Source: news.google.com

The Web3 project raised more funds last year than it did in 2021, despite bear market pressures. So what opportunities lie ahead for 2023?

2022 saw a growing interest in investment in Web3, divided into four key areas. There is interest from commercial banks, namely Morgan Stanley and Goldman Sachs, then successful financing of Web3 companies with global venture capitalists joining the game.

Meanwhile, other trends included Tier 1 digital asset institutions like Binance Labs, Coinbase Ventures, and Kraken Ventures boosting or instead pooling funds. Lastly, there are the network-specific backgrounds, as mentioned in the screenshot below.

But despite the cryptocurrency slowdown and general bearish sentiment, 348 startups raised or raised a total of $7.16 billion in investment last year. This was more than $4.5 billion compared to the previous year according to the Metaverse Post.

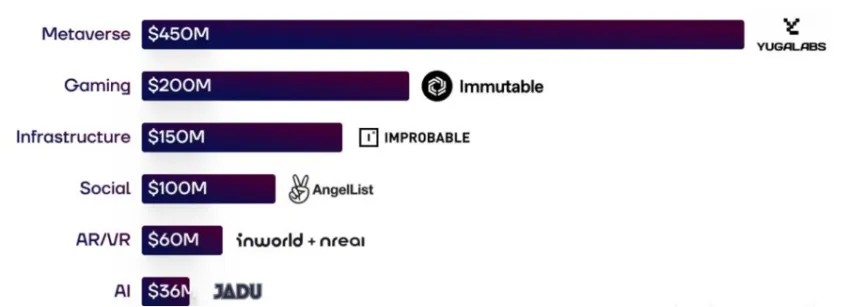

The report separated the amounts into Games, Metaverse, Social Networks, Infrastructure, Artificial Reality and Virtual Reality (AR and VR) and Artificial Intelligence (AI). Although, with growing innovation and demand, several categories made headlines throughout 2022.

In the second quarter of 2022, metaverse and gaming projects attracted millions of dollars worth of funding. In addition, venture capitalists kept their allocations to gaming-to-win projects, “paying particular attention to blockchain casinos, collectibles, loot boxes, and soccer-themed games,” the report said.

But Q4 saw some deviation.

Change in investment strategy

In the last quarter, investors shifted their attention to augmented, virtual, and mixed reality startups. Artificial intelligence, such as the AI chatbot ChatGPT, also received a lot of interest from venture capital firms. For example, InworldAI raised $50 million in a Series A round, followed by SEED with $41 million. SingularityDAO raised $25 million and MarqVision saw around $20 million raised in a Serie A game.

Adding further support, the spokesperson said: “Venture capitalists are unlikely to lose interest in Artificial Intelligence (AI) in 2023, and more AI startups are likely to secure funding.”

BeInCrypto reported on the rise of AI Farming in books written by AI that appeared in the previous year.

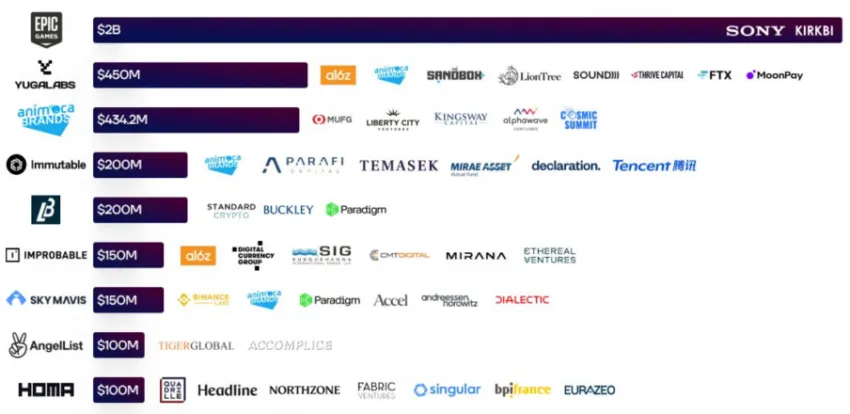

Moving on to another change in the narrative around investments. Given the increase in attacks and other illicit operations, investors are focusing on the importance of security in Web3, leading to increased investment in new infrastructure. Here is a list of the top projects in the mentioned categories that raised the most funds.

