Source: dailyhodl.com

A leading analytics firm says that deep-pocketed investors of Cardano are loading up on ADA and have been heavily buying dips since the high-profile implosion of FTX.

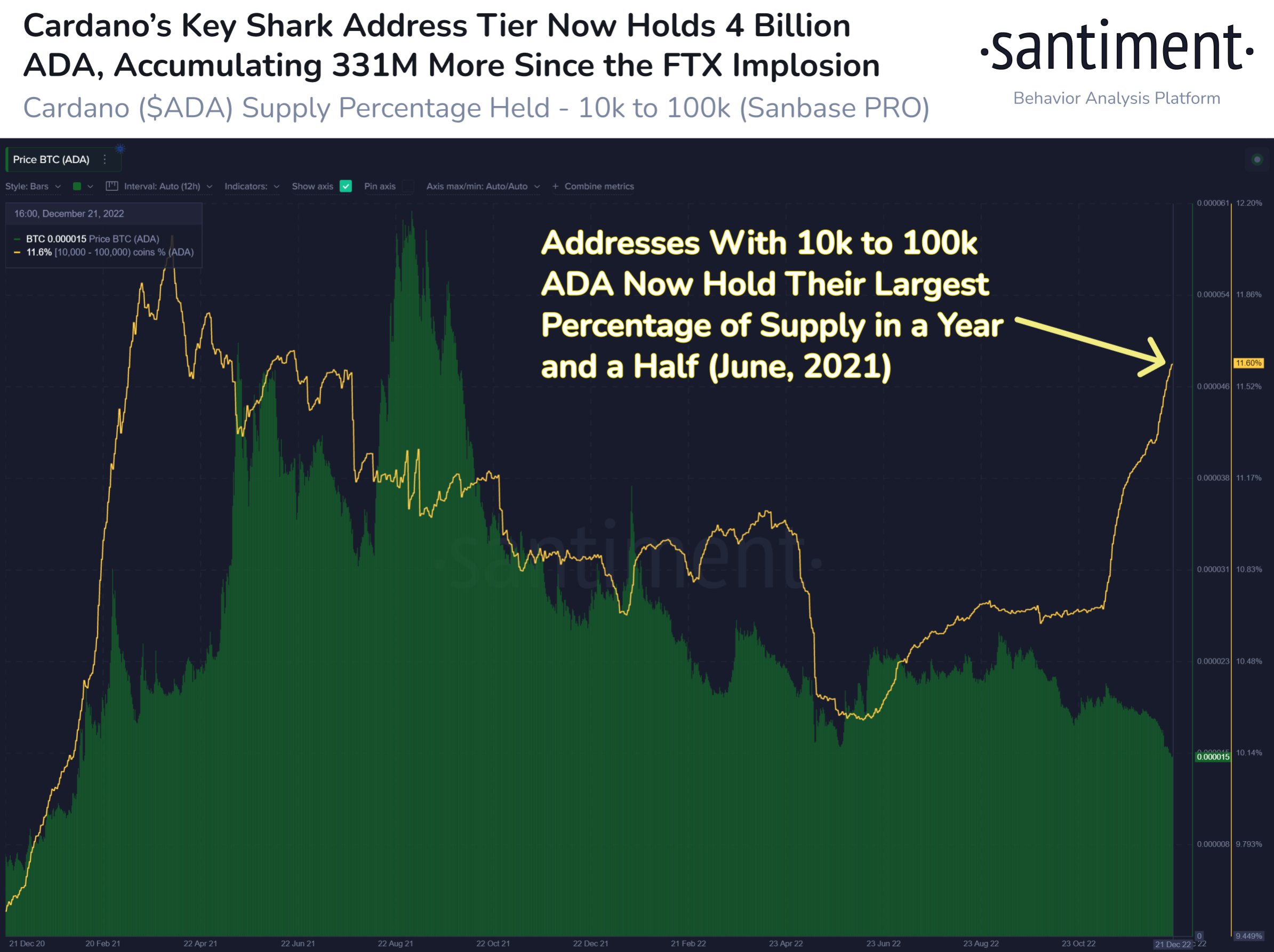

Santiment says that addresses with a balance of 10,000 to 100,000 Cardano now hold their largest percentage of the supply in a year and a half to the tune of four billion ADA tokens.

“Key Cardano sharks have been accumulating steadily since June. And they have taken this level of dip buying to a new level since the FTX fallout in early November. Addresses holding 10,000 to 100,000 ADA have added $83 million worth of coins since November 7th.”

At time of writing, Cardano is changing hands for $0.257, a fractional decrease on the day.

