Source: www.ledgerinsights.com

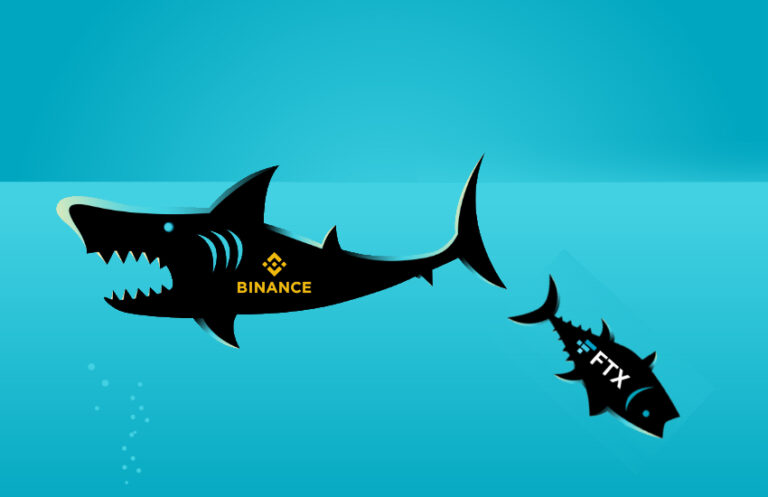

Cryptocurrency exchange Binance has withdrawn from its non-binding letter of intent to acquire FTX.com.

The change statements rheads“As a result of corporate due diligence, as well as recent news reports of mishandling of customer funds and alleged investigations by the US agency, we have decided that we will not pursue the potential acquisition of FTX. .com,” said Binance, which was also tweeted.

The New York Times reported that FTX is looking to raise $8 billion to bail it out and has seen withdrawals of $6 billion since Sunday.

The run on the FTX exchange began on Sunday when Binance CEO Changpeng Zhao (CZ) tweeted plans to sell his holdings of the FTX token FTT and drew comparisons to the crash of LUNA/Terra. This followed a report by Coindesk last week that Alameda Research, the market-making firm owned by FTX CEO Sam Bankman-Fried, had $5.8 billion in FTT and FTT collateral.

After the announcement of the agreement, CZ tweeted on Tuesday,

“1: Never use a token you have created as collateral.

2: Do not borrow if you have a cryptocurrency business. Don’t use capital “efficiently”. Have a large reserve.

Binance has never used BNB as collateral, and we have never gone into debt.”

One has to guess that by then, CZ had some data. If the hole in FTX’s balance sheet is due to the price of the FTT deposit, then the Binance deal seemed to exacerbate the issues. Between the start of the run and the CZ takeover tweet, the price of FTT fell from $23 to around $15 and leveled off. It partially recovered for a short time after the ransom tweet. But after that, it sank to just over $4. That may have created a much more significant ransom issue. Currently, the price is $2.65.

But the execution doesn’t just have to be about the FTT token. FTX.com was especially known for its derivatives and perpetual futures that offer significant leverage. Being able to provide leverage means that the crypto exchange borrows money or has significant capital. Clearly, FTX did not have a significant capital cushion.

Some of FTX CEO Bankman-Fried’s tweets were deleted in recent days. That includes one on Monday that read: “FTX has enough to cover all client properties. We do not invest client assets (not even in Treasuries).”

From Binance’s perspective, it is already receiving enough regulatory attention. If there’s a lot of research going on about FTX and you own FTX, you don’t want the extra attention. And the authorities would have the right to ask Binance a lot of questions.

Collateral damage

FTX was also a sponsor of the Solana blockchain. Aside from the FTT token, Solana is the biggest loser, dropping 50% in the last seven days. The second biggest drop is Dogecoin.

In related news, one of FTX’s sponsors, capital of the redwoodsit has already reduced its shares to zero.

And Silvergate Capital’s share price is down more than 30% in one day. It is the bank that acts as the on and off ramp for many digital asset companies. There are concerns about potential loans he advanced that are backed by cryptocurrency tokens. However, if a large exchange has large cash balances withdrawn without notice, that could also have an impact. However, the Wall Street Journal quoted Silvergate Chairman Ben Reynolds as saying, “FTX’s challenges have not had a direct impact on the company.”

Read More at www.ledgerinsights.com