List of the best projects by category

Moving on to the individual entities within the categories, Epic Games, the gaming giant, closed on $2 billion of investment money from Sony and LEGO owner KIRKBI. The Fortnite creator would use funds to “advance his vision of the metaverse and support the continued growth of it.” At the time of writing, the company is valued at $31.5 billion.

Moving on to Yuga Labs, the creator of the Bored Ape Yacht Club (BAYC), raised over $400 million to build the Otherside metaverse. Lately, Yuga Labs released the “First Ride” of the Otherside experience and teased BAYC fans with the upcoming Second Ride.

Another big name to make the top three list was venture capital Animoca Brands, a metaverse-focused startup. Immutable, a Sydney-based Layer 2 NFT company, was next in line. The report further focuses on deep-pocketed investors, meaning four spenders with a total spend of more than $7 billion.

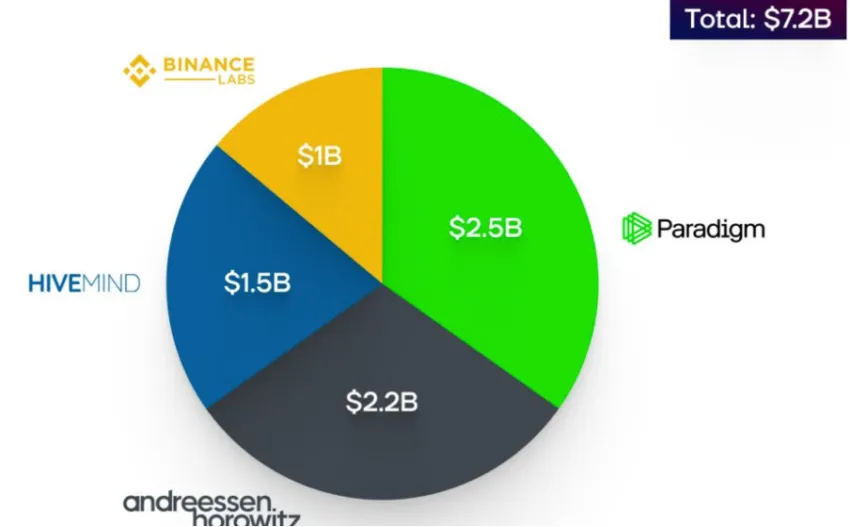

The biggest investors

Leading the charge is Paradigm, a San Francisco-based crypto-focused investment firm. The famous firm spent $2.5 billion in 2022 backing 31 projects, including Coinbase, Uniswap, Magic Eden, and Optimism.

Next, Andreessen Horowitz, or a16z, became the second most active investor after Paradigm with a sum of $2.2 billion. Meanwhile, HiveMind Capital Partners invested $1.5 billion in Web3 startups, while Binance Labs ranked #4 with a $1 billion spending spree in 2022.

Next, Andreessen Horowitz, or a16z, became the second most active investor after Paradigm with a sum of $2.2 billion. Meanwhile, HiveMind Capital Partners invested $1.5 billion in web3 startups, while Binance Labs ranked #4 with a $1 billion spending spree in 2022.

While investing within this cohort may sound safe and lucrative, failures are an integral part of it. The first exchange would be Singapore-based cryptocurrency hedge fund Three Arrows Capital, also known as 3AC. Millions of dollars were lost after the collapse. This list continues to expand as BeInCrypto covers it extensively.

In general, investors should exercise caution when it comes to technologies that continue to develop and mature over the years.

Disclaimer

All information contained on our website is published in good faith and for general information purposes only. Any action the reader takes on the information found on our website is strictly at their own risk.

Read More at news.google.com