Source: blockchain.news

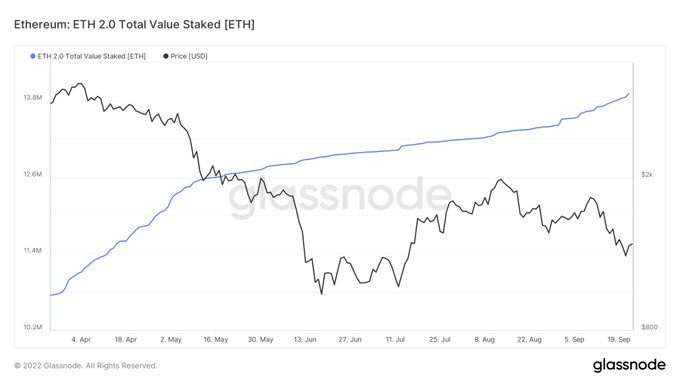

More investments continue to pour into the Ethereum 2.0 deposit contract based on all-time highs noted.

Market analyst Ali Martinex he pointed:

“Approximately 150,000 ETH, worth around $195 million, was transferred to the ETH2 deposit contract over the past week, reaching a new all-time high of 13.9 million ETH staked.”

Source: Glassnode

The ETH 2.0 deposit contract was launched in December 2020 to aid the shift from the proof-of-work consensus mechanism to a proof-of-stake (PoS) framework called fusion.

The long-awaited merger it was live on September 15 getting the ball rolling for a PoS structure on the Ethereum network. Therefore, it is expected to fuel Ethereum’s quest to become a deflationary asset.

However, a recent analysis highlighted that Ethereum had to go through four more steps to resolve the scalability issue even after the merger materialized.

The four phases include the surge, the edge, the purge and the waste. Your time frame is not well defined. Sameep Singhania, co-founder of QuickSwap, fixed:

“It is difficult to talk about the timing of the next four stages because all of them are still under active research and development. But in my opinion, it will easily be 2-3 years before all the phases are completed.”

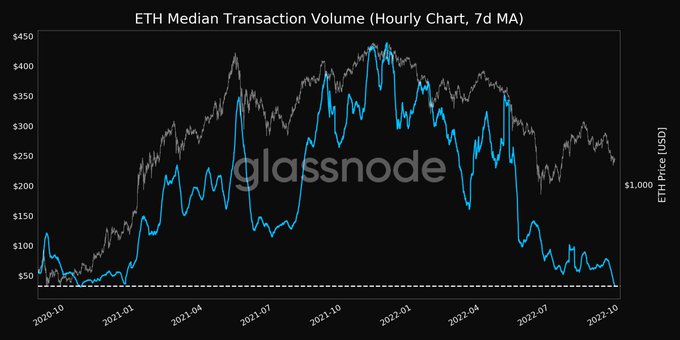

Meanwhile, the average transaction volume on the ETH network has plummeted. Crypto Information Provider Glassnode explained:

“ETH average transaction volume (7d MA) just hit a 23-month low of $32.38.”

Source: Glassnode

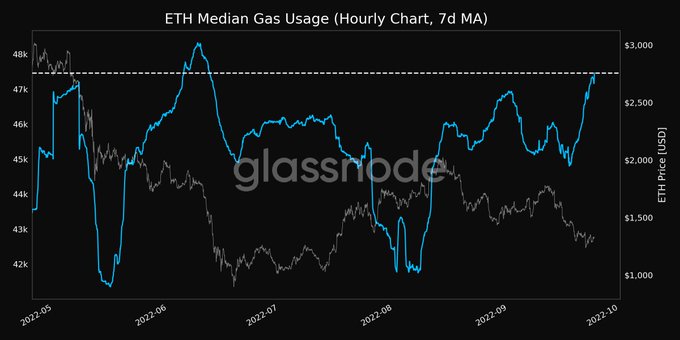

On the other hand, gas usage has been on the rise, suggesting that gas fees paid in transactions have remained high. glass node additional:

“ETH average gas usage (7d MA) just hit a 3-month high of 47,461,113. The previous 3-month high of 47,349,137 was seen on September 23, 2022.”

Source: Glassnode

Ethereum hovered around the $1,330 area during intraday trading, according to CoinMarketCap.

Image Source: Shutterstock

Read More at blockchain.news