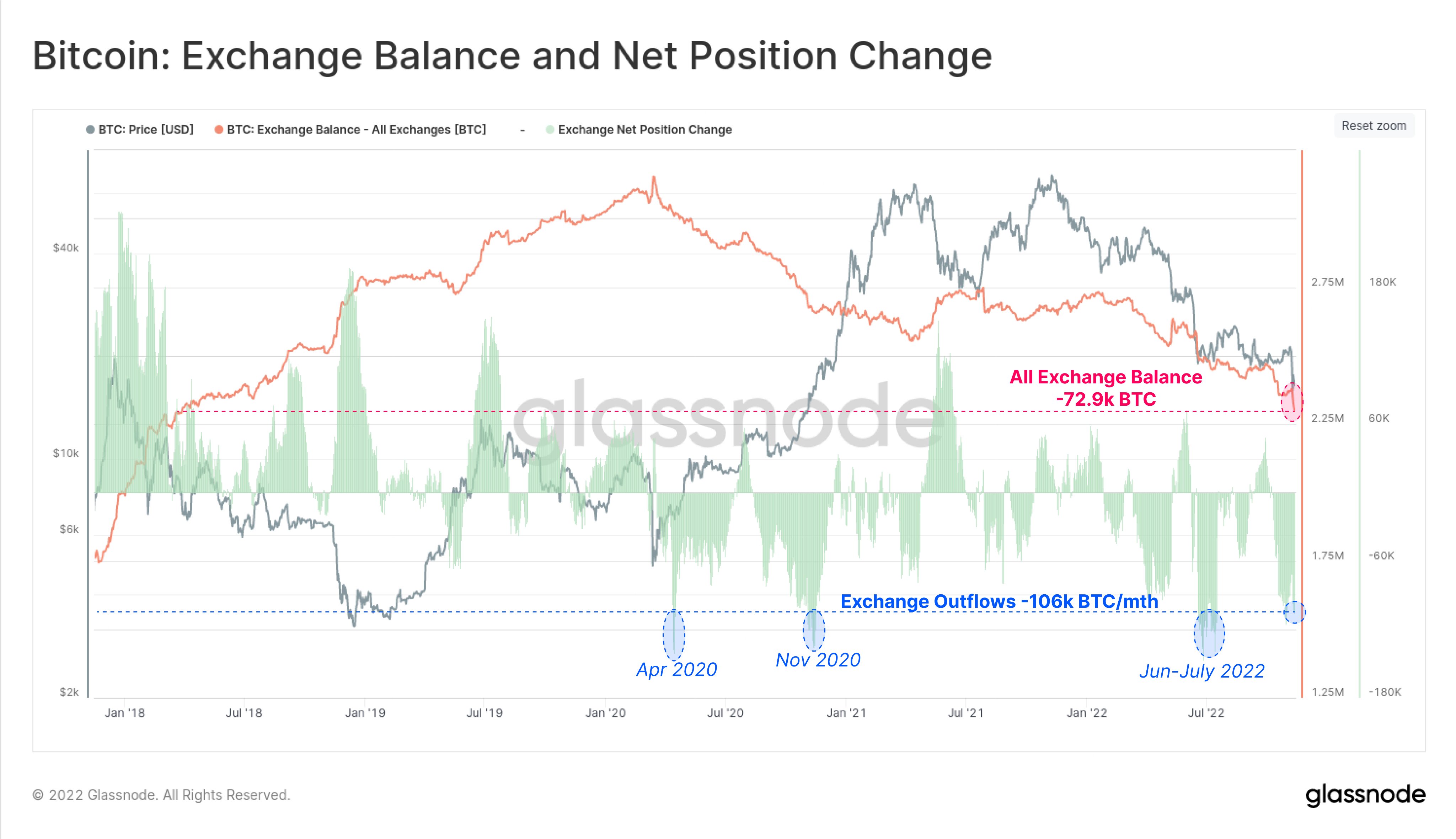

Leading analytics firm Glassnode says that Bitcoin (BTC) holders are withdrawing from crypto exchanges at an astounding pace.

According to the insights platform, Bitcoin investors have taken it upon themselves to take custody of their BTC troves after the implosion of crypto exchange FTX.

Glassnode says that crypto exchanges are now witnessing a massive exodus of Bitcoin at a rate of over $1.75 billion in BTC per month.

“Following the collapse of FTX, Bitcoin investors have been withdrawing coins to self-custody at a historic rate of 106,000 BTC/month.

This compares with only three other times:

– Apr 2020

– Nov 2020

– June-July 2022.”

