Source: dailyhodl.com

Crypto analytics firm Santiment says on-chain signals for Cardano show that ADA is currently trading at a significant discount.

Santiment takes a look at Cardano’s MVRV Z-Score, which compares an asset’s total market cap to its total realized market cap.

Traditionally, a low Z-Score suggests that an asset is undervalued. Santiment says ADA’s MVRV Z-Score is at its lowest level since January 2019.

“Cardano now sits at its lowest relative position compared to its realized value since January, 2019. This is a sign of undervaluation based on average trader losses. ADA’s price doubled the following three months the last time its MVRV Z-Score hit this level.”

At time of writing, ADA is trading at $0.34, down more than 88% from its all-time high.

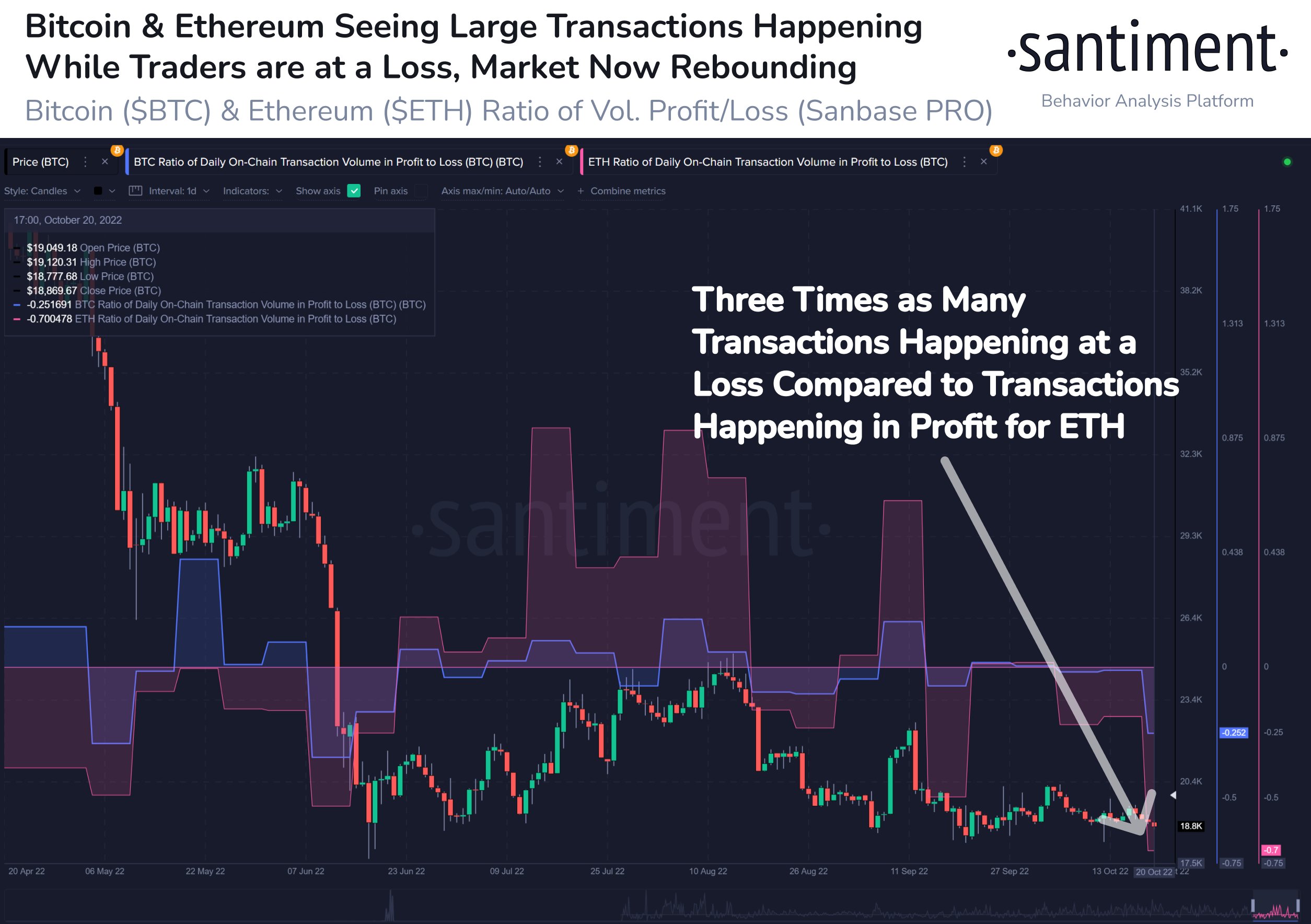

The analytics firm also says that the overall crypto market is showing signs of capitulation, with many traders closing out positions at a loss. According to Santiment, the capitulation is potentially kicking off a market rebound.

