Source: www.ledgerinsights.com

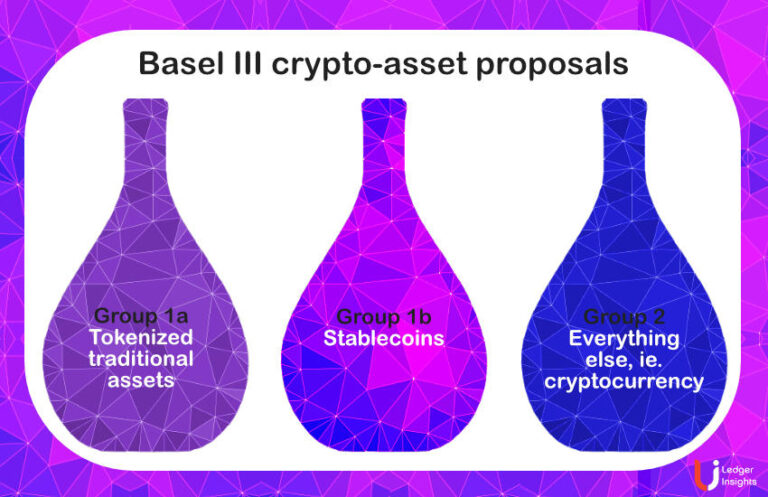

Today, the Basel Committee on Banking Supervision released the final version of the rules for crypto assets to be implemented by January 1, 2025. It follows two rounds of consultations on proposals.

The second version of the rules was much stricter than the first and received strong rejection from the banking sector. The latest rules are still strict, but they have been relaxed in key headline areas.

Here are the highlights:

- The 1,250% risk weight is maintained for unhedged cryptocurrency exposures, which means that one dollar of capital must be reserved for every dollar of exposure.

- The high risk weight does not apply to assets in custody. Had this remained, it would have prevented banks from providing crypto custody on a large scale.

- Previously, Basel proposed a 2.5% infrastructure risk add-on for digital securities and stablecoins. This has been waived by default. However, it can be imposed on a bank if an infrastructure risk is perceived.

- Cryptocurrency exposures are still capped at 1% of Tier 1 capital with significant new relaxations for hedging. It can exceed 1%, but must not exceed 2%.

- The tests for evaluating low-risk stablecoins have changed. Now it’s a combination of redemption risk and regulatory oversight, but it will evolve.

Pablo Hernández de Cos, Chairman of the Basel Committee and Governor of the Bank of Spain, said: “The Committee’s standard on crypto-assets is yet another example of our commitment, willingness and ability to act in a coordinated manner globally to mitigate emerging risks. of financial stability. .”

“It is important to continue to monitor bank-related developments in the crypto asset markets. We remain ready to act further if necessary,” added Tiff Macklem, Chairman of GHOS (Governors and Heads of Supervision) and Governor of the Bank of Canada.

More to follow.

Read More at www.ledgerinsights.com