With Bitcoin flying off of crypto exchanges, Glassnode notes that all wallet cohorts from shrimp to whales are seeing huge spikes in their BTC balances.

“The failure of FTX has created a very distinct change in Bitcoin holder behavior across all cohorts.

The balance change has been dramatic across all cohorts since November 6th:

Shrimp [<1 BTC] = +33,700 BTC

Crab [1-10 BTC] = +48,700 BTC

Sharks [10-1,000 BTC] = +78,000 BTC

Whales [>1,000 BTC] = +3,600 BTC.”

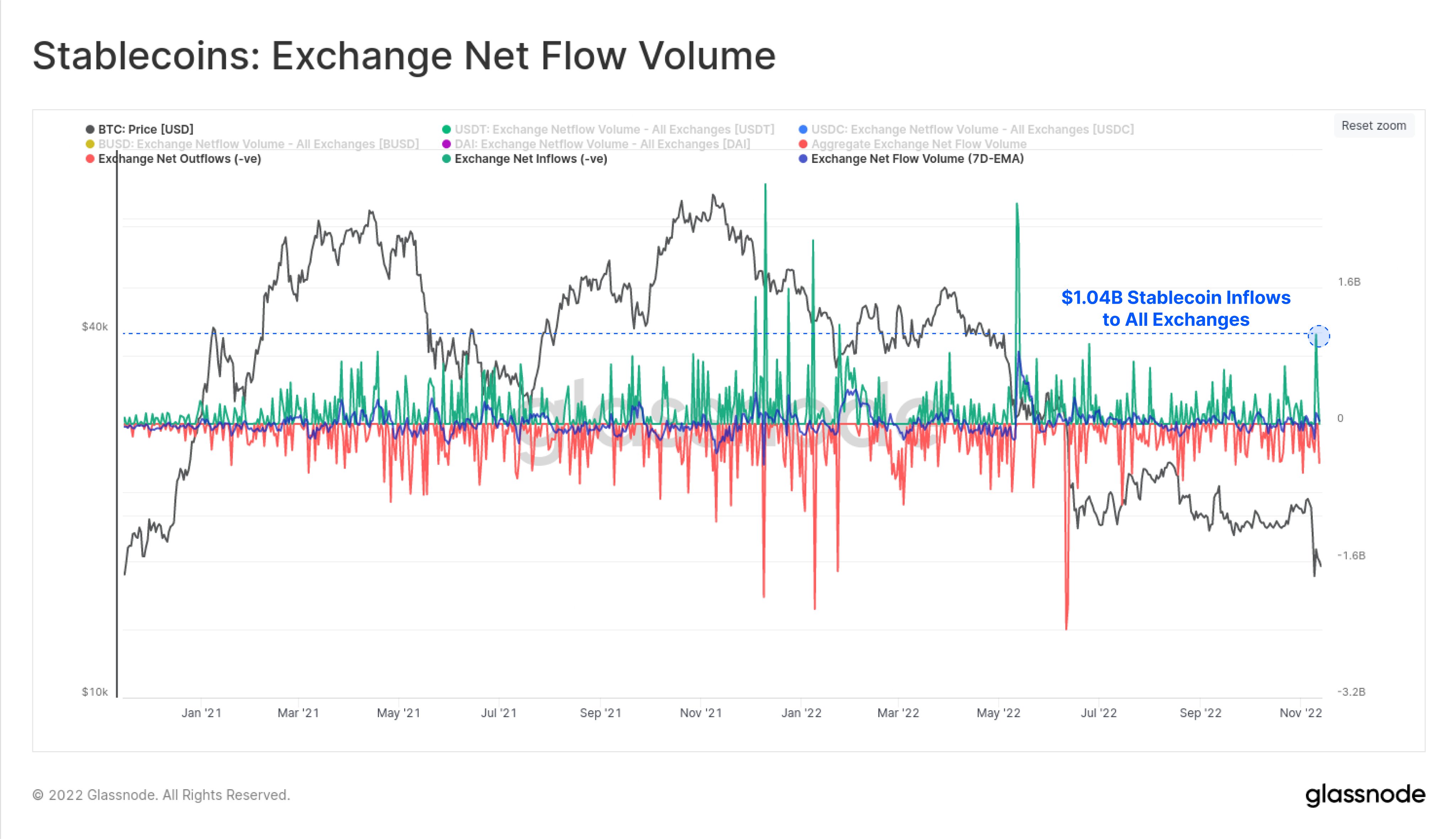

Looking at stablecoins, Glassnode highlights that traders flooded crypto exchanges with dollar-pegged crypto assets after the meltdown of FTX, suggesting that market participants are gearing up to buy the dip.

