Source: seekingalpha.com

fazon1/iStock Editorial via Getty Images

Apple (NASDAQ: AAPL) hasn’t released any major new products for a few years now, with Apple Car and AR/VR headsets being the two most anticipated new products to launch in the near future. However, these the products should have limited weight in the company’s revenue mix and are not likely to significantly boost Apple’s growth prospects.

Product diversification and innovation

Apple is one of the largest companies in the world and has the most valuable brand globally, according to Interbrand. This clearly shows that it has a unique position in the technology sector, which was built on the foundation of its innovative capabilities and distinctive products.

Apple’s current product portfolio is quite diverse between smartphones, tablets, laptops, and wearable devices, in addition to its service offerings. Despite that, Apple remains heavily dependent on the iPhone, which accounts for more than half of its annual revenue, while other products carry much less weight.

Due to its great success in the past, the expectations of investors and consumers for new products are usually quite high, and people always expect a new product to hit the market soon. This hasn’t exactly happened in recent years, considering the last big new product was the Apple Watch, which launched in 2015, seven years ago. This means that Apple has struggled in recent years to truly innovate, failing to bring anything truly new to market.

In fact, its strategy seems to have changed from developing new products and segments, such as the tablet in 2010, to focusing on wearables and services, which have significantly increased their share of total revenue in recent years.

Considering that Apple hasn’t launched a major new product for several years, this has led investors to increasingly question whether Apple still has the ability to innovate or whether in the long run Apple will follow in the footsteps of other big tech companies. that have lost a dominant position in their industry, such as IBM (IBM). If that is the case, a much lower valuation may be warranted in the long run, as the company’s growth prospects will not warrant a higher valuation.

However, taking into account Apple’s historical capacity for innovation, in recent months there has been speculation about new products, with the Apple Car and the Virtual Reality (VR) headset being the two most speculated products for launch in the near future. .

I discussed the Apple Car in a previous article, and I think it’s a questionable move by the company to enter the auto industry and isn’t likely to account for much of its total revenue because it’s expected to focus on the luxury market. . This means that VR headsets are the only new product that can potentially change Apple’s revenue stream significantly in the short term, if consumer adoption is good for this product.

Apple AR/VR Headset

While virtual reality/augmented reality (VR/AR) headsets aren’t particularly new, having been used especially in gaming for many years, a VR headset from Apple is highly anticipated and could, potentially, be a key factor for the development of the metaverse.

The metaverse is a virtual environment where people can be together in digital spaces, where people will be embodied instead of just looking at it. A critical technology to achieve this is augmented reality and virtual reality (AR/VR), which allows people to hang out, play, work, and more in an immersive, game-like world.

Metaplatforms (META) has been one of the companies that has invested the most in this industry lately, as the company is betting heavily on the metaverse. Meta offers the Oculus Quest 2 VR, which has seen some success, selling about 15 million units since its launch in 2020, according to IDC. This shows that consumer adoption of VR headsets is growing rapidly and they are increasingly being used for activities beyond gaming.

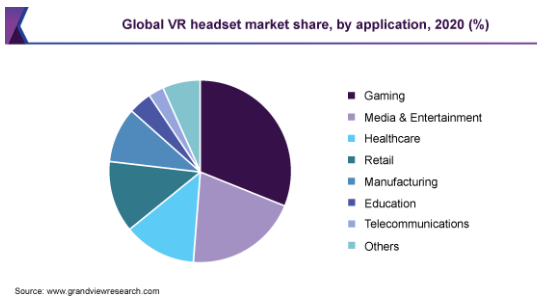

However, according to Grand View Research, the total addressable market (TAM) for VR headsets globally was only $21 billion in 2021, showing that this market is still relatively small. Growth prospects are good, considering that the expected CAGR is 15% between 2022 and 2030, which means that the TAM is estimated to reach around $69 billion by 2030. As shown in the graph below, there are various applications for virtual reality headsets, even though games remain the most widely used.

Virtual reality applications (Grand View Research)

Despite this somewhat limited market size for VR headsets, a potential milestone for this technology may be reached next year, when Apple is expected to enter the AR/VR market with its own hardware. Given that Apple has a loyal customer base and a track record of successfully entering new markets, this may be a pivotal time for widespread adoption of VR technology, which may also be key to the success of the metaverse.

According to various leaks, Apple’s highly anticipated virtual reality headset is a high-end device that will combine virtual and augmented reality. Apple’s goal is to compete with the best VR available on the market and be a separate product from Apple Glasses, which are pure augmented reality. It’s expected to use the new M2 chip, which means it could be as powerful as a MacBook Pro and 16GB of RAM. The expectation is that the launch of Apple VR will increase demand for associated AR games and apps, which are critical to its long-term success.

