Source: blockchain.news

Interest in Bitcoin (BTC) spiked on social platforms over the weekend, leading to an increase in its social dominance, according to Santiment.

The cryptographic information provider explained:

“This weekend saw a spike in Bitcoin interest on social platforms. Among cryptos Top 100 assets, BTC is the topic in more than 26% of discussions for the first time since mid-July. Our subsequent tests show that more than 20% dedicated to Bitcoin is positive for the sector.”

Source: Santiment

Thus, the renewed interest in Bitcoin is happening amid top cryptocurrency trading below the psychological price of $20,000. BTC hovered around $19,038 during intraday trading, according to CoinMarketCap.

Additionally, Bitcoin has been trading well below its all-time high (ATH) of $69,000 set in November of last year. The bearish momentum extended throughout the year in 2022, one of the factors triggered by similar interest rate increases from the Federal Reserve (Fed).

Sudden increases in interest rates often have a bearish impact on high-risk assets like Bitcoin. For example, Bitcoin (BTC) sank to $18,500 on September 19 due to concerns about global monetary tightening, Blockchain.News reported.

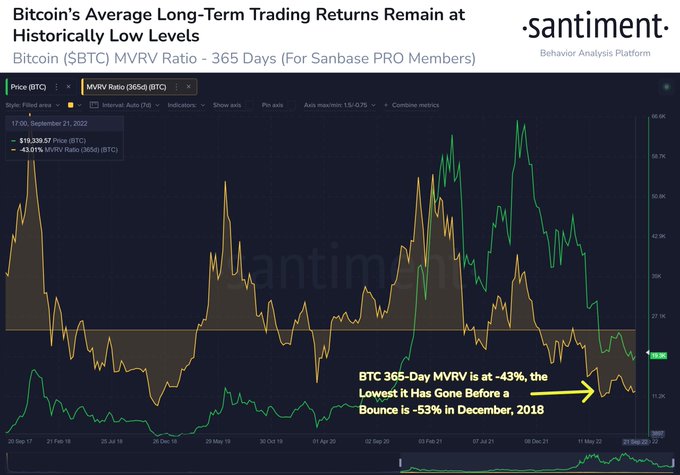

On the other hand, BTC’s long-term average trading returns continue to trend at historically low levels. Santimento he pointed:

“Bitcoin remains -72% from its November 2021 all-time high. with such market cap drop, active traders who have transacted over the past year are down an average of -43%. Historically, MVRV hasn’t fallen much lower than this before a rally.”

Source: Santiment

Additionally, key Bitcoin whale addresses have depleted their holdings to levels last seen in April 2020.

Santimento admitted:

“The amount of Bitcoin held by whales has been falling for 11 months. As fears of inflation and a global recession continue, addresses holding 100 to 10k BTC have reduced their supply percentage of the leading crypto asset to 29-month lows.”

With the number of non-zero BTC addresses reaching a monthly high, it remains to be seen how the leading cryptocurrency performs in the short term as more participants continue to enter the market.

Image Source: Shutterstock

Read More at blockchain.news