Source: dailyhodl.com

Digital assets manager CoinShares is seeing signs of bullish sentiment on the horizon among large institutional investors.

In the latest Digital Asset Fund Flows Weekly Report, CoinShares finds evidence of vanishing bearishness as short Bitcoin (BTC) investment products saw outflows last week.

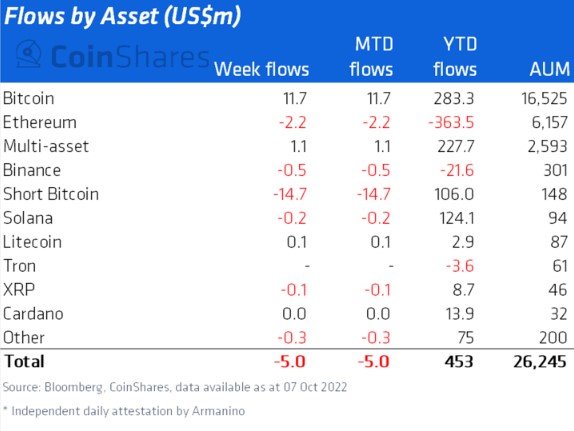

“Digital asset investment products saw outflows totaling $5 million last week, although the majority was from short investment products.”

Short BTC products suffered $15 million in outflows last week as traditional BTC products lost $12 million. Short BTC investments aim to borrow Bitcoin to sell on the market before repurchasing it at a lower price and returning it at a profit.

CoinShares says the Fed’s monetary policies are the likely cause of low volumes seen across the board.

“Volumes remain historically low as investors wait for signs that the US Federal Reserve will back down from its hawkish monetary policy.”

Ethereum (ETH) institutional investment products saw $2.2 million in outflows over the last week, and CoinShares suggests regulatory concerns accompanying the success of the merge update could be the cause.

“Recent feedback from clients suggest concern for its regulatory status as a security now it offers a staking yield.”

While multi-asset investment products, or those investing in more than one crypto, took in $1.1 million in inflows, Solana (SOL) and XRP products both suffered outflows. Litecoin (LTC) was the only altcoin to see inflows last week at $100,000.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Tithi Luadthong

Read More at dailyhodl.com