Source: dailyhodl.com

Popular quantitative analyst PlanB says Bitcoin’s (BTC) current price action mirrors a pattern that preceded the massive rally that catapulted BTC to its all-time high.

The pseudonymous trader argues to his 1.8 million Twitter followers that $20,000 “is the new” $4,000 for BTC.

After breaking $19,000 in late 2017, Bitcoin plummeted to below $4,000 by late 2018. BTC hovered around that $4,000 level until April 2019, when it started moving upwards. The top crypto asset by market cap then largely continued its ascent until November 2021 when it printed its all-time high of $69,000.

$20K is the new $4K pic.twitter.com/HCnIla45KA

— PlanB (@100trillionUSD) October 16, 2022

Bitcoin is trading at $19,606 at time of writing and is up 1.7% in the past 24 hours. BTC has been trading around the $20,000 level since mid-June.

PlanB also notes that the percentage of Bitcoin in loss currently mirrors the levels it was at during great buying opportunities in 2011, 2015 and 2019.

Great buying opportunity (like 2011, 2015 and 2019) or this time is different, that is the question. pic.twitter.com/Wh1Pp44xgR

— PlanB (@100trillionUSD) October 13, 2022

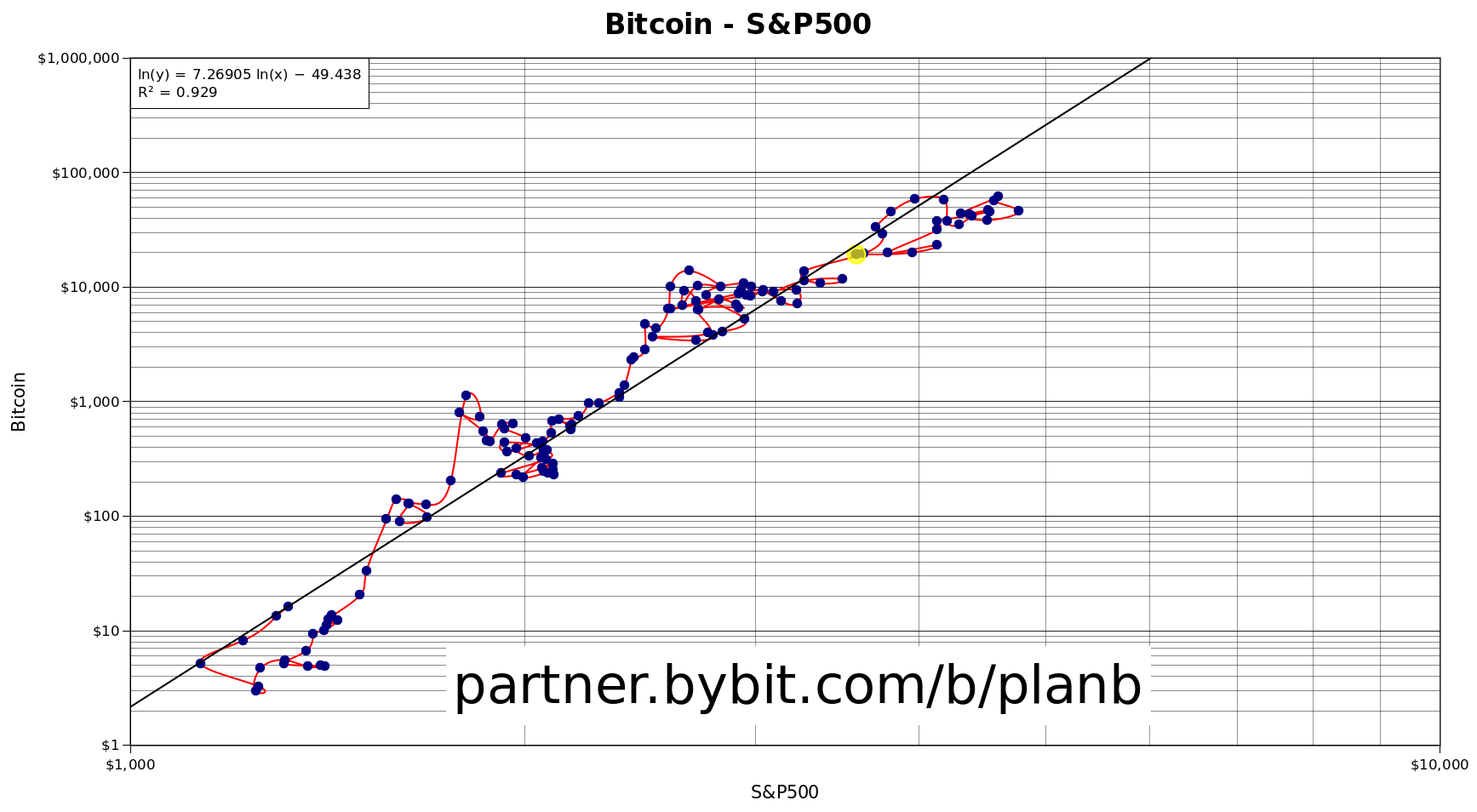

Looking at the correlation between Bitcoin and the S&P 500, the analyst predicts that both BTC and the stock market index will eventually recover from the current bear market.

“It’s only recently that people started complaining about the correlation between Bitcoin and S&P500, only since they both decreased in value. But the correlation has always been there since S&P500 increased from 1,000 [points] to 4,000 [points] and BTC from $1 to $20,000. Both will rise again.”

PlanB also notes that most of the Bitcoin selling in the past 12 months came from traders who are cutting their losses after buying BTC at $60,000, as well as some older buyers who are taking profits after accumulating BTC for less than $15,000.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Xavier Fargas

Read More at dailyhodl.com