Source: www.ledgerinsights.com

Today, Broadridge released a report exploring the metrics cryptocurrency investors use to make decisions. Several of the survey findings are to the contrary. For example, 65% of those surveyed identified themselves as long-term investors rather than speculators. Perhaps because of this, most only want monthly or quarterly data updates rather than when they happen. And tokenomics ranks low on his list of preferred decision-making metrics.

Dr. Chris Brummer of Georgetown Law assisted with the survey.

With these kinds of results, the first question is who the participants are. Half of the 2,000 respondents were from the US, and the rest were split evenly between Canada and the UK. True North Market Insights randomly selected individuals who identified themselves as current, former, or potential cryptocurrency holders. They are a reasonably well-to-do bunch. Fifty-two percent of respondents in the US and Canada had investable assets between $100k and $500k, with another 20.5% above that. The British were a little poorer.

One indicator that may contribute to the results is that the median age was older compared to the typical cryptocurrency demographic: 41% of respondents were 50 or older.

However, they invested a fairly significant proportion of their assets in cryptocurrency, averaging 27.9%. A significant number (18.3%) invested more than half of their assets in cryptocurrencies.

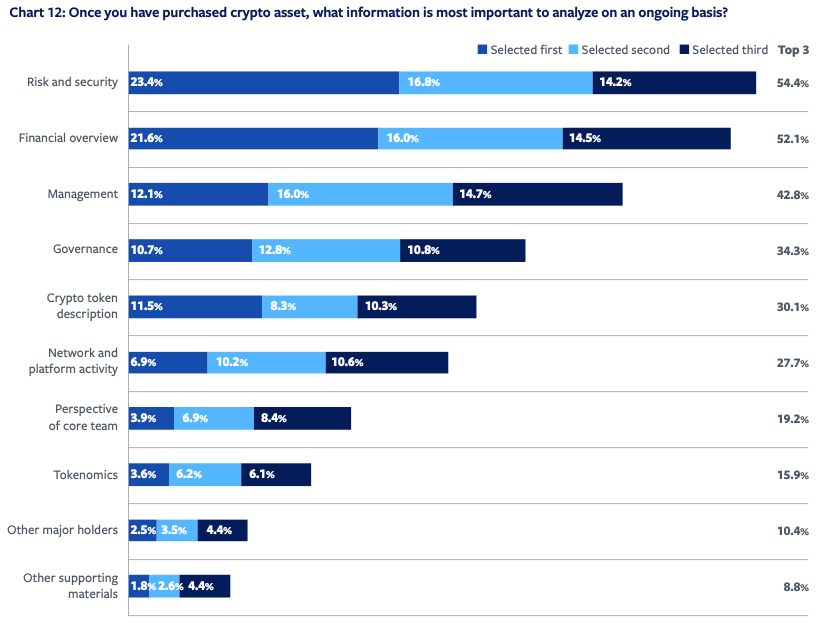

The really interesting answer was about preferred metrics. Conventional decision factors such as risk and security topped the list, not surprising given the tumult of the crypto market. Financial statements, like cash flows, came right after it. Two factors that were very low on the list were network performance (28%) and tokenomics (16%).

The answer on tokenomics is a surprise as it determines how quickly and to what extent the investment is diluted. The choice of metrics did not vary significantly by wealth or region. One explanation proposed by the report’s authors was a lack of familiarity or understanding of tokenomics.

“To help better inform and educate investors, metrics that track crypto asset performance need to be standardized, better disclosed, and made more accessible, especially for retail investors who need the most relevant information and support possible to make informed decisions.” said Rob Krugman, Chief Digital Officer, Broadridge.

Meanwhile, last year Bank of America surveyed wealthy Americans and found that digital assets were the preferred investment for growth opportunities for the 21-42 age group. Public actions topped the list for those 43 and older, but didn’t make the top five for the youngest age group.

Read More at www.ledgerinsights.com