“Capitulation signs have been popping up Friday, including transactions from addresses trading out their assets while at a loss. Bitcoin is seeing its lowest ratio of loss vs. profit transactions in 4.5 months, and Ethereum is seeing historical lows.”

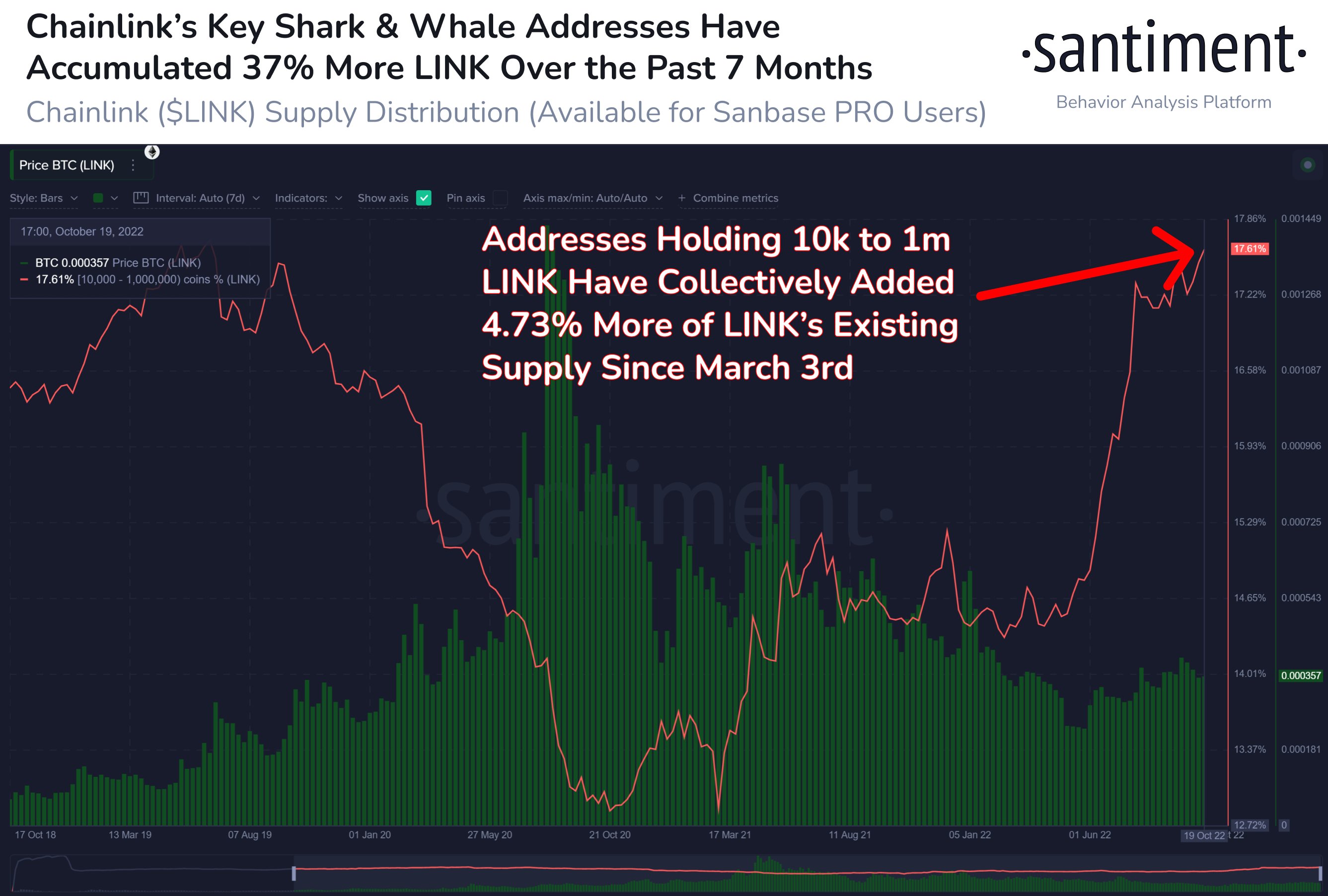

While many crypto assets see signs of capitulation, Santiment has also recorded heavy accumulation of altcoins by deep-pocketed investors.

Last week, the firm said large investors of decentralized oracle network Chainlink had accumulated more than $312 million worth of LINK since the beginning of the 2022 bear market.

“Chainlink’s shark and whale addresses (holding 10,000 to one million LINK) have been busy accumulating during the 2022 bear market. Since March 3rd, these addresses have added 47.31 million LINK to their wallets, collectively. This translates to $312.7 million more invested.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Bruce Rolff

Read More at dailyhodl.com