Source: dailyhodl.com

Bitcoin (BTC) is headed for a sell-side liquidity crisis, according to the co-founder and chief executive of analytics platform CryptoQuant.

Ki Young Ju tells his 336,400 followers on the social media platform X that Bitcoin bears “can’t win this game” until spot Bitcoin exchange-traded fund (ETF) inflow stops.

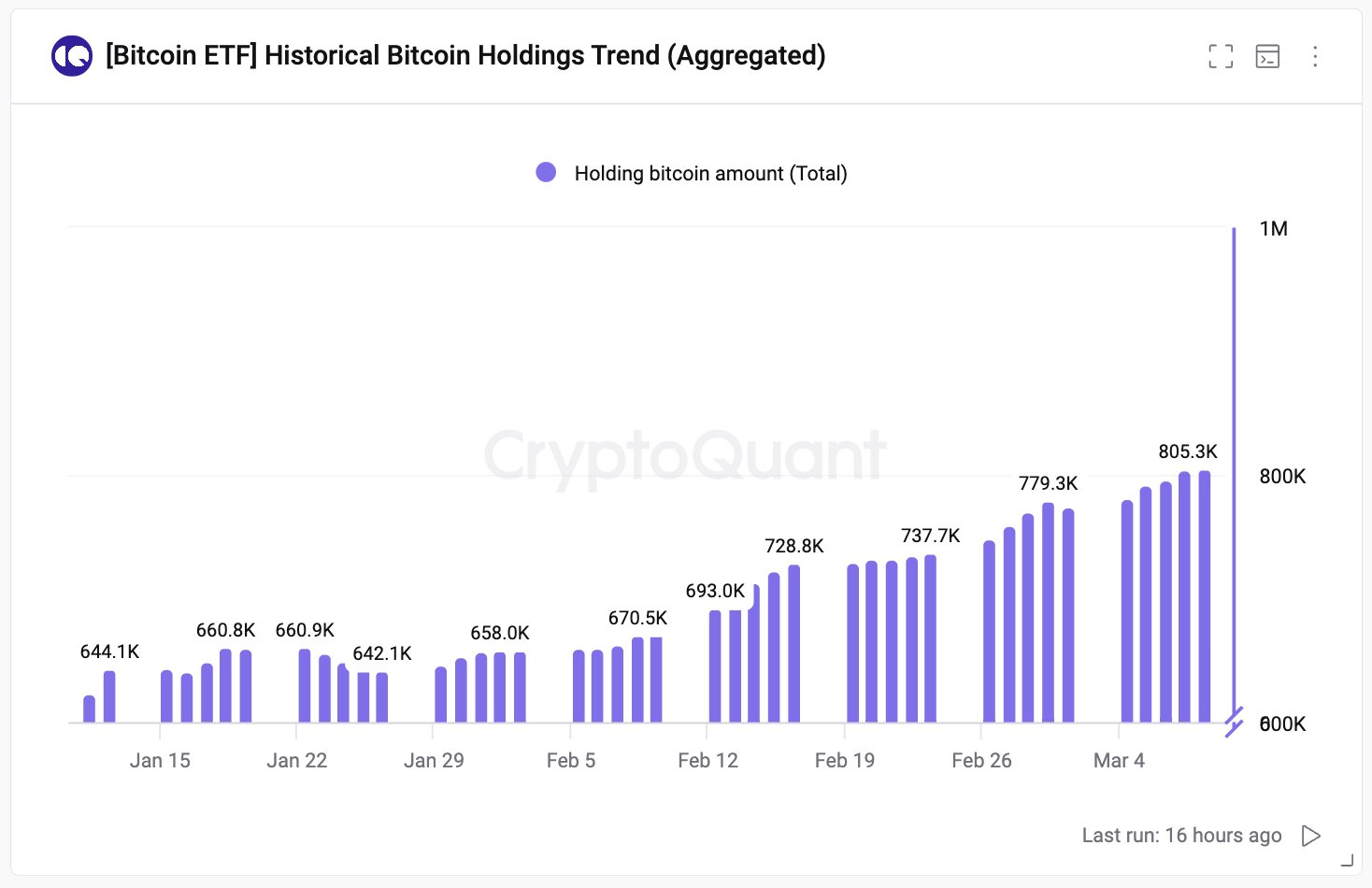

“Last week, spot ETFs saw netflows of +30,000 BTC. Known entities like exchanges and miners hold around 3 million BTC, including 1.5 million BTC by US entities. At this rate, we’ll see a sell-side liquidity crisis within 6 months.

Bitcoin is currently in the price discovery phase. Once a sell-side liquidity crisis happens, its next cyclical top may exceed our expectations due to limited sell-side liquidity and a thin order book.

This could occur once accumulation addresses reach around a total of 3 million BTC.”

