Source: www.ledgerinsights.com

The Bank for International Settlements published a report on Basel III, the risk assessment framework, which has a new segment for crypto asset reports. Only 19 out of 182 banks reported exposures to crypto assets at the end of 2021, and two are purely crypto banks. Banks are unlikely to be the largest, as their combined assets make up just 2.4% of all reporting banks. In terms of risk exposure, crypto assets accounted for 0.01% of all exposures.

The total of all crypto exposures was €9.4 billion ($10.7 billion at the end of 2021). In context, the total market capitalization of cryptocurrencies at the end of last year was $2.7 trillion. In other words, banks accounted for much less than one percent of crypto assets. That said, there have been some big banking announcements during 2022.

And of those 19 banks that had some exposure, three made up two-thirds of the figures and the top six banks accounted for 92% of crypto assets. Unsurprisingly, almost 90% of crypto assets were invested in Bitcoin or Ether, albeit through a variety of means, such as direct, through Grayscale trusts, and ETFs. Most of the rest of the cryptocurrencies were tokens from other layer 1 blockchain networks, although there were smaller amounts in the USDC stablecoin and tokenized assets.

US banks made up ten of the 19 banks, with seven in Europe and the rest in Asia.

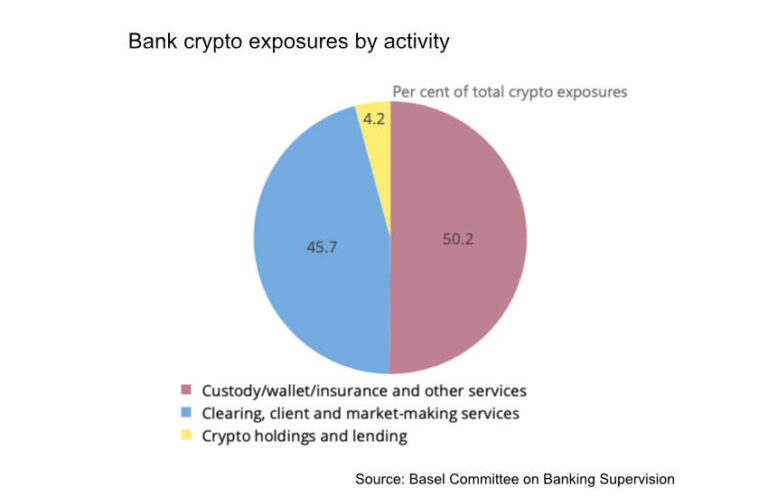

The main activities offered by the banks were divided into:

- Custody/portfolio/insurance and other services (50%)

- Clearing services, clients and market making (46%)

- Crypto holdings and loans (4%)

Basel III consultations on crypto

As previously reported, inquiries about how to treat crypto assets under the Basel rules have entered a second phase. The latest proposals added a 2.5% DLT infrastructure risk for tokenized conventional assets. And the SEC went a step further by saying that anything involving DLT should be listed on a bank’s balance sheet, which would include custody of real-world tokenized assets. When a bank safeguards conventional assets, they do not appear on the balance sheet. Last month it was reported that some banks had stopped custody activities as a result.

Read More at www.ledgerinsights.com