Source: dailyhodl.com

A widely followed on-chain analyst thinks that Bitcoin (BTC) bears are about to get wiped out following last week’s crypto correction.

Analyst Willy Woo tells his 1.1 million followers on the social media platform X that the most recent Bitcoin retracement to $60,000 flushed out leveraged longs.

Woo says he doesn’t see Bitcoin going down in a straight line as he believes that BTC bulls will defend the “formidable” short-term holder (STH) at $59,000. According to the analyst, the odds are higher that BTC will bounce and liquidate traders who shorted at around $70,000.

“We flushed out long leverage down to $60,000.

To liquidate lower, price would have broken the formidable $59,000 STH support, and a strong sign of a bear market.

More likely short liquidations to $71,000-$75,000 is next.

Short-term price is a walk of liquidations.”

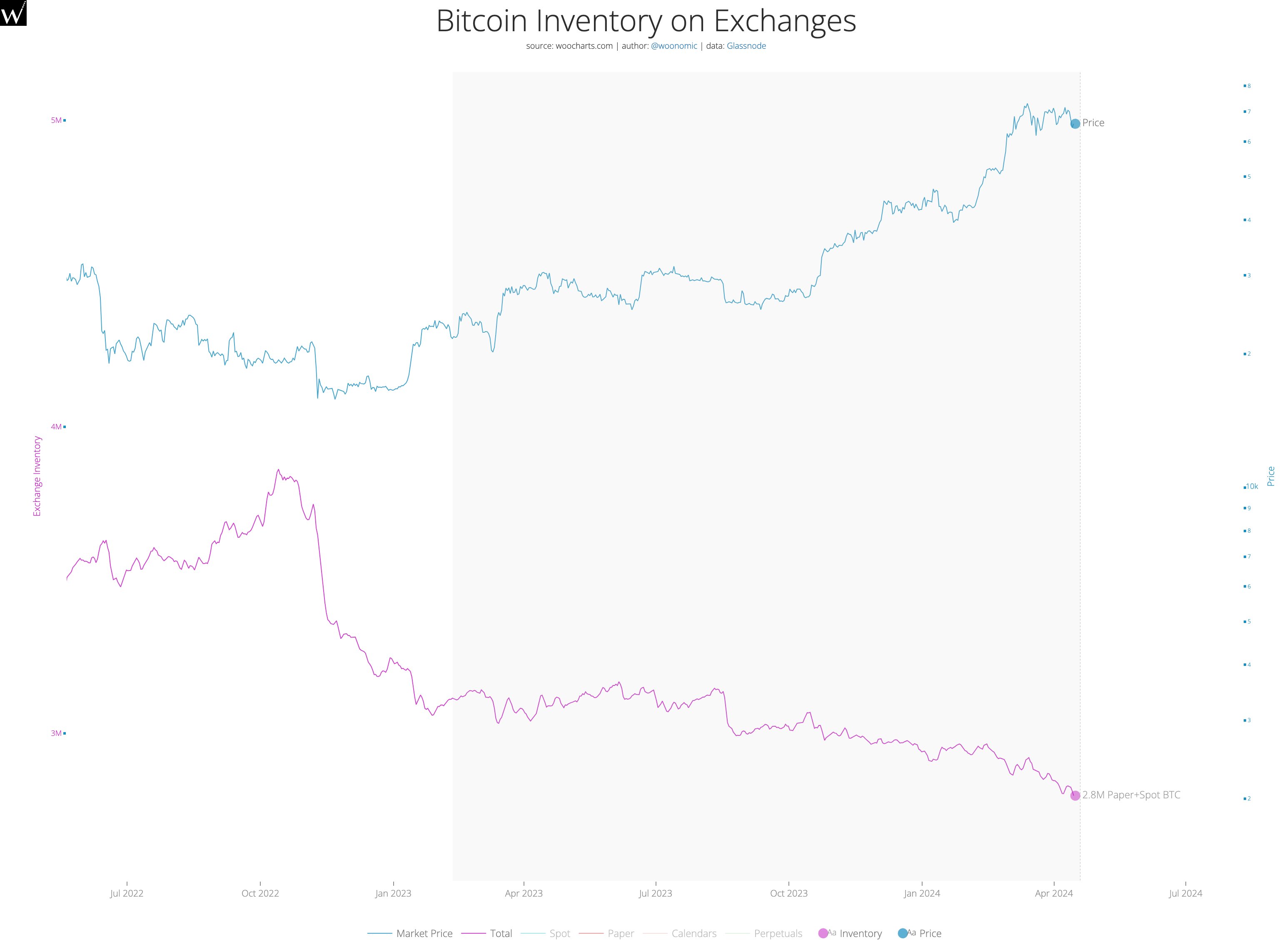

Woo is also keeping a close eye on the amount of Bitcoin supply available on crypto exchanges. According to the analyst, BTC’s inventory on exchanges has been on a downtrend since October 2022, suggesting that it’s only a matter of time before demand overwhelms supply and pushes Bitcoin to new all-time highs (ATH).