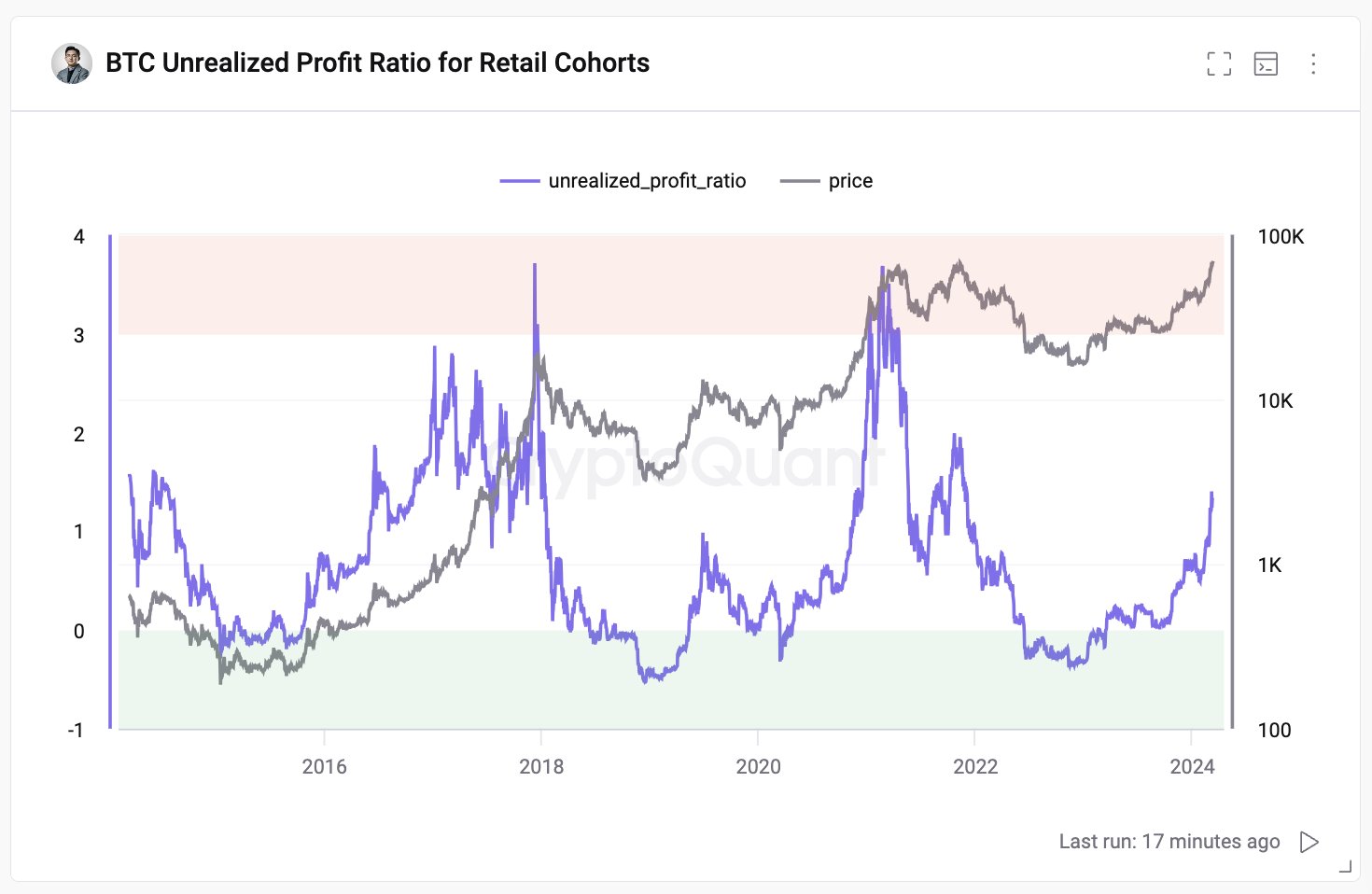

Young Ju also says the current market is “halfway to Bitcoin euphoria.”

“Retail on-chain activities are definitely active but don’t indicate a cyclical top.

Bitcoin is in the price discovery phase, so it’s important to determine whether we’re at the cyclical top.”

Bitcoin is trading at $71,487 at time of writing. The top-ranked crypto asset by market cap set a new all-time high of $72,733 on Tuesday morning and is up more than 12% in the past week.

Don’t Miss a Beat – Subscribe to get email alerts delivered directly to your inbox

Check Price Action

Follow us on Twitter, Facebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making any high-risk investments in Bitcoin, cryptocurrency or digital assets. Please be advised that your transfers and trades are at your own risk, and any loses you may incur are your responsibility. The Daily Hodl does not recommend the buying or selling of any cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Generated Image: DALLE3

Read More at dailyhodl.com