Source: www.ledgerinsights.com

This morning, the BIS Innovation Hub released a report to the G20 on lessons learned from its various central bank digital currency (CBDC) projects around the world. The paper critically assesses the convenience, feasibility, and viability of wholesale and retail CBDCs for domestic use cases, as well as the potential of digital currencies for cross-border use. It highlights some of the challenges central bankers will face as their economies go digital and prepare to implement a potentially disruptive new form of public money.

Prolific BIS CBDC Activity

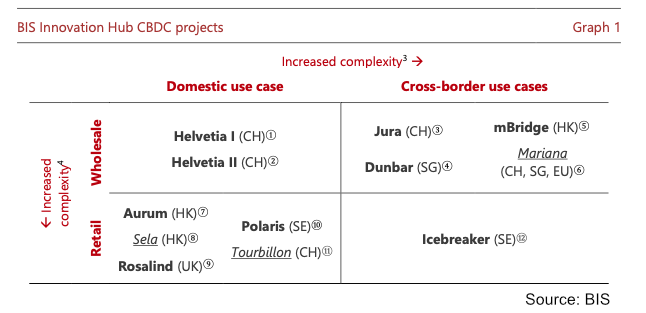

In recent years, the BIS Innovation Hub has partnered with central banks, financial institutions, and the private sector on a dozen projects to help shape research efforts in CBDC development. Most initiatives have focused on cross-border wholesale (eg Jura, Dunbar and mBridge) or national retail (eg Rosalind and Polaris) challenges. But the BIS has also worked on a national wholesale CBDC project in Switzerland (Helvetia), as well as a cross-border retail one (Icebreaker) with Sweden, Norway and Israel.

These studies have helped the BIS to understand what is desirable (from an individual and societal perspective), feasible (in a technical, legal and regulatory sense) and viable (mainly in economic terms), providing practical lessons for policymakers to as they develop the technical capability to make a future release decision.

CBDC Home Use Cases

At the national level, the Helvetia project demonstrated the functional feasibility and legal robustness of settling tokenized assets with a wholesale CBDC or with a link to the Swiss Real-Time Gross Settlement (RTGS) system, often referred to as a trigger solution. .

However, while the RTGS link is operationally simpler, as it would not require significant changes to existing systems, the BIS concludes that the wholesale CBDC approach provides more scope for future innovation and efficiency gains. The Swiss National Bank is evaluating these two models, as well as a private Swiss franc stablecoin solution.

As for retail CBDCs, the report highlights their potential to improve financial inclusion, increase payment efficiency, and maintain monetary sovereignty, but also points to challenges related to insufficient uptake. So far, only four jurisdictions (Bahamas, Eastern Caribbean, Jamaica, and Nigeria) have introduced live retail CBDCs, but all have faced difficulties with adoption and sidestepping privacy concerns and legal and regulatory implications.

Cross-border CBDCs

Finally, the paper explores the lessons from CBDC cross-border use cases in the wholesale and retail space. Reflecting on the experience of the Dunbar, mBridge and Icebreaker projects, he concludes that central banks have several options for making cross-border CBDCs work. A hub and spoke model like Project Icebreaker connecting separate retail CBDC projects might be easier in the short term. However, a shared common platform is considered to have more advantages.

However, any type of platform will face governance challenges. While there have been private sector collaborations like Swift, there is less experience in the central bank sector of multi-jurisdictional governance. Furthermore, these platforms will face the same difficulties in managing multiple legal and regulatory frameworks as traditional cross-border deals.

Read More at www.ledgerinsights.com