Source: blockchain.news

After falling to lows of $18,000, Bitcoin (BTC) gained some momentum and crossed the psychological $20,000 price point.

The leading cryptocurrency is up 7.77% in the past seven days to hit $20,154 during intraday trading, according to CoinMarketCap.

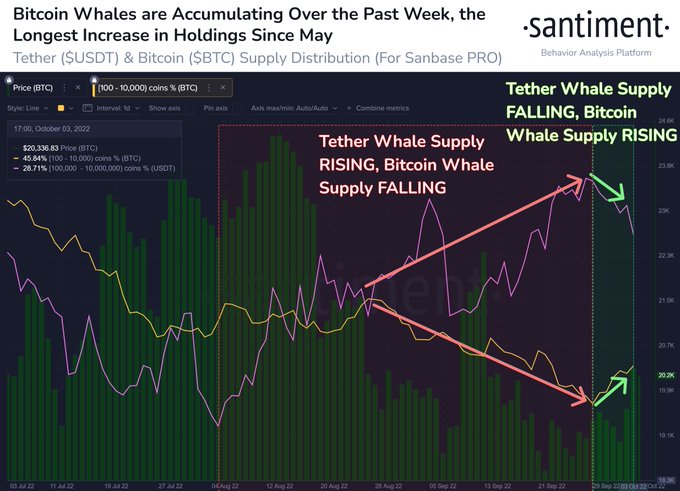

The upward momentum is being experienced amid Bitcoin whales on a spending spree based on further accumulation. Santiment Market Knowledge Provider explained:

“Bitcoin whales are showing signs of sustained accumulation, which has been a rarity in 2022. Since September 27, addresses holding 100 to 10k BTC have collectively added 46,173 BTC to their wallets as they have dwindled the big USDT holdings.”

Source: Santiment

Therefore, the whales in the Bitcoin network show a sustained hodling trend, which can also be represented by the fact that more coins have exited cryptocurrency exchanges.

Santimento additional:

“Bitcoin continues to see its supply pull away from exchanges as traders show more signs of being happy with their current holdings. With less than 9% of BTC on exchanges for the first time since 2018, it bodes well for confidence for bulls.”

Source: Santiment

Trades coming out of Bitcoin generally reflect a hodling culture because the coins are transferred to digital wallets or cold storage for the future other than speculation. Therefore, it is a bullish sign because it drastically reduces the selling pressure.

Bitcoin hodlers have shown no signs of giving up in their quest for more coins as more than 42 million addresses hold BTC despite the bear market. This is 4.5 million more than in 2021; noted data analytics firm IntoTheBlock.

The bullish momentum being experienced in the BTC market comes at a time when UNCTAD has warned federal Reserve not waste caution by tightening fiscal and monetary policies because this could trigger a global recession.

The Federal Reserve has been at the forefront of raising interest rates, which has been detrimental to the cryptocurrency market as bears continue to bite.

Therefore, if the Federal Reserve heeds this call, it could trigger a bullish trend in the crypto market because interest rate hikes have been the main obstacles.

Image Source: Shutterstock

Read More at blockchain.news