Source: www.ledgerinsights.com

Bank Indonesia has launched a consultation for the first phase of the Garuda Project, its central bank digital currency (CBDC) initiative.

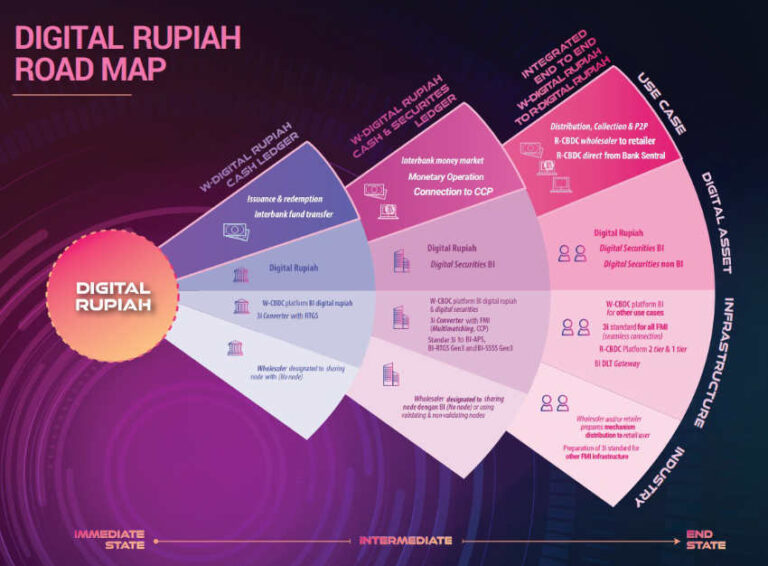

In late November, the central bank revealed its plans for a digital rupee that involves a three-stage approach, including a basic wholesale CBDC (wCBDC), a more advanced wCBDC, and finally a retail CBDC.

The current inquiry is for the first iteration of a wholesale CBDC that will have basic CBDC issue, redemption, and transfer functionality, including integration with the Real-Time Gross Settlement System (RTGS), the primary payment system. The digital rupee will use a permissioned blockchain network.

The novelty of the wholesale CBDC (wCBDC) is that it will not be limited to banks. In addition, there are wholesale and non-wholesaler designations. Wholesalers will be responsible for distributing a future retail digital rupee, and the central bank will specify qualification requirements for wholesalers.

It is unclear at this stage which non-bank institutions will participate in the wholesale CBDC. Central counterparties for securities transactions will certainly participate, but non-bank payment providers may also participate.

The central bank as regulator will have visibility over all wholesale transactions, but all other participants will only be able to see the details when necessary. However, some of the participants will be running validation nodes on the blockchain, giving them some level of visibility into transactions in which they are not a counterparty.

The second phase of the CBDC project will take wholesale CBDC a step further and include security tokenization and settlement of security transactions, as well as other wholesale use cases.

Eventually, the plan is for the wholesale CBDC to provide the foundation for a retail CBDC. So, the central bank will issue wholesale CBDCs to wholesalers who will distribute retail CBDCs to retail users. In addition to this intermediate version, Bank Indonesia is also considering serving end users directly, potentially in more remote areas.

The retail version of the digital rupee is unlikely to be based on the blockchain for scalability reasons.

Read More at www.ledgerinsights.com