Apple’s AR/VR headset is expected to be like a typical VR headset, but with an array of exterior cameras and sensors that add additional functionality. This means you can offer body tracking and incorporate real-world environments into a virtual space. This would be an advantage over the Oculus 2, for example, which is VR only.

This new product was expected to enter the market during 2022, but there has reportedly been some pushback due to development issues such as overheating, cameras, and software issues. The latest expectation is that development will be finished by the end of this year, with the product expected to be on sale in 2023.

While an Apple VR headset may be an important product to drive growth in the AR/VR headset market, based on current global TAM estimates, this product should not weigh heavily on Apple’s total revenue in the next years. In its last fiscal year, Apple’s revenue totaled $365 billion and is projected to reach about $450 billion by 2025. Assuming Apple’s VR headset is very successful and commands a 50% market share in three years, this would generate about $18 billion in revenue by fiscal 2025. This means that AR/VR headsets would account for about 4% of Apple’s total revenue, which would weigh very little in the revenue mix. of the company.

AAPL rating

While Apple’s growth has been very strong over the past two years, fueled by the pandemic and increased demand for consumer electronics and also the 5G upgrade phase in the iPhone, the company’s growth prospects in the coming years are not particularly impressive. The current macroeconomic environment is challenging for large companies, such as Apple, that rely on consumer spending, which is expected to decline due to lower economic activity around the world.

This means that for Apple to report strong revenue growth it needs new products, but AR/VR headsets and the Apple Car are niche products and should have limited impact on Apple’s revenue growth. In fact, based on sell-side estimates, its expected revenue growth over the next four fiscal years (including fiscal 2022) is only 5.8% per year, which isn’t particularly impressive.

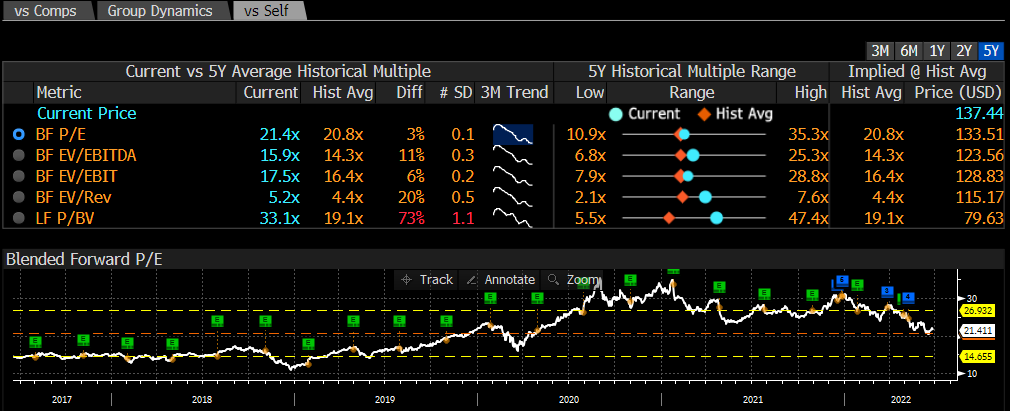

Despite lackluster medium-term earnings growth, Apple shares have been fairly resilient during this bear market and are only down 25% from their all-time highs, a far better performance than most stock companies. technology. This means that its valuation has not lost much value in recent months, and it continues to trade at a level above its historical average, as shown in the following chart.

Valuation (Bloomberg)

Apple is currently trading at 21.4x earnings over the next twelve months, while its historical average over the last five years is 20.8x. However, before the pandemic, its maximum valuation multiple was 22x forward earnings, and it was only during the 2020-21 bubble that it reached an extreme valuation above 30x earnings. Furthermore, prior to 2020, its valuation multiple was typically in the 10-15x earnings range, a multiple that seems more appropriate for a company that is projected to grow revenues in the mid-singles for the next several years.

Therefore, despite its recent correction, Apple shares can still be considered overvalued at the moment and further declines are likely in the future, as current estimates may be overly optimistic if major economies developed enter recession in the coming months and the demand for their products decreases. as people will be less willing to buy high-end products.

conclusion

Apple is a great company and historically innovation has been one of its key strengths, a situation that has changed in recent years as the company has struggled to deliver new products that have a real impact on its revenue mix. The Apple Car and AR/VR headsets are the two most anticipated new products to hit the market, but they will most likely be niche products that won’t be game-changers for the company’s fundamentals.

While Apple has excellent fundamentals, its growth prospects are somewhat dim and this is not reflected in its current valuation. For long term investors this means that Apple is ‘held’ at the moment, but if you are a market timing sensitive investor then you are probably better off selling Apple stock as new products are likely to do not boost their growth by much in the coming years.

Read More at seekingalpha.com