“This week also saw one of the most dramatic one-day inflows of stablecoins across all exchanges on November 10th. Over $1.04 billion worth of stablecoins flowed into exchanges following the collapse of FTX.”

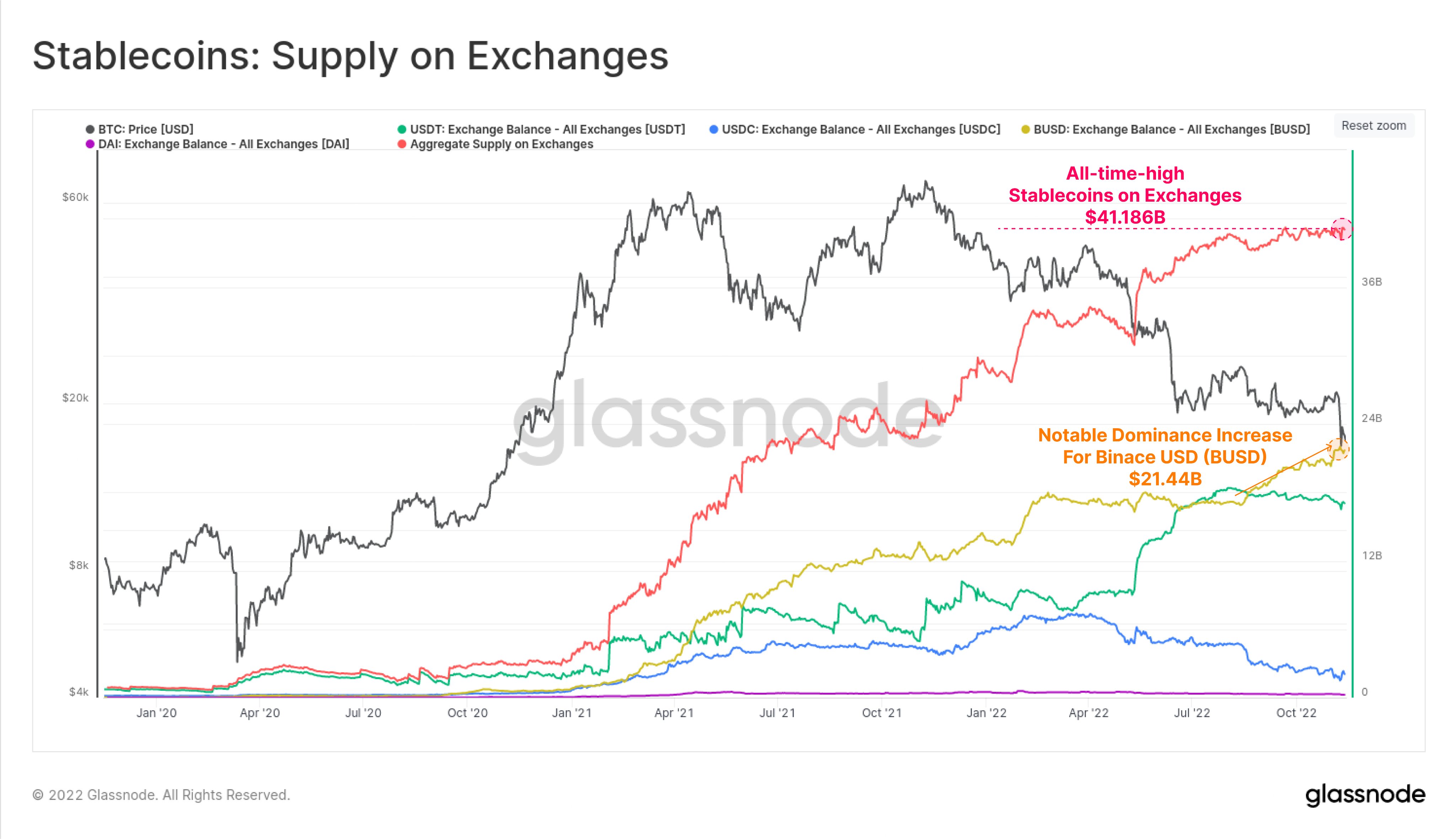

According to Glassnode, the abrupt change in trader behavior has pushed stablecoin reserves across crypto exchanges to a fresh all-time high of $41.18 billion.

Glassnode concludes,

“On net, there appears to be a transition in investor holdings.

– Stablecoins are flowing into exchanges

– Trustless assets like BTC and ETH are flowing out

This leads to a net increase in stablecoin ‘buying power’ on exchanges of ~$4 billion per month.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Chiikun Box

Read More at dailyhodl.com