Source: dailyhodl.com

A widely followed crypto strategist says a short squeeze could materialize for an altcoin project that just suffered a $41 million hack.

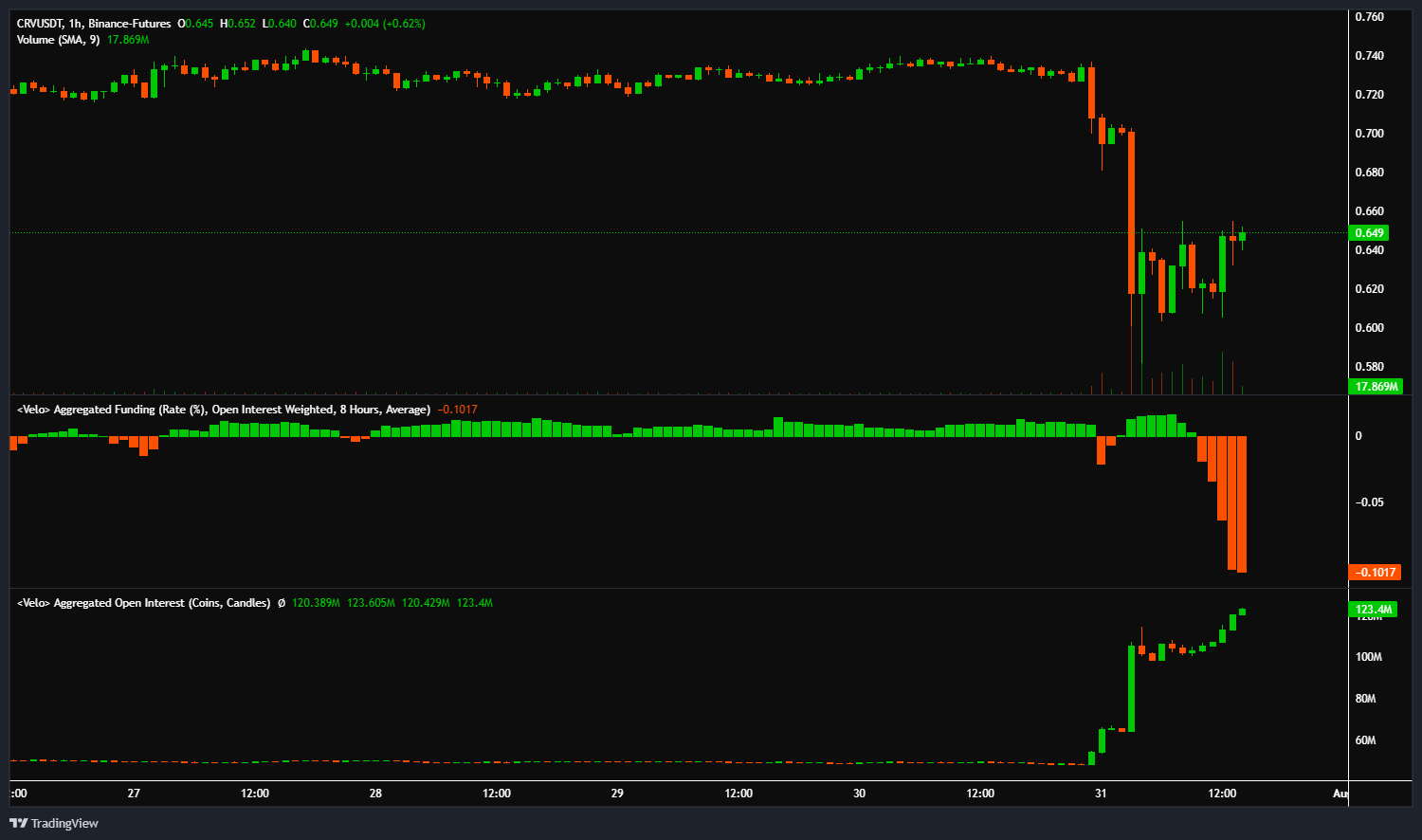

Pseudonymous analyst Credible Crypto tells his 343,200 Twitter followers that Curve (CRV) is experiencing a massive amount of short interest.

However, the analyst says that if the native token on the decentralized finance (DeFi) Curve platform does not soon move further down from its current value it may trigger a short squeeze.

A short squeeze happens when traders who borrow an asset at a certain price in hopes of selling it for lower to pocket the difference are forced to buy back the assets they borrowed as momentum moves against them, triggering further rallies.

“Also worth noting the massive increase in shorts down at these levels. While another swing down seems like the obvious move to me (and clearly many others) the high short interest here could facilitate a squeeze in the opposite direction if we don’t move down soon. The next couple of days will be interesting to say the least.”

