Source: news.google.com

Neobanks like Chime, which lack physical branches, have found a niche offering services like direct deposit, checking accounts and paycheck advance all within one app. Now, a neobank called Cogni is including a distinctive Web3 feature in its app: a non-custodial crypto wallet.

While many financial companies allow customers to buy and sell cryptocurrency, they typically do so through so-called hosted wallets, which are ultimately controlled by the company. Non-custodial wallets, by contrast, give the wallet holder ultimate control over their crypto by means of a series of keywords known as a seed phrase.

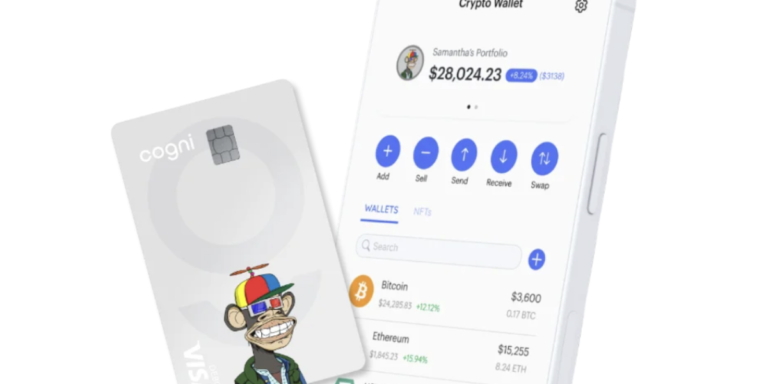

In Cogni’s case, customers set up the wallet where they can send and receive Bitcoin, Ethereum, and a handful of other cryptocurrencies, as well as NFTs. They control the wallet through the seed phrase they receive, but they can also use facial identification.

While the wallet resides within the Cogni app alongside other services, it is not connected to the customer’s bank account and the app does not currently offer access to an exchange to purchase cryptocurrency. In an interview, Cogni CEO Archie Ravishankar said Fortune that the company plans to link the wallet to bank accounts in the future and allow customers to buy and sell cryptocurrency.

Cogni launched in 2018 as a lifestyle brand that offered users discounted gift cards to companies like Adidas and Southwest Airlines. The company started leaning into cryptocurrencies and Web3 earlier this year.

Cogni won’t publicly disclose how many clients it has, and it’s not a household name even among neobanks. But their announcement is significant because it appears to be the first FDIC-insured bank to offer a non-custodial wallet, which could lead others to do the same. (Financial technology giants Robinhood and PayPal offer non-custodial wallets, but they’re not technically banks.)

Like other neobanks, Cogni relies on a “letter-letter” agreement with an established bank, paying the bank to come under its regulatory umbrella, in this case Community Federal Savings Bank in Queens, New York.

Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today’s executives. Subscribe here.

Read More at news.google.com