Source: news.google.com

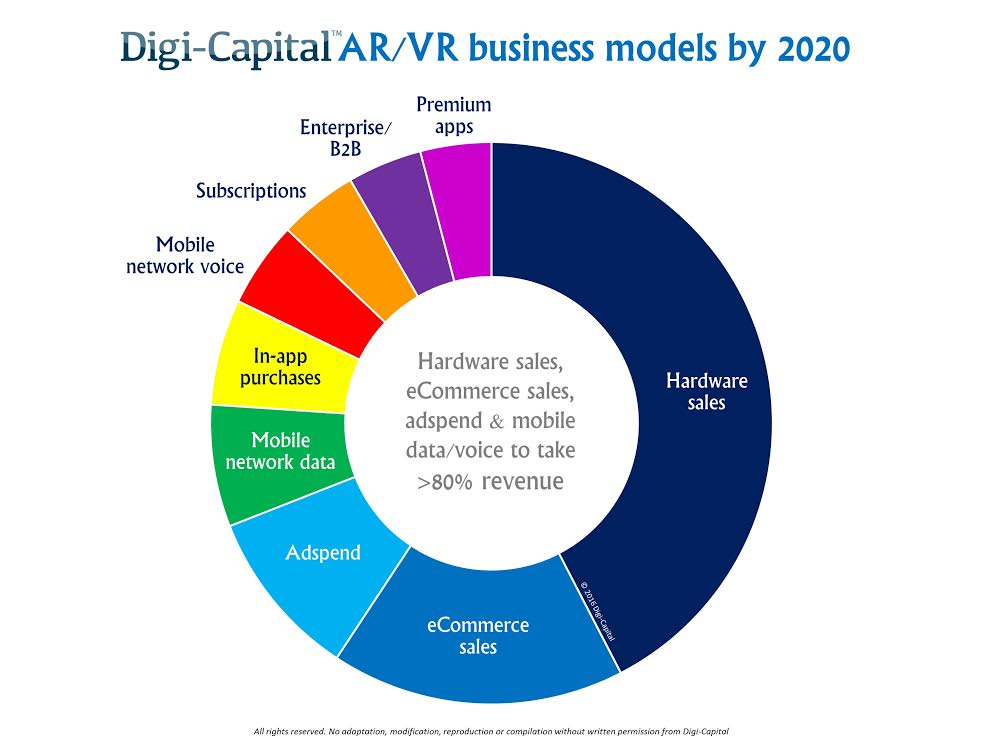

There is almost as much confusion as there is excitement about virtual and augmented reality. While virtual reality could be big and augmented reality could be bigger (and take longer), there are more questions than answers. I’ll do a deep dive on one aspect of AR/VR each month. This month we start with business models. AR/VR hardware sales, e-commerce sales, ad spend, and mobile data/voice could drive more than 80 percent of all AR/VR revenue. Things may look a little different than you expect.

Business models are difficult to crack during platform changes, but can work with great success (as was the case with mobile devices over the last decade). AR/VR is the fourth major platform change (after PC, web, and mobile). CEOs must decide how to play. At the end of the day, business models come down to installed bases, use cases, and economic units, so let’s dip our hands into the pot of virtual money and see what comes out.

hardware sales

Facebook paid $2 billion for Oculus. Magic Leap took $1.4 billion from Google (and others). Apple bought Metaio. As well as significant commitments from Microsoft, HTC/Valve, Sony, Samsung and other heavyweights. Serious people. It’s not his first rodeo.

But the hardware is hard to beat. So why so much interest in an unproven early-stage hardware market? Looking at the future through the lens of the past helps, and that’s what’s happening here.

Apple owns global mobile hardware gains in the market it created, making it the most valuable company on the planet (for the most part). Google has also taken over MVP, but is increasingly relying on advertising being sold using other people’s mobile devices, even though it owns Android. Facebook has learned valuable lessons from how mobile has performed, including its initial failure and spectacular comeback. Hardware is the strategic terrain during platform changes, and these guys know it.

AR/VR could have an installed base in the hundreds of millions of low single digits by 2020, ranging from low-end VR Cardboard to premium AR Magic Leap (and everything in between). With long-term unit prices ranging from free to something equivalent to high-end smartphone prices, hardware sales could generate more than $4 of every $10 spent on AR/VR by 2020.

Ignoring hardware is not an option for established leaders and new insurgents. Hardware sales might be the one business model to rule them all in AR/VR, and investing early seems like smart money.

ecommerce sales

Alibaba led Magic Leap’s $793.5 million round at a $4.5 billion valuation, with Vice Chairman Joe Tsai joining the board. Alibaba and Tsai are among the best and brightest in China (and the world). Why would a Chinese e-commerce company spend hundreds of millions of dollars on a Florida hardware startup with no sales?

ecommerce sales (goods and services, not in-app purchases) it could take nearly $2 out of every $10 spent using AR/VR within five years. Alibaba, Amazon, eBay, and a host of other startups will be able to sell things to people in entirely new ways. Some of this could cannibalize existing e-commerce/mobile commerce, but AR/VR could also increase e-commerce’s share of all sales.

sales advertising

For app and content developers (who don’t sell hardware, goods, or services), ad sales could be the most valuable business model with about $1 in every $10 generated from AR/VR. The first AR advertising unicorn emerged this year with Blippar, and that’s before the head-mounted display market hits its stride.

