Source: dailyhodl.com

Leading on-chain analyst Willy Woo is expressing confidence that the collapse of the FTX crypto exchange won’t dissuade traditional finance investors from putting their money in Bitcoin (BTC) and other digital assets.

Woo tells his 1 million Twitter followers that high net-worth investors who don’t face regulatory restrictions have spotted an entry opportunity despite the popular opinion being that the collapse of FTX would set the crypto industry back many years.

“After the FTX blow up many think it’s set the industry back many years, but this is contrary to the conversations I’ve had. Traditional finance capital allocators are seeing an opportunity to come in now. They see Bitcoin and crypto is here to stay and it’s now been de-risked.

Traditional finance in this instance means high-net-worth investors free from regulatory restrictions on mainstream retail. This is where we are right now for the bulk of traditional finance capital.

By the way, obviously, a decent chunk of retail is already here, Bitcoin flipped the status quo.”

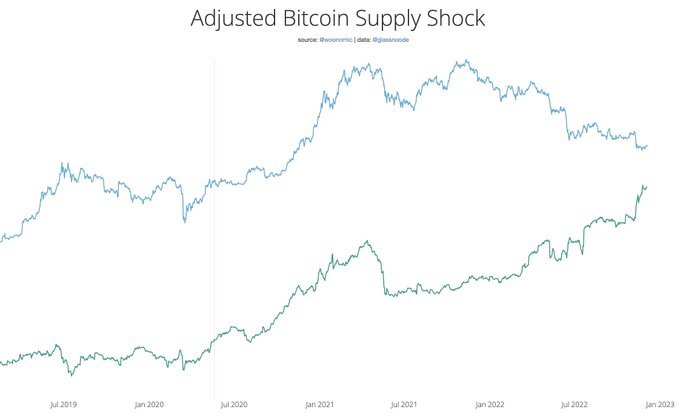

On the price of Bitcoin, Woo says that the reason the flagship crypto asset has withstood the headwinds amid an adverse macroeconomic environment is that long-term holders continue to accumulate.

“If you’re wondering why BTC is holding up against so much deleveraging, it’s the long-term hodlers, the Rick Astleys who ain’t giving up their BTC, that are absorbing the sells. Buying spot and adding to their stack.”

Woo uses the term “Rick Astleys” to refer to long-term holders who won’t let go of their Bitcoin, a tongue-in-cheek reference to the pop star’s one-hit-wonder, “Never Gonna Give You Up.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Dk008

Read More at dailyhodl.com