Source: blockchain.news

After falling to lows of $15.5K amid the FTX liquidity crunch, Bitcoin (BTC) gained momentum due to better-than-expected Consumer Price Index (CPI) figures released by the US Bureau of Labor Statistics.

Crypto and Market Education Platform IncomeSharks tweeted:

“Bitcoin has an easy path back to $20k as stocks rally and IPC numbers positive.”

Bitcoin rose 3.78% in the last 24 hours to reach $17,281 during intraday trading, according to CoinMarketCap.

The CPI increase was lower than expected because it rose 0.4% in October, the lowest since January 2022. The US Bureau of Labor Statistics noted:

“The All Items Index increased 7.7% in the 12 months ending October, this was the smallest 12-month increase from the period ending January 2022. The All Items Less Food and energy increased 6.3% in the last 12 months…all of these increases were less than for the period ending in September.”

The lower IPC numbers triggered a bullish reaction in the BTC market because this could mean that the Federal Reserve (Fed) will ease interest rate hikes, which have been detrimental to the crypto ecosystem.

The Federal Reserve has been raising interest rates to the tune of 75 basis points (bps), and this is one of the main factors hindering a significant upside for cryptocurrencies.

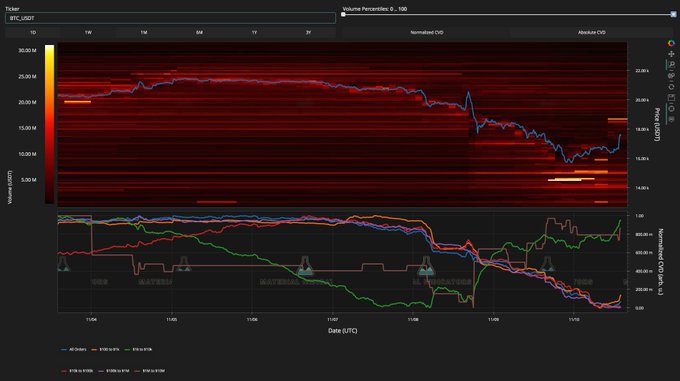

Despite the positive IPC numbers, the crypto market is not out of the woods yet as the bears continue to bite. Market knowledge provider Material indicators explained:

“CPI was lower, jobless claims were higher. FireCharts shows the initial reaction of the crypto market to a hit in the forecast economic numbers. Bear Market Rally is still alive BTC.”

Source: MaterialIndicators

The collapse of FTX, one of the major cryptocurrency exchanges, has also rocked the digital asset space.

The liquidity problem facing FTX may have reportedly emanated from the exchange’s CEO, Sam Bankman-Fried, secretly transferring at least $4 billion to boost his trading arm Alameda Research, with some of the funds being deposits from customers.

Image Source: Shutterstock

Read More at blockchain.news