Source: www.ledgerinsights.com

Today, Bloomberg reported that the Central Bank of Nigeria (CBN) has approached potential new providers for its central bank digital currency (CBDC) project, the eNaira, which was launched in October 2021. Bloomberg cited anonymous sources as saying that the central bank wanted to control its own technology, a point the central bank has made before. Enterprise blockchain firm R3 was one of the firms said to be in talks with CBN.

The central bank is currently working with Bitt, who is also involved in other CBDC projects, including for the Eastern Caribbean.

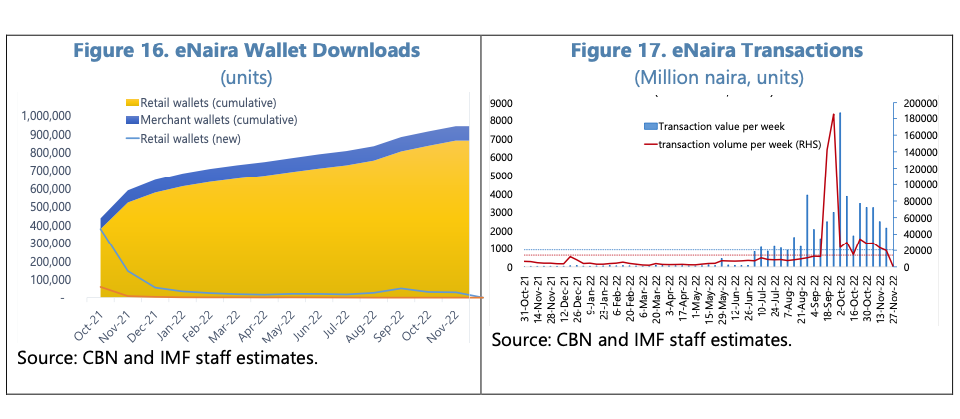

So far, the uptake of Nigeria’s CBDC can be described as lukewarm at best. Last week, the International Monetary Fund (IMF) described the adoption of eNaira as “quite slow.” As of the end of November 2022, the number of wallets was less than one million, representing less than one percent of bank account holders. Ten percent of merchants with POS terminals are CBDC compliant. However, even those with wallets are mostly inactive.

This slow adoption is despite a young population. Nigeria has a population of 211 million, of whom more than 62% are 24 years of age or younger.

Since one of the goals of the CBDC is financial inclusion, the IMF suggested that the CBDC be integrated with existing mobile payment solutions and that eNaira be used to deliver social assistance. The first iteration of the CBDC focused on bank account holders and smartphone apps, despite the goal of financial inclusion. In the middle of last year, the central bank said it was working to extend the service to basic phones.

Apart from financial inclusion, another key objective is to reduce the cost of remittances. Small transfers to and from Nigeria cost more than 10% on average, with nearly half the cost of foreign exchange. Support for remittances could be a key factor for the adoption of eNaira.

There are dozens of CBDC technology providers, but a handful have emerged from multiple research projects. For retail or consumer-facing CBDCs like eNaira, providers that have won multiple launches and competitions include Bitt, ConsenSys, G+D, IDEMIA, and Soramitsu.

Soramitsu is an interesting example because it is involved in multiple projects in Southeast Asia. One of the advantages is possible future technological compatibility that could help with remittances. Another is that some of the countries have similar goals for their CBDC due to economic similarities, such as dollarized economies.

Read More at www.ledgerinsights.com