Source: news.google.com

Virtual and augmented reality are the new rage as venture capitalists and companies get involved. While Facebook’s multibillion-dollar acquisition of Oculus grabbed everyone’s attention early last year, it’s only in the past 12 months that investment has accelerated.

Augmented/virtual technology, real investment

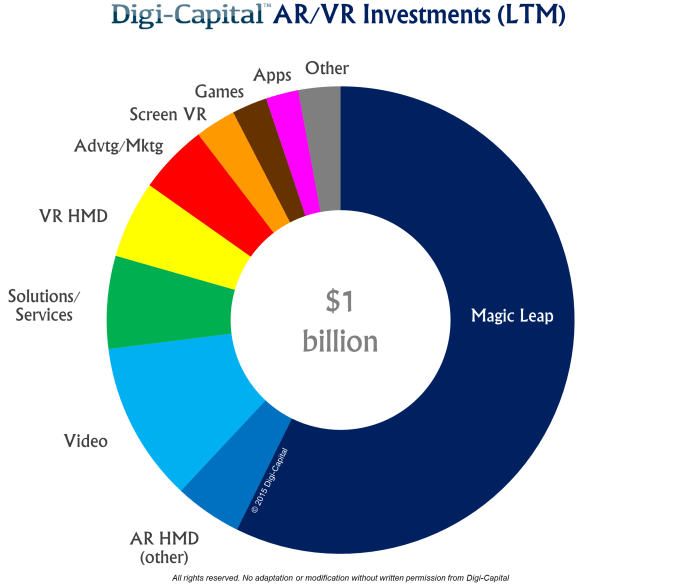

There was a slow trickle of investment in AR/VR from 2006 to the end of 2014. Magic Leap then raised $542 million from Google and others. This was the starting signal for the investment acceleration, with almost $1 billion invested in the sector in the last 12 months.

The last quarter alone saw more than 6 times the investment in the market since the second quarter of 2014. While the venture capital and corporate communities are still developing an informed approach to the industry, their interest has never been greater.

Magic Leap took more than half of the money in the last 12 months, and there are reports that they are raising another billion. Venture capitalists and companies have also gotten excited beyond our Florida friends, with an impressive diversity of investments in a market yet to be launched.

There have been significant investments in AR/VR head-mounted displays, video, solutions/services, advertising/marketing, games and apps. As the ecosystem begins to take shape, the investment community is providing the fuel to take AR/VR skyward.

Not yet an outlet market

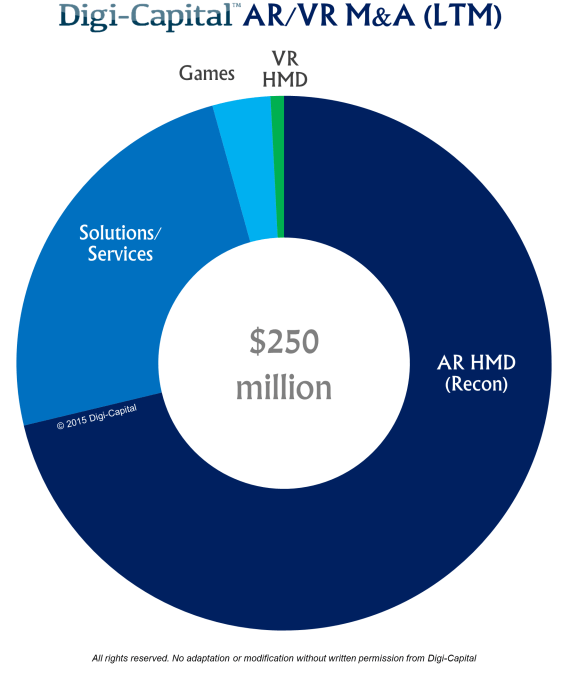

Facebook’s acquisition of Oculus was another catalyst for investors and companies, but so far there has been a bigger impact on investment than mergers and acquisitions.

The AR/VR market delivered $250 million in M&A in the last 12 months, with Intel buying Recon accounting for about three-quarters of the total. That could change dramatically next year, as major corporations try to outdo the competition by buying startups.

Virtually guaranteed to be increased

With the launch of the AR/VR market, today’s investment community is divided into true believers like Intel, Google, Facebook, and Microsoft, and those with a wait-and-see attitude.

There will be bumps in the road next year, but fortune favors the brave in the early-stage investment markets. When the market gets going and there are a few more exits, it will be harder and harder for people to stay on the sidelines.

You can learn more about who invested what and where (including the Arkansas/virtual reality investment/M&A Database included for free with the latest Digi-Capital report) here.

Read More at news.google.com