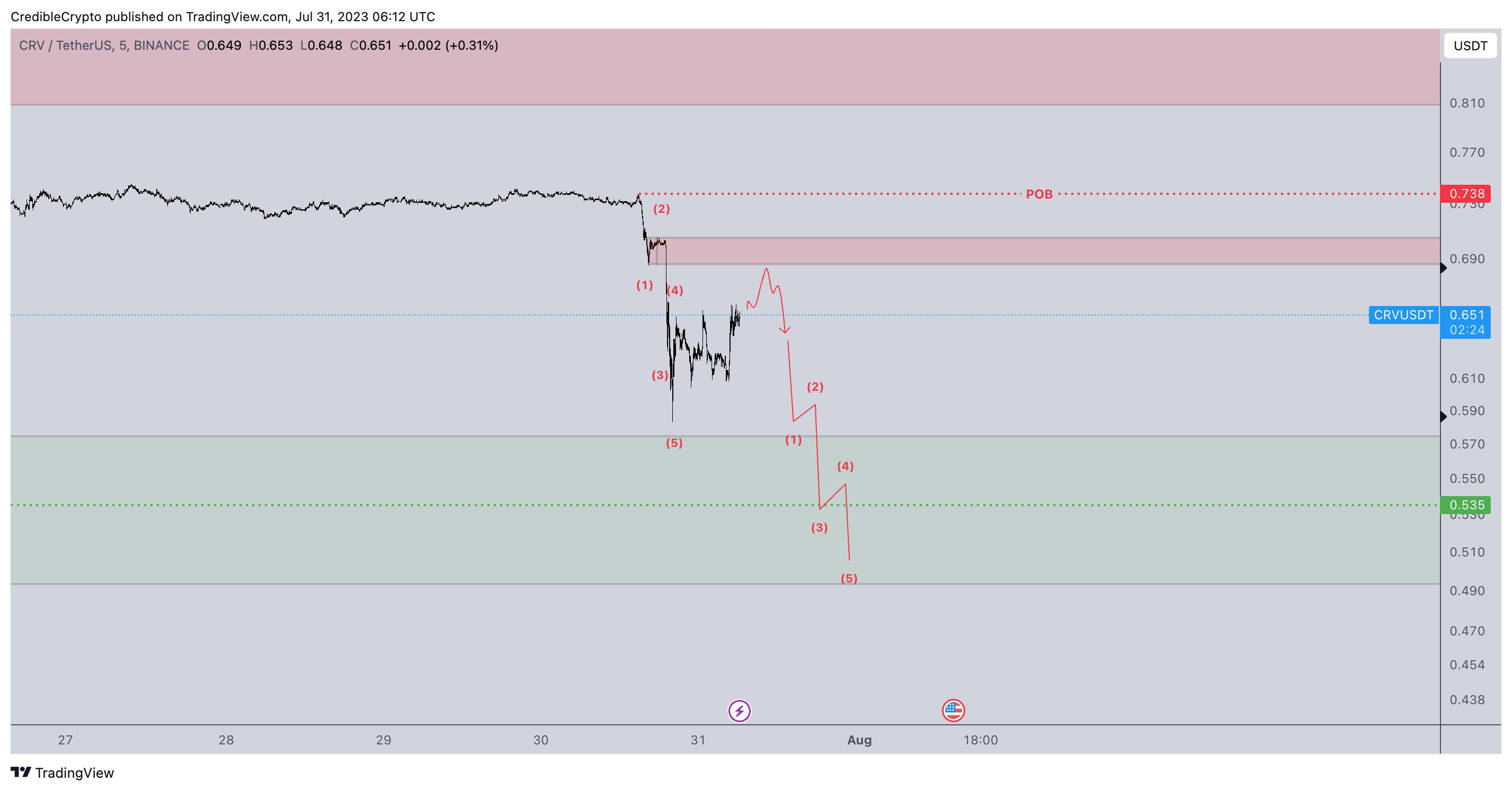

According to the trader, CRV could decline from its current value at time of writing of $0.59 to $0.49, a 17% decrease. He uses the Elliott Wave theory, which states that the main trend of the price action of an asset occurs in a five-wave pattern to arrive at his bottom price target.

“While the dust may be starting to settle on the recent CRV events, we are still waiting on a couple of wild cards that need to be addressed before we can go back to focusing exclusively on the charts. These issues are probably addressed in the next 48-72 hours.

In the meantime and from a purely technical perspective, I don’t think our drop is done yet. If we can get back above the RED ZONE and point of breakdown (POB) then it likely is, but until then I expect that this move down is not yet complete – and looking for a push into the GREEN zone below for now. This is the same zone I highlighted in my prior chart about a month ago – so the levels haven’t changed. Let’s see how things develop over the next couple days.”

Curve said on Sunday that because of a vulnerability with the programming language Vyper 0.2.15, several liquidity pools on the platform were exploited. Users in the affected pools were told to withdraw their funds.

Blockchain security infrastructure firm BlockSec estimates the hack resulted in a theft of more than $41 million.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: Midjourney

Read More at dailyhodl.com