AR/VR entrepreneurs don’t need to reinvent the virtual wheel. They get to increase it.

As ad formats emerge, from virtual banner equivalents to full-fledged native AR/VR formats like The Martian VR Experience, AR/VR advertising could follow the path blazed by the web and mobile devices. With a third of global advertising and half of all Chinese web/mobile advertising in 2016, platform switching means serious business for advertisers. AR/VR advertising is more immersive than any rich media (when done right), and ad spend should follow the eyeballs.

Mobile network voice/data

Mobility will drive the installed base for AR/VR.

For VR, the installed base will be driven by price, with mobile VR solutions trending down from $99 to free. Free is the most attractive price point, even though high-end VR provides a more complete experience (for now). (Note: PlayStation VR will be the other volume controller for the VR installed base, again due to price plus existing PS4 installed base.)

For AR, mobility is even more fundamental than it is for VR. AR devices that can’t make phone calls or access cloud-based services all day outside of Wi-Fi range won’t be able to replace smartphones in the long run. AR devices that don’t help mobile networks make money from data/voice won’t be cross-subsidized by telcos, a key to mass adoption. We have lobbied hard for AR hardware manufacturers to prioritize cellular capability and longer battery life in roadmaps for this reason.

Mobile network data revenue from AR/VR could be golden for telcos. YouTube estimates that each frame of 360 video requires 4-5 times the bandwidth of traditional video. High-resolution, high-frame-rate stereo images and data could push some applications even further in terms of bandwidth requirements; someone has to pay for all that data. AR/VR data could be the catalyst to knock mobile networks off their current less than 2 percent annual revenue growth, so that’s a big deal.

Mobile network voice revenue for AR/VR (voice with mobile quality of service, not VoIP) it will largely cannibalize existing mobile voice revenue rather than add new revenue for telcos. They will be there, but this is not new money.

In-app purchases

For mobile developers, in-app purchases are one of the core business models. Mobile charts are dominated by free apps, and even the premium console/PC gaming markets see downloadable content as an important business model. The question of free versus paid AR/VR app has not yet been answered, but users have been informed that digital content is mostly free. Younger users, in particular, rarely pay for content, so you can’t put the free genie back in the bottle.

Ad spend should follow the eyeballs.

In-app purchases should be an important business model for AR/VR developers, whether through speed-ups/virtual items or additional services. There will be a premium app market (see below), but in-app purchases could play as big a role in AR/VR as they already do in the web and mobile markets.

subscriptions

Netflix, Amazon, Hulu, Spotify and others demonstrated just how effective web/mobile subscription business models can be. AR/VR content and SaaS players are set to offer services that people will happily subscribe to each month (although these may be at the expense of other platforms). Higher service levels and ad-free services could boost AR/VR subscription revenue, though more innovative models may emerge.

Business/B2B

The enterprise market is well served by AR players such as Microsoft, Meta, ODG, and DAQRI, as well as a variety of VR service/solution providers. With use cases in military, medical, education, architecture/construction, maintenance, and more, enterprise sales will be a driver for both AR and, to a lesser extent, VR.

Replacing traditional desktop/laptop machines can take some time, but business users will be able to improve productivity in specific areas. With HoloLens now on the International Space Station, AR/VR will reach new heights for business users (pun intended).

B2B sales from AR/VR service/solution providers will also be part of the mix. B2B revenue will come from areas like graphics engines (Epic’s Unreal Engine at the high end to free integrated services like Amazon Lumberyard with AWS), facial animation (Cubic Motion), gesture recognition (Leap Motion, Gestigon), 3D model distribution (Sketchfab) and more.

premium apps

Premium apps will have a role to play in AR/VR, despite the potential dominance of free apps. The higher the user experience, the greater the potential for paid business models. High-end VR games could see the largest share of premium apps, tapping into an installed base of console/PC gamers accustomed to paying up to $60 for their fun. Non-game AR/VR consumer apps could see a lower share of premium apps, similar to the paid portion of mobile apps today.

There’s virtual gold in those hills

When the 99-cent Angry Birds app dominated mobile, few predicted that Supercell and King’s in-app purchase business models would dominate today. So while long-term business models may look different than what we’ve explored, AR/VR entrepreneurs don’t need to reinvent the virtual wheel. They get to increase it.

Over the next few months, we’ll be digging all over the place, so don’t hesitate to reach out if your company is doing something special (no guarantees you’ll be covered, it’s a big market). Topics will include AR/VR Video, Commerce, Social Media, Voice/Messaging, Data, Enterprise/B2B, Advertising, Space (I’ve been talking to NASA), Gaming, Theme Parks, User Interfaces, Optics, Processing (CPU/ GPU/VPU), Audio, Platforms, Tracking/Sensors, Venture Capital, Countries (US, China, others), Pricing, and Users.

Read More at news.google.com