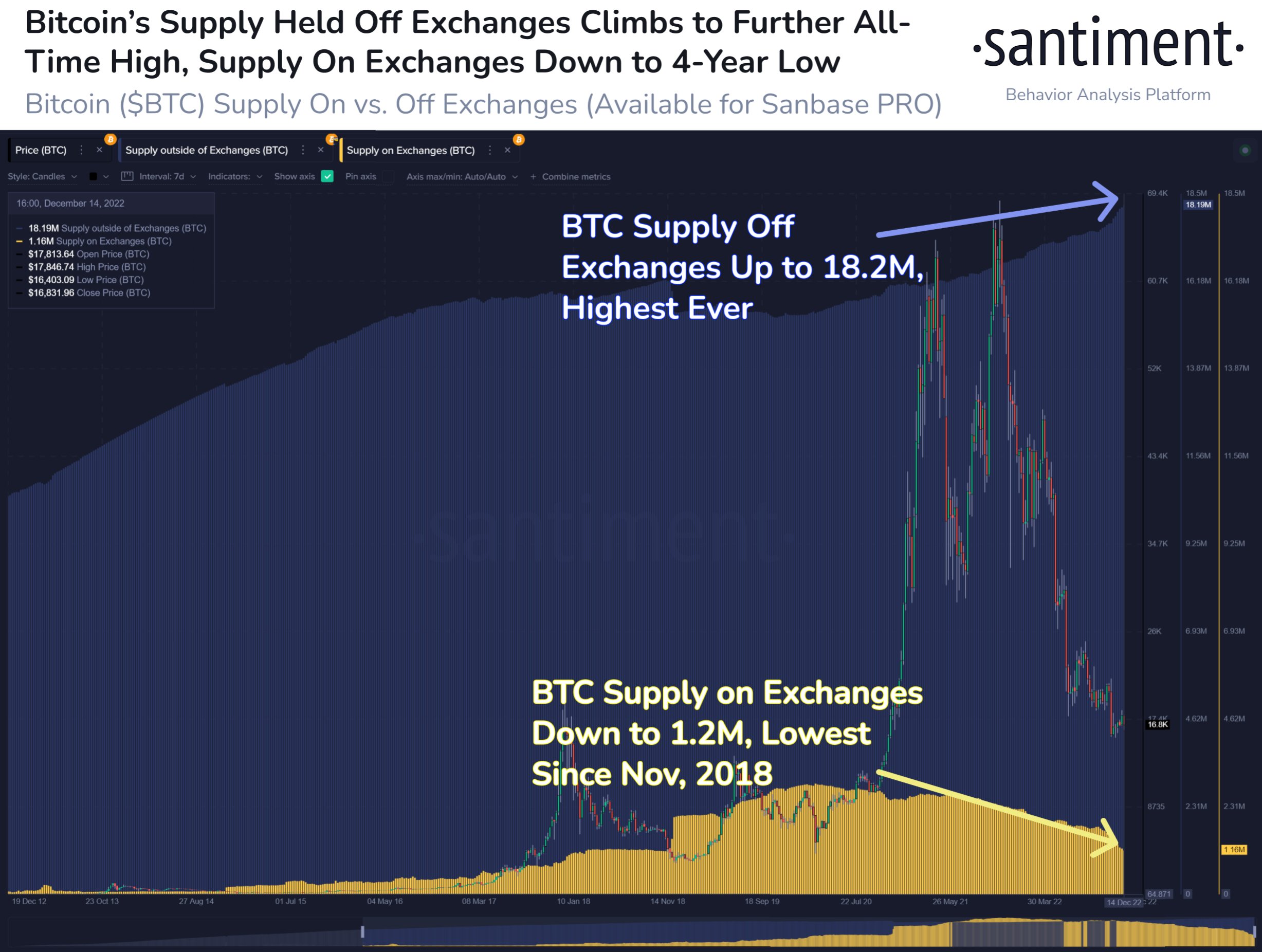

Looking at Bitcoin, Santiment reveals that the amount of BTC held off centralized crypto exchanges is now at its highest ever. According to Santiment, crypto exchanges are witnessing an exodus of over $304 billion worth of BTC from their platforms.

“Illustrated is the 10-year long-term view of Bitcoin’s funds moving on and off exchanges. The amount of coins in self custody continues, creating a new all-time high, now at 18.2 million BTC.”

According to crypto tracking website CoinGecko, Bitcoin has a circulating supply of 19.24 million BTC, indicating that over 94.5% of the king crypto’s supply has been withdrawn from digital asset exchanges.

At time of writing, Bitcoin is changing hands for $16,847, flat on the day.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Digital Storm

Read More at dailyhodl.com