Source: dailyhodl.com

Cryptocurrency analytics platform Santiment is saying that one key metric indicates a bearish mood for Bitcoin (BTC).

Santiment says that the social dominance level of Bitcoin, or the discussion rate of Bitcoin relative to altcoins, is currently at 13.15%.

According to the analytics platform, crypto prices typically start to increase when the social dominance level is above 20%. Santiment further says that long-term traders are currently waiting for the flagship crypto asset’s social dominance level to go up again before potentially re-entering the market.

“Traders are chasing short-term pumps right now to salvage losses. Weak hands dropped out of crypto in 2022, and long-term traders are waiting for Bitcoin to begin receiving the spotlight again. When BTC social dominance is high, prices typically rise.”

Bitcoin is trading at $19,155 at time of writing, down 3.44% in the past day.

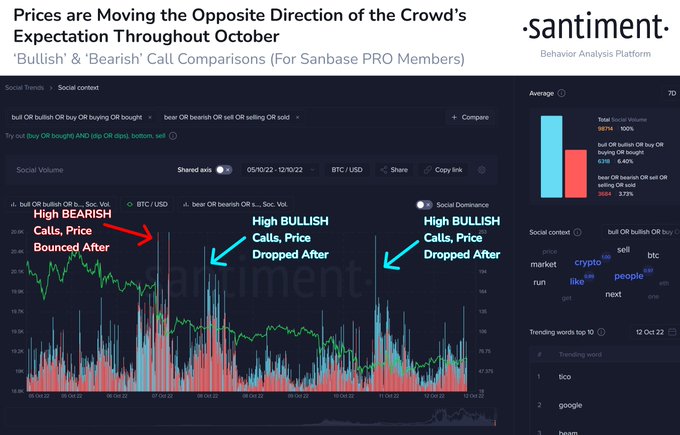

The crypto analytics platform also says that it has noted that throughout this month so far, digital asset prices have moved contrary to prevailing market sentiment.

According to Santiment, excessive bearish sentiment has resulted in crypto prices going up while excessive bullish sentiment has resulted in crypto prices falling.

“Though the long-term crowd sentiment has remained negative, swing trades in October have been dictated by how often bullish and bearish calls are happening. When social platforms show too much bearish sentiment, prices bounce. When bullish, prices drop.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured Image: Shutterstock/Jorm S

Read More at dailyhodl.com