“Looking at views of demand and supply, this chart being only one of them, it’s just a matter of time before the accumulation happening throughout this consolidation squeezes us past ATH. Patience is key, don’t be degenerate.”

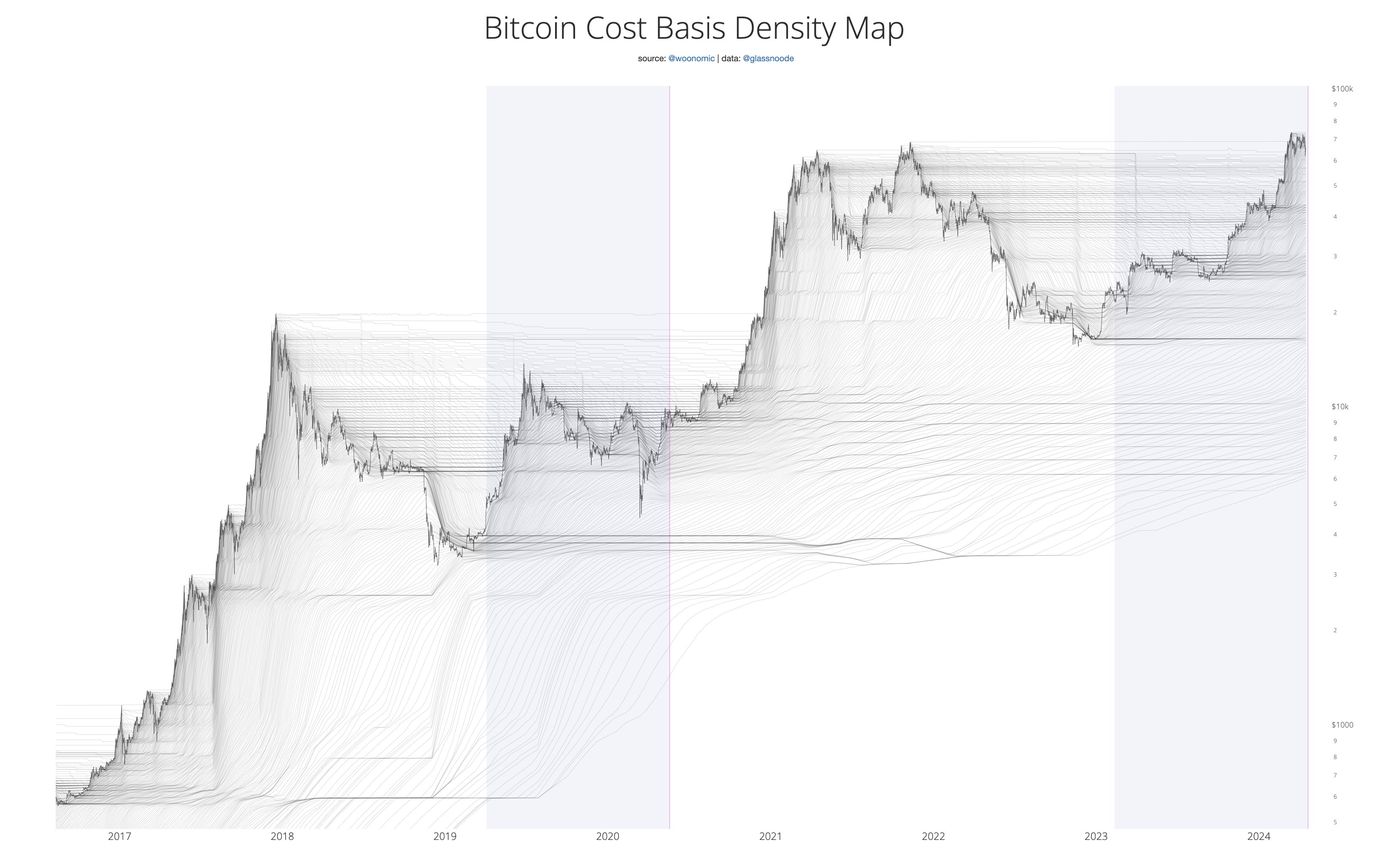

Woo also highlights that the current consolidation around the all-time highs is creating a solid support level for BTC. According to Woo, the ongoing accumulation between $60,000 and $70,000 is establishing a base of buyers that will secure BTC’s place as a trillion-dollar asset.

“Remember: the longer BTC consolidates around ATH, the more coins that change hands between investors cementing its price discovery.

This creates formidable long-term support once we break it.

Bitcoin as a trillion-dollar asset class is here to stay.

This is a good thing.”

At time of writing, Bitcoin is trading for $63,272, down nearly 4% in the past day.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Read More